Are you looking for the best VPN services? This post has got you covered.

Virtual Private Networks (VPNs) are always in the discussion about internet security and privacy. Experts advise everyone mindful of the growing internet threats to use a VPN. However, the problem for many people is identifying the best VPN services.

The best VPN services protect your internet privacy without taking advantage of your trust. They secure your traffic, allow you to access the internet freely, and keep you out of sight of cybercriminals.

Thankfully, there are many such VPN services, and you will find them in this article. Read on.

Table of Contents

What Is A VPN?

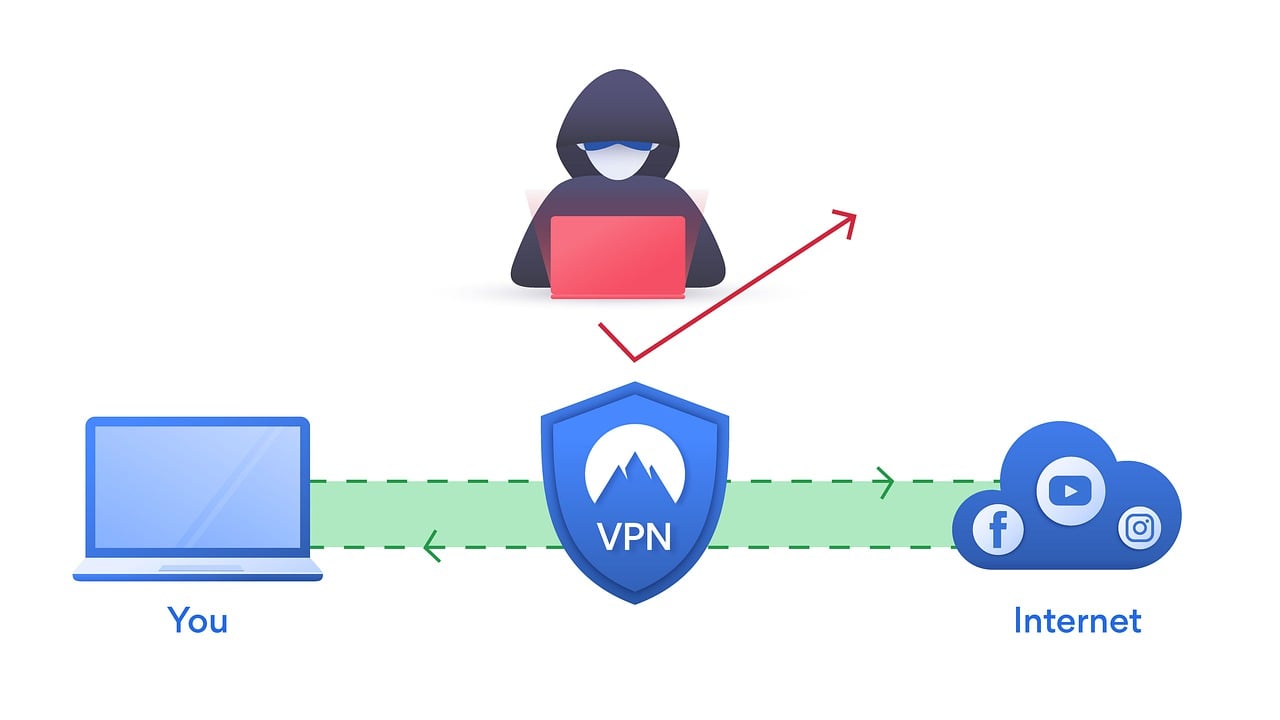

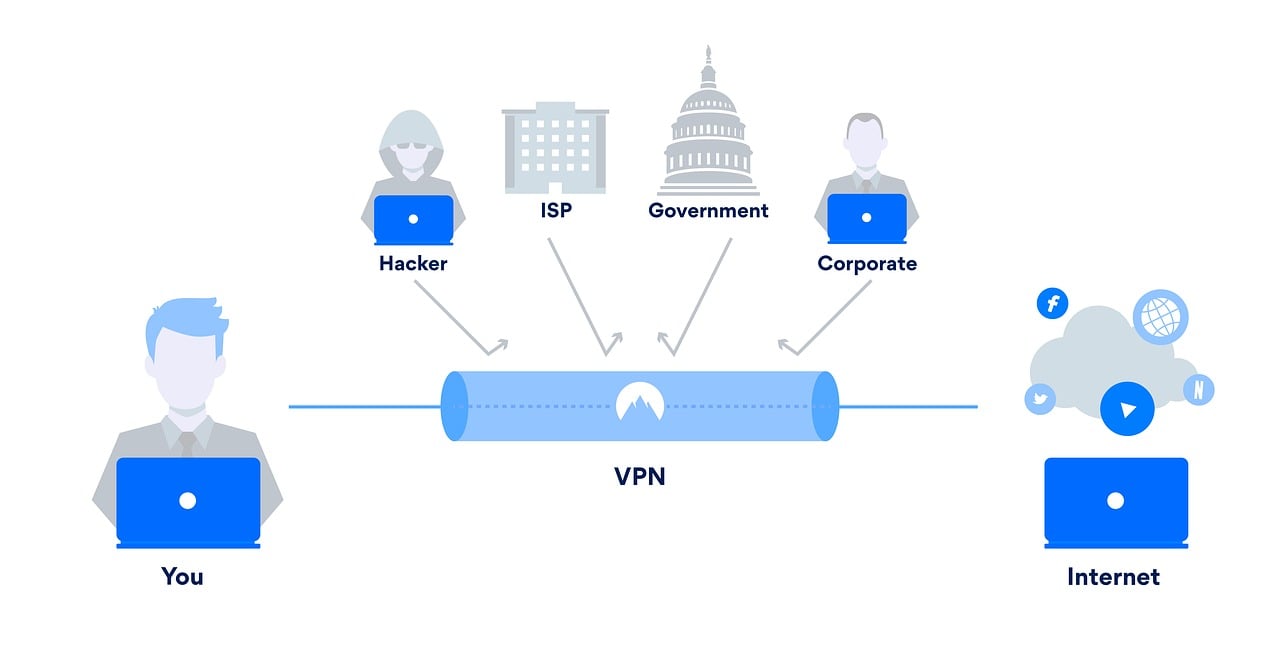

A VPN, or virtual private network, is a service that offers protection for your internet connection and privacy online. It creates an encrypted tunnel for your internet traffic, ensuring your data remains secure and protected from snoopers.

When you use a VPN, your internet traffic is rerouted through a remote server, which encrypts the data and hides your IP address. This process increases your privacy by providing a new IP address from the VPN server.

The encryption protocols used by VPNs help funnel all of your internet traffic through an encrypted tunnel, which acts as a virtual private network between your device and the server.

This safeguards your data from interception and makes your IP address appear as the VPN server’s, further enhancing your privacy.

In addition to privacy and security, a VPN has several other benefits. It can help you access blocked websites by bypassing geographical restrictions or censorship.

It also encrypts your internet connection, ensuring your data transfer remains secure even when connected to public Wi-Fi networks. Some VPNs offer additional features such as protection against malware, web trackers, ads, and malicious links.

Whether you’re concerned about protecting sensitive information or accessing blocked content, a Virtual Private Network can be an effective solution.

TL;DR – What Are The Best VPN Services?

- Surfshark: Best cheap VPN, best for unlimited simultaneous connections

- CyberGhost: Best VPN service for streaming

- NordVPN: Best all-around VPN service

- ExpressVPN: Best Virtual Private Network for fast speeds

- ProtonVPN: Best VPN service for privacy-focused users

- Private Internet Access: Best VPN service for torrenting

- PureVPN: Best VPN service for dedicated IP addresses

- PrivateVPN: Best Virtual Private Network for simplicity

- Atlas VPN: Best free VPN tier

- TorGuard: Best VPN service for specialized privacy features

- VyprVPN: Best VPN for bypassing restrictions

- TunnelBear: Best user-friendly Virtual Private Network

- FastVPN: Best VPN service for high-speed connections

- VeePN: Best affordable Virtual Private Network

- VuzeVPN: Best Virtual Private Network for torrenting support

- Mozilla VPN: Best VPN service from a trusted source

- KeepSolid Unlimited VPN: Best VPN service for flexible pricing

- Hide.me VPN: Best VPN service for easy use

- IPVanish: Best Virtual Private Network for Kodi

How Does A Virtual Private Network Work?

The primary function of a Virtual Private Network is to protect you when you go online. It’s a service or an application that tunnels your network via an encrypted path, keeping it secure and private.

When you connect to the internet, you give away much information via your IP address. Through your IP address, anyone can uncover your location, device type, network carrier, and more.

With a Virtual Private Network, these details stay hidden. It VPN changes your IP address and gives you a new, different one to browse with. The new one you get can be from any location. And anyone who reads it gets information on that location – not your real location.

So, in simple words, a Virtual Private Network works by switching your IP address. You can be in the United States and change your IP address to the United Kingdom, France, Spain, or any other country you want.

READ ALSO: Everything You Need To Know About Using A VPN

What Are The Benefits of Using a Virtual Private Network?

A Virtual Private Network is important if you frequently use the internet. It is extra important if you frequently use the internet for sensitive communications.

As aforementioned, anyone can extract your browsing details from your IP address. Some – hackers, cybercriminals, data thieves – will do more than simply extract your browsing details.

They can hack your device, hijack it, or extract more private information. This can easily happen if you connect to public hotspots and WiFi – which we all do nowadays. With a VPN, you are less at risk of a hack because your online traffic stays invisible.

Talk about having fun – streaming content, playing games, for example – a VPN can also help. If you use apps like Netflix, Spotify, and Disney Plus, you’ll agree that you can access all content.

Some content on these platforms is limited to specific countries. But with a Virtual Private Network, you can bypass these limits and access whatever you want. All it takes is a change of your IP address.

What To Look For When Choosing a VPN?

Despite its delicate function, a Virtual Private Network is an app like any other. What that means is that there are both reliable and unreliable VPNs. Of course, you can’t leverage the previously mentioned benefits if you use an unreliable Virtual Private Network.

As a result, there are notable factors to consider when choosing a Virtual Private Network. They include:

- Security: A Virtual Private Network is meant to keep you secure online. So, it must be secure before it can secure you. The best VPN services will have advanced encryption and sophisticated protocols to guarantee security.

- Server Count: The number of servers a Virtual Private Network has determines the number of IPs and countries you can connect to. Therefore, the higher the number of servers, the better.

- Speed: When you connect to a VPN, you add a layer of protection to your network. This extra layer of protection will either slow or speed up your browsing speed. Which would you prefer? The latter, of course.

- Policy: You should only use a particular Virtual Private Network to avoid sharing your browsing logs with a third party. Look for VPNs with a true “No Logs Policy.”

- Price: Price is important because free VPNs are generally unreliable. If you want the best VPN service, you must pay. But that doesn’t mean you should break the bank to get one.

All the above factors were considered to select the best VPN services available. So, you can save yourself the time of searching for which VPN to use. Check out the list below and pick a VPN that works for you.

READ ALSO: Best VPN For 2023: Top Picks Reviewed by Our VPN Experts

Best VPN Services

1. Surfshark – Best cheap VPN, best for unlimited simultaneous connections

Surfshark is undoubtedly one of the best VPN service providers available today.

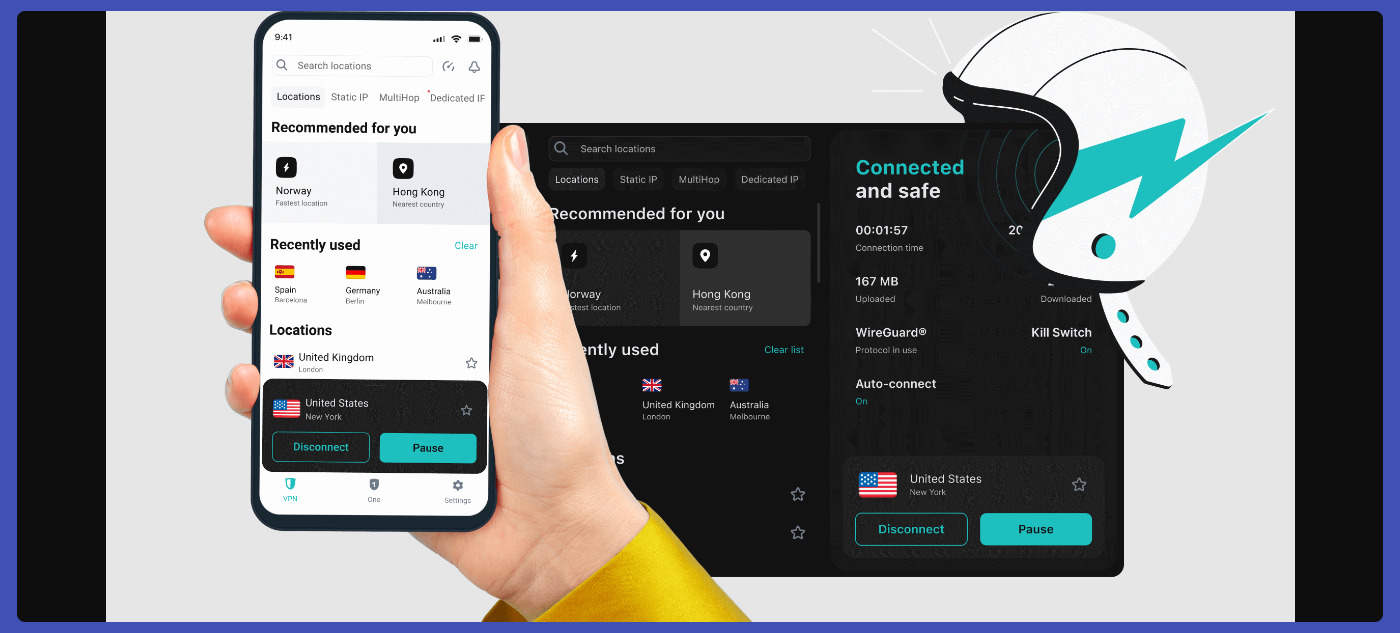

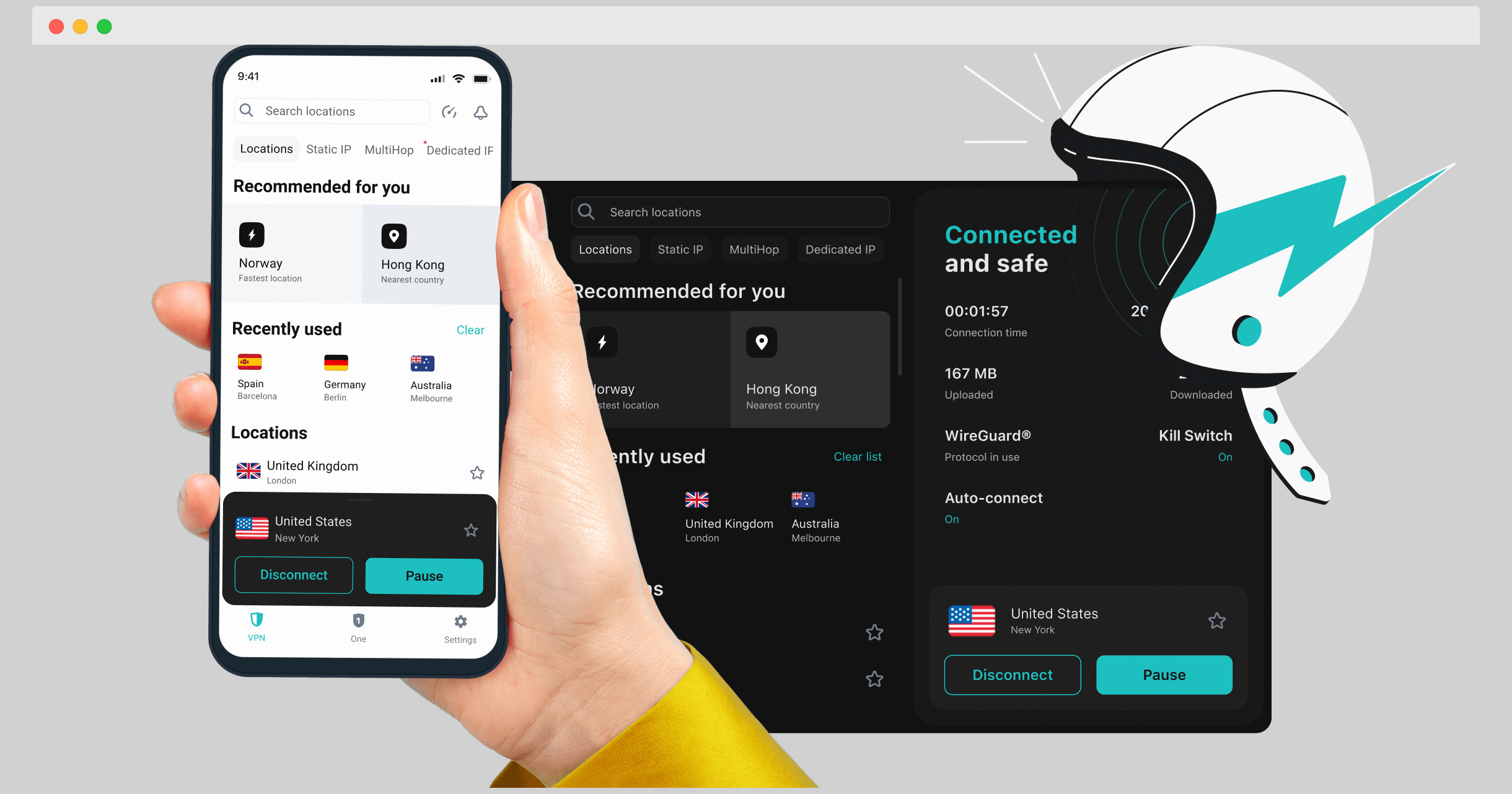

With its advanced security features, lightning-fast speeds, and unlimited connections, Surfshark is an excellent choice for individuals and large families. It is especially ideal for those new to virtual private networks who want a user-friendly experience.

Surfshark is a virtual private network trusted by experts. It lets you browse the web privately, switch your IP address, and browse quickly. This service is available for all major devices – Windows, Mac, iOS, and Android. In addition, you can use one subscription on an unlimited number of devices.

One of the standout features of Surfshark is its ability to access popular streaming sites, making it a dream come true for all the binge-watchers out there.

Additionally, it allows torrenting on all servers, providing users with the freedom to download their favourite content hassle-free. Moreover, Surfshark boasts a vast network of servers spread across numerous countries, ensuring a seamless browsing experience for users worldwide.

Besides its core features, Surfshark offers several additional functionalities that enhance the overall browsing experience. Split-tunneling allows users to choose which apps or websites to route through the VPN service, giving them more control over their online activities.

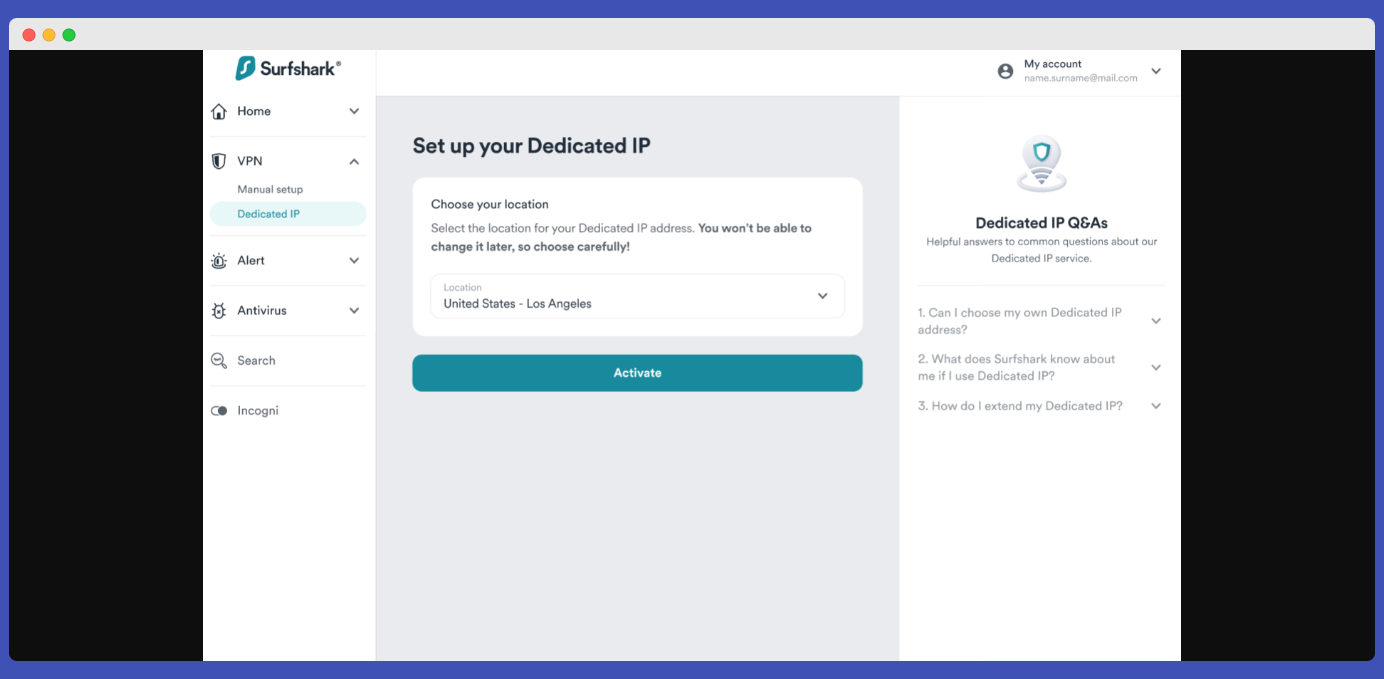

Ad blocking ensures a clean and uninterrupted browsing experience by eliminating annoying ads. And with IP address rotation, users can further protect their privacy by regularly changing their virtual location. Also, you can get a dedicated IP address with Surfshark.

You stay safe from hackers and cybercriminals thanks to Surfshark’s advanced security features. Not to mention, Surfshark is a No-Log Virtual Private Network, so your browsing activities remain anonymous.

Surfshark remains highly ranked in the industry due to its affordability, reliable performance, and generous money-back guarantee. Surfshark is easy to use, and you’ll hardly have any problems with it. But if you do, 24/7 customer support can assist you anytime.

Whether you’re streaming your favorite shows, torrenting files, or simply looking to safeguard your online privacy, Surfshark is the ultimate solution.

With its affordable plans and commitment to customer satisfaction, it’s no wonder that Surfshark is widely regarded as one of the best VPNs available today.

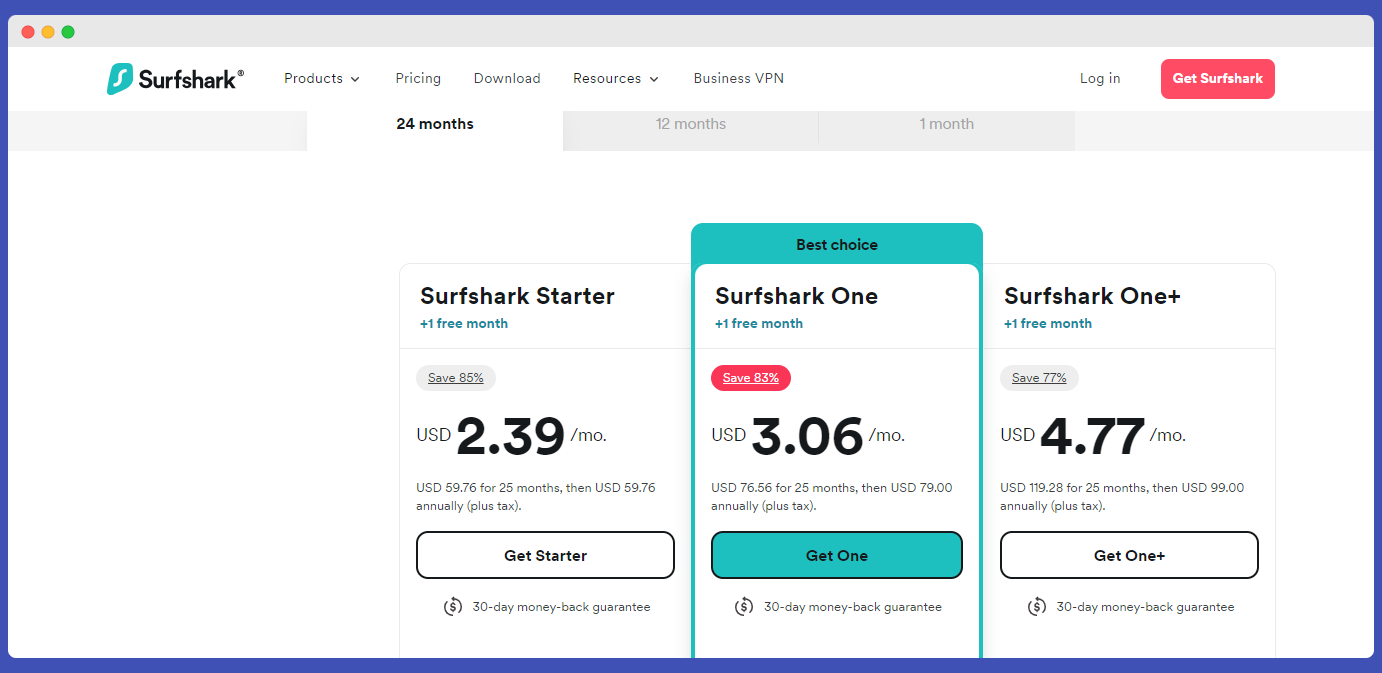

Aside from its features, Surfshark is also one of the best VPN services for its price. In particular, you can get their VPN service by opting for any of the Surfshark One packages below:

- Surfshark Starter (Surfshark and Ad Blocker) – $2.39 per month for 25-month plan

- Surfshark One (Surfshark, Alert, Antivirus, and Search) – $3.06 per month for a 25-month plan

- Surfshark One+ (Surfshark, Alert, Antivirus, Search, and Incogni)– $4.77 per month for a 25-month plan

⇒> Get Surfshark

2. CyberGhost VPN – Best VPN service for streaming

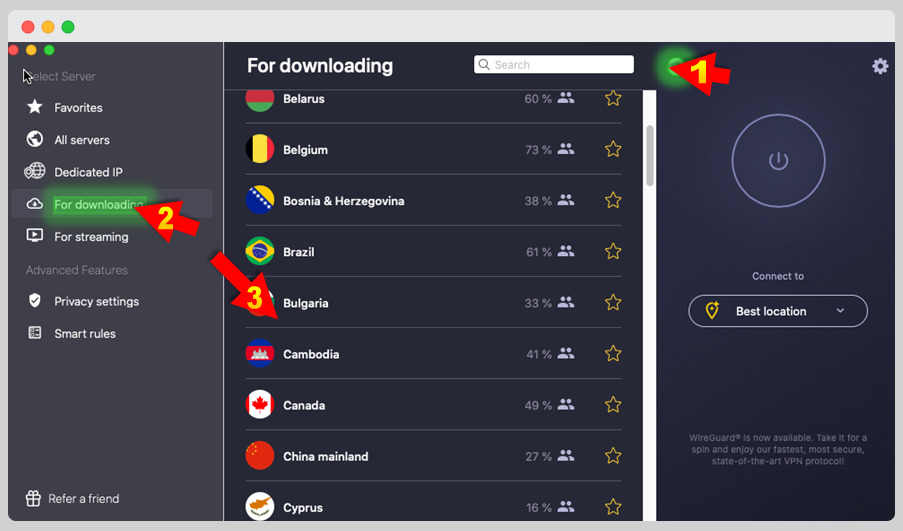

If you’re looking for the best VPN service to protect your online activities, look no further than CyberGhost. As one of the better Virtual Private Networks on the market, CyberGhost offers a powerful and reliable tool to ensure your privacy and security.

With an impressive network of VPN servers, CyberGhost stands out among its competitors. This VPN will work on Windows, macOS, iOS, and Android. It’ll also work on Smart TVs, game consoles, routers, and Amazon Fire TV Stick devices.

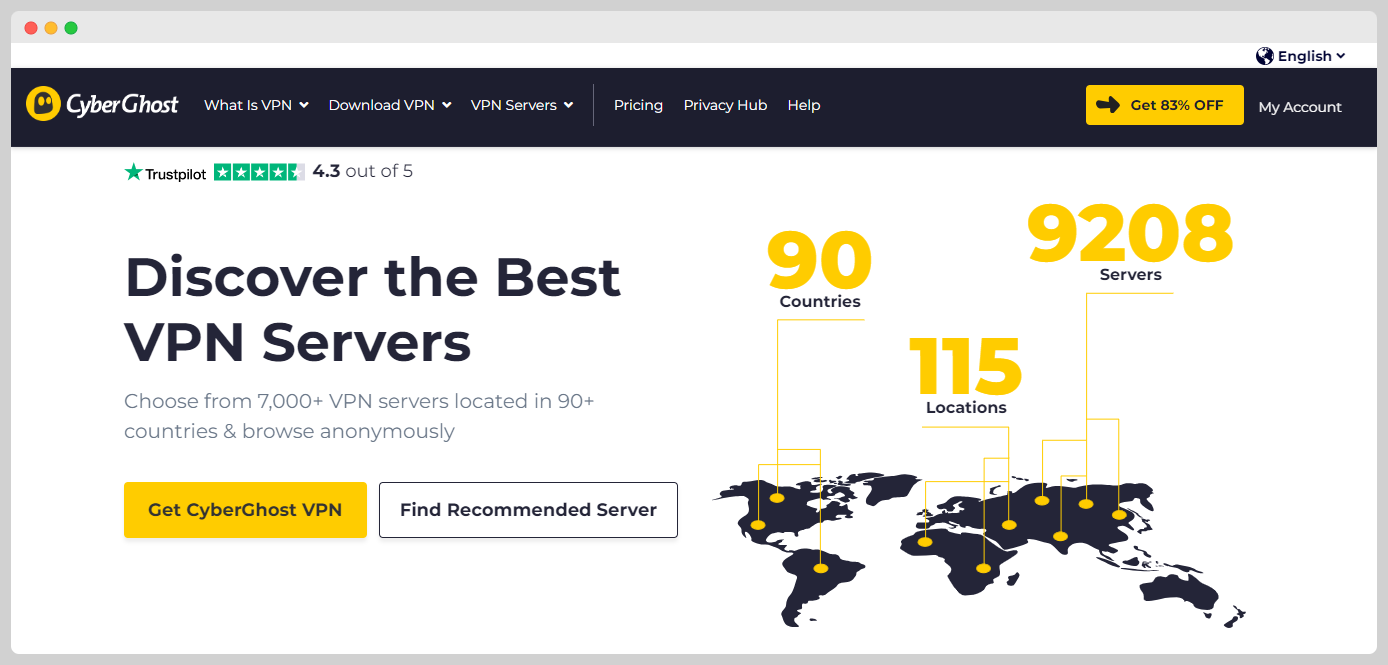

CyberGhost is a wide-coverage VPN with over nine thousand VPN servers. It keeps you safe online by offering complete privacy to all devices.

With a single CyberGhost subscription, you can connect and protect seven devices. CyberGhost employs 256-bit AES, industry-leading encryption that ensures your internet traffic stays anonymous.

As mentioned earlier, CyberGhost has over nine thousand VPN servers. Its network servers are spread across the globe – in Europe, Africa, Asia, and the Americas.

One thing to consider when choosing a VPN is its speed performance. While CyberGhost has a fast-growing server network, its speed tests showed an average download speed of 85Mbps on a 100Mbps internet connection.

The Windows client also tends to have faster speeds than the MacOS client. So, if speed is your primary concern and you prioritize privacy and security, CyberGhost remains a solid choice.

Furthermore, note that CyberGhost is a fast VPN. Hence, it’s one of the best VPN services for streaming content, playing online games, and sharing large files.

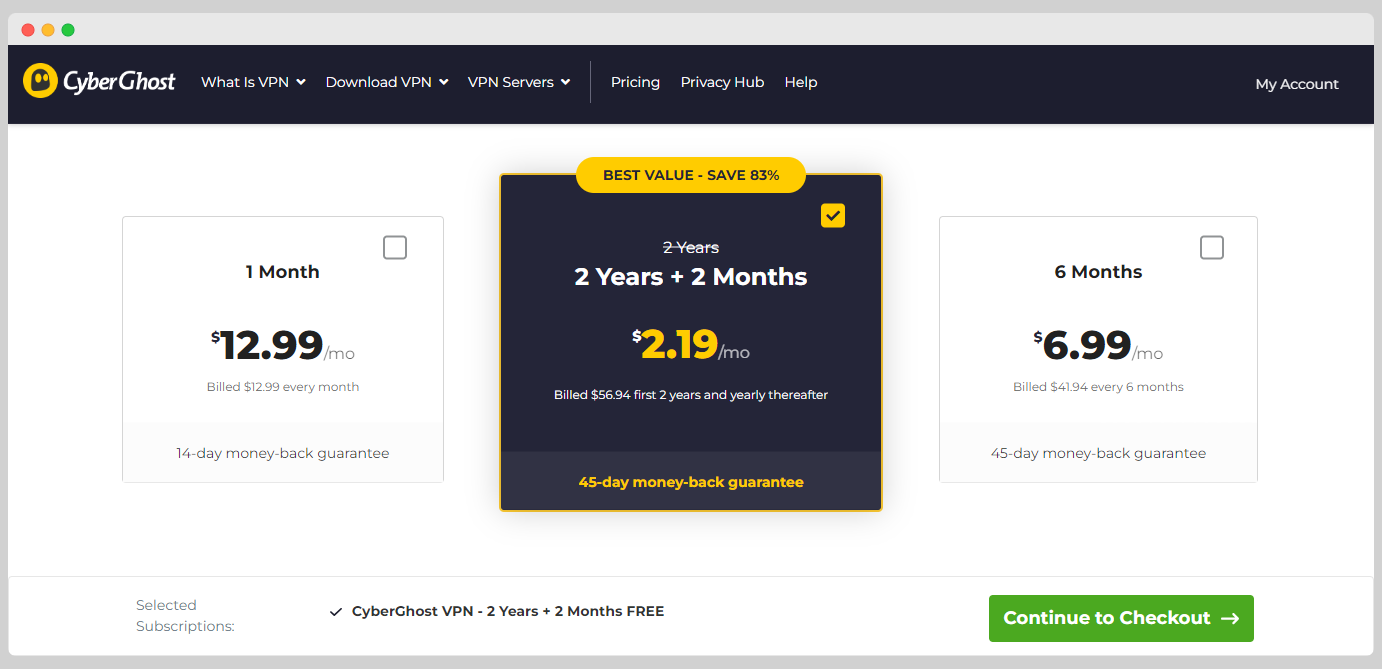

Aside from its robust security features, CyberGhost also offers competitive pricing plans. You can purchase CyberGhost for two years and two months for $2.19 monthly. If you don’t opt for that, then the six-month plan for $6.99 is the next best option.

⇒> Get CyberGhost VPN

3. NordVPN – Best all-around VPN

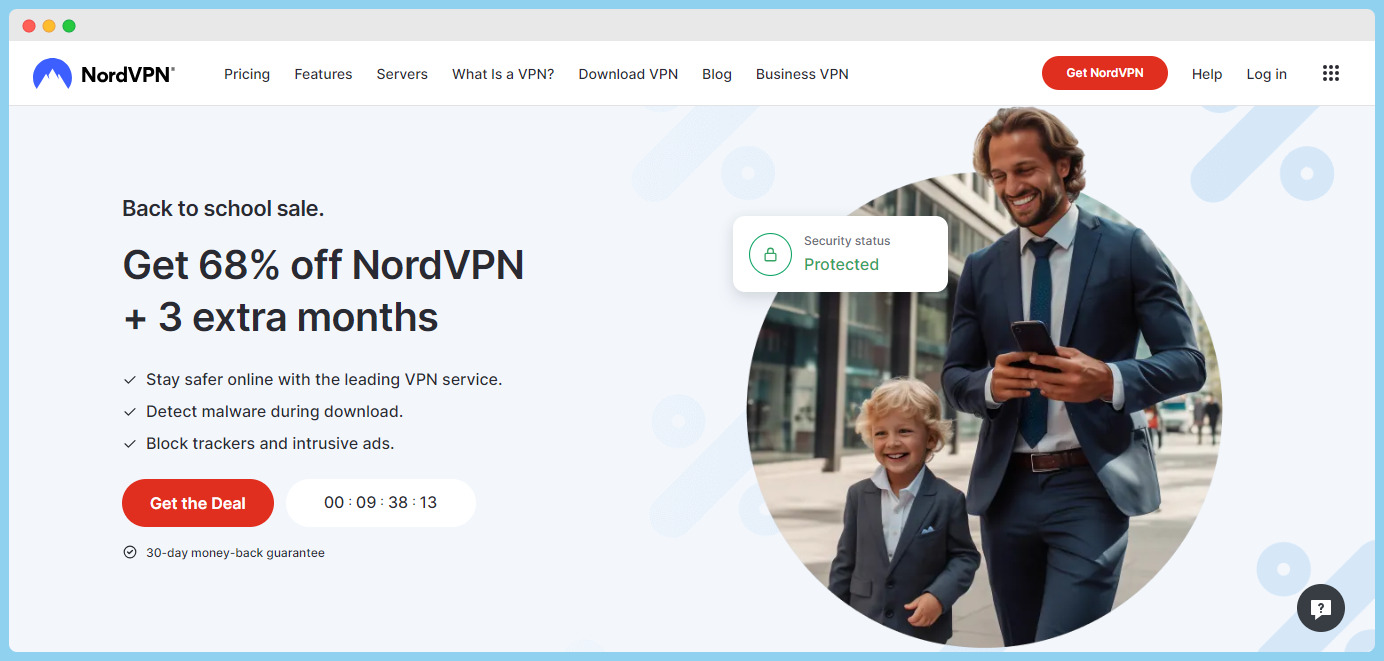

Number three on this list of best VPN services is NordVPN. Self-described as “the world’s leading VPN,’ NordVPN is the Virtual Private Network for seamless browsing.

With over 5,500 unique servers in 59 countries and over 100 cities, NordVPN offers users a wide range of options worldwide. Whether you’re a frequent traveller or want to protect your data, NordVPN has covered you.

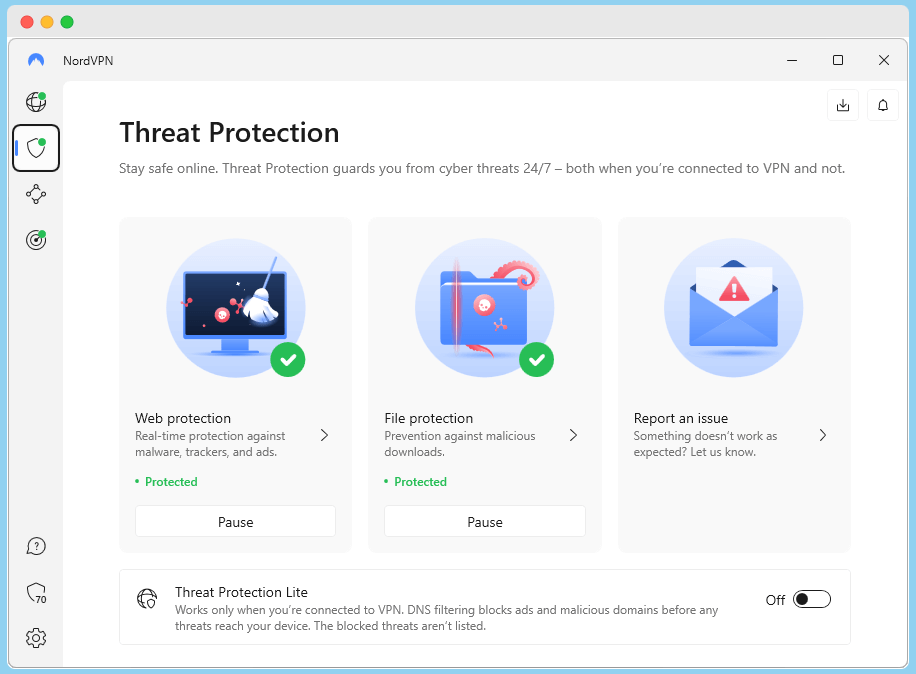

This VPN service has a fleet of servers, top-notch encryption, and keeps no logs. However, the ad blocker is the standout feature for the seamless browsing experience.

The NordVPN ad blocker will keep annoying and intrusive ads away from your screen. Consequently, it keeps you safe from trackers, spyware, and malware.

One of the standout features of NordVPN is its headquarters in Panama. This is a significant advantage because Panama is not a member of any surveillance alliances, ensuring your online activities remain private and secure.

Additionally, NordVPN offers a kill switch feature that automatically halts your internet connection if it gets disconnected. This feature provides extra protection and ensures your sensitive information doesn’t fall into the wrong hands.

NordVPN has Windows, macOS, iOS, Android, Linux, and Android TV apps. You can also use it as a Chrome, Firefox, and Edge browser extension on a PC.

You don’t need a separate NordVPN subscription for your devices. A single subscription will cover up to six devices.

Speed is another area where NordVPN excels. You can browse, stream, and download content with fast speeds without frustrating lag or buffering.

Furthermore, NordVPN offers unlimited data usage, so you don’t have to worry about hitting any caps or restrictions. You can enjoy a seamless online experience without any interruptions.

In addition to its impressive features, NordVPN allows users to change their Netflix region by connecting to a server in a different country. Not to mention, it offers a dedicated IP address service as well.

This means you can access a wider range of content and enjoy your favourite shows and movies from anywhere in the world. Whether craving the latest releases or revisiting old classics, NordVPN has got you covered.

As you’d expect from a service with all these features, NordVPN is premium. Nevertheless, you can try it risk-free for thirty days before you pay.

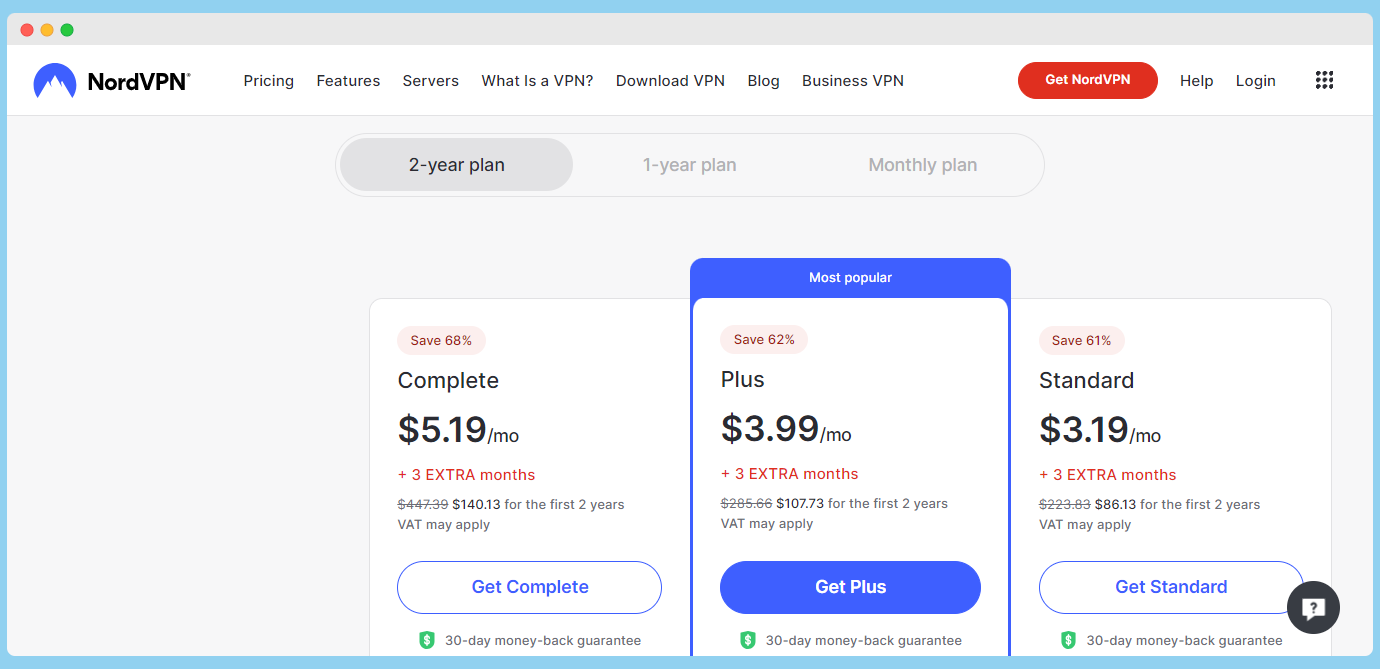

NordVPN is available in three packages, including

- Standard (NordVPN) – $3.19 per month for a 2-year plan

- Plus (NordVPN and NordPass) – $3.99 per month for a 2-year plan

- Complete (NordVPN, NordPass, and NordLocker)– $5.19 per month for a 2-year plan

⇒> Get NordVPN

4. ExpressVPN – Best VPN service for fast speeds

One of the best VPN services in the market is ExpressVPN.

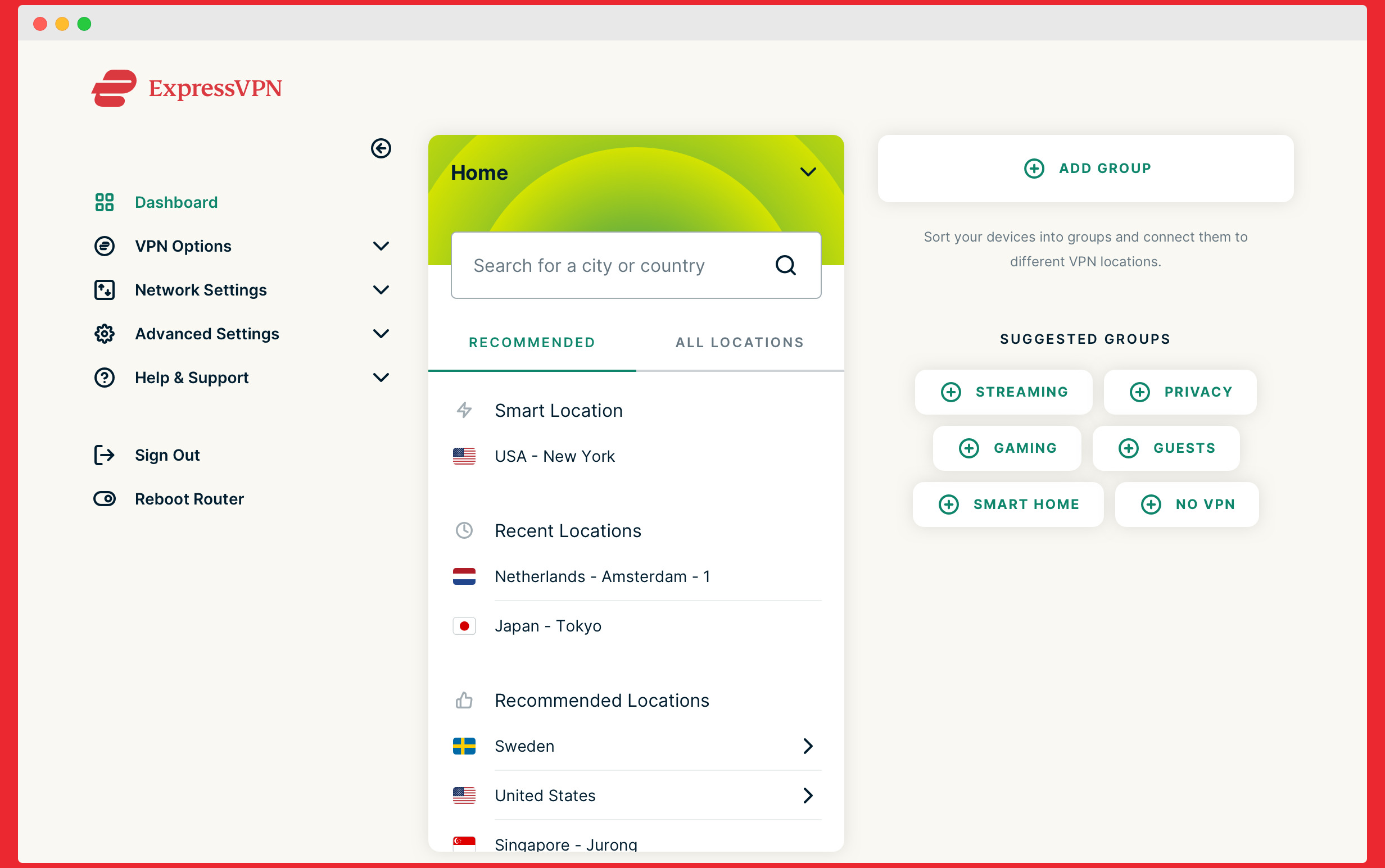

ExpressVPN is famous for its many servers. This Virtual Private Network has hundreds of servers in ninety-four countries on every continent.

This gives you more freedom and control over your internet connection, allowing you to access content worldwide. But it’s not just the server count that makes it one of the best VPN services. Speed is also notable.

In particular, ExpressVPN’s servers are ultra-fast. This is mainly due to the Lightway protocol they use. Lightway is a native VPN protocol built by ExpressVPN, so you won’t get it with any other services.

ExpressVPN constantly optimizes its network for speed, providing fast and reliable connections for a seamless streaming experience.

ExpressVPN has a Network Lock feature that acts as a kill switch to ensure that your network and traffic are always protected. This stops all traffic if you get disconnected from the internet, thereby keeping your data safe.

Interestingly, ExpressVPN also supports other common Virtual Private Network protocols. In fact, it supports OpenVPN, IKEv2, WireGuard, IPSec, and SSTP protocols, to name a few.

Another notable feature of ExpressVPN is the TrustedServer technology. This technology prevents your data from being stored anywhere.

This Virtual Private Network runs only on your RAM and wipes off all data once you reboot your device. It’s a step further from a no-logs policy, which is regular with many VPNs.

And with apps available for all devices, including Android, iPhone, iPad, and routers, ExpressVPN is compatible with all your devices.

You can also install it on unlimited devices, giving you the flexibility to protect all your devices.

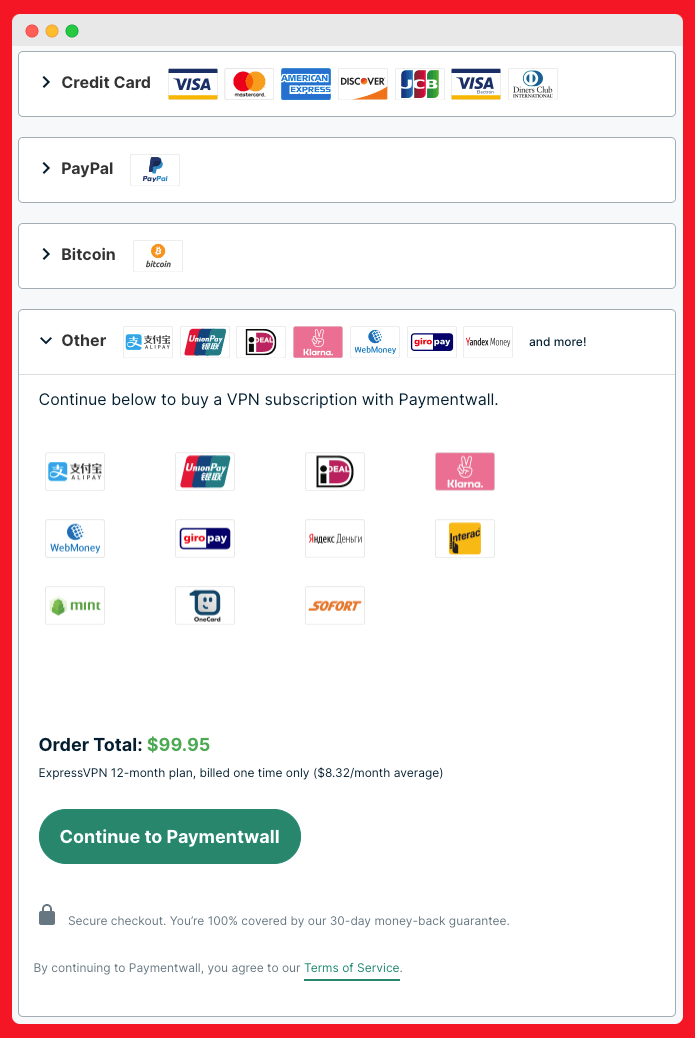

In terms of payment options, ExpressVPN accepts globally recognized payment options as well as anonymous Bitcoin payments. This adds an extra layer of anonymity and security to your online transactions.

Not to mention, ExpressVPN has been trusted by tech experts since 2009. With a track record of reliability and customer satisfaction, it’s no wonder why users and experts continue to choose ExpressVPN as their go-to VPN provider.

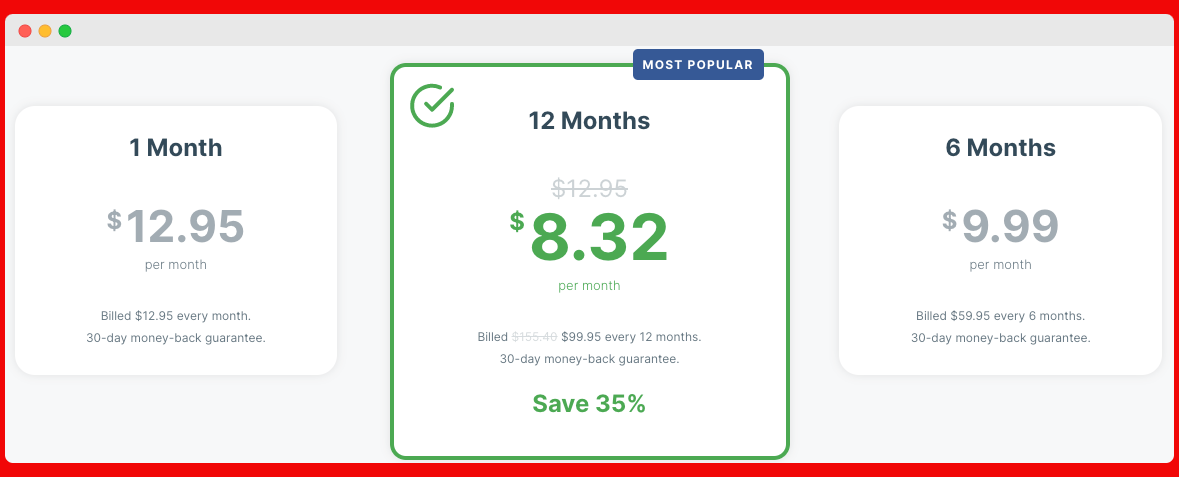

ExpressVPN pricing starts at $12.95 per month. But you can go for the six-month plan and pay $9.99 monthly.

The cheapest option, however, is the annual plan. It costs $8.32 per month, so you save thirty-five percent from the monthly plan.

⇒> Get ExpressVPN

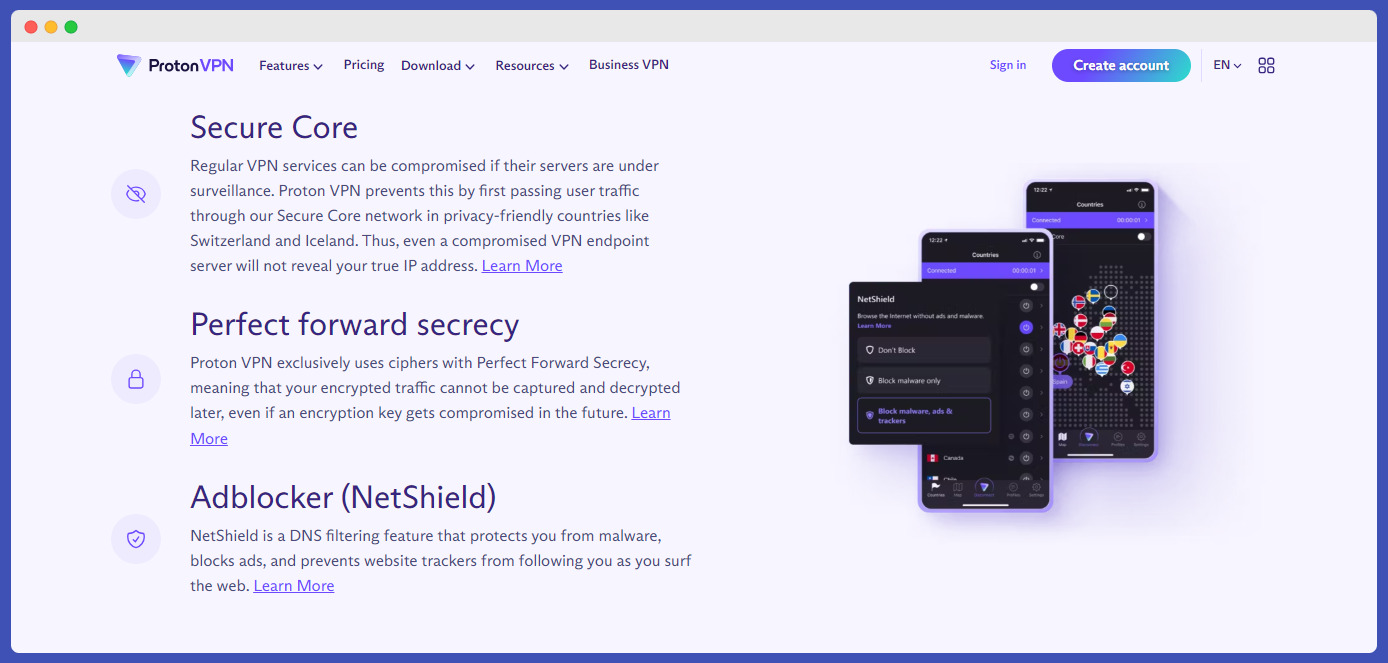

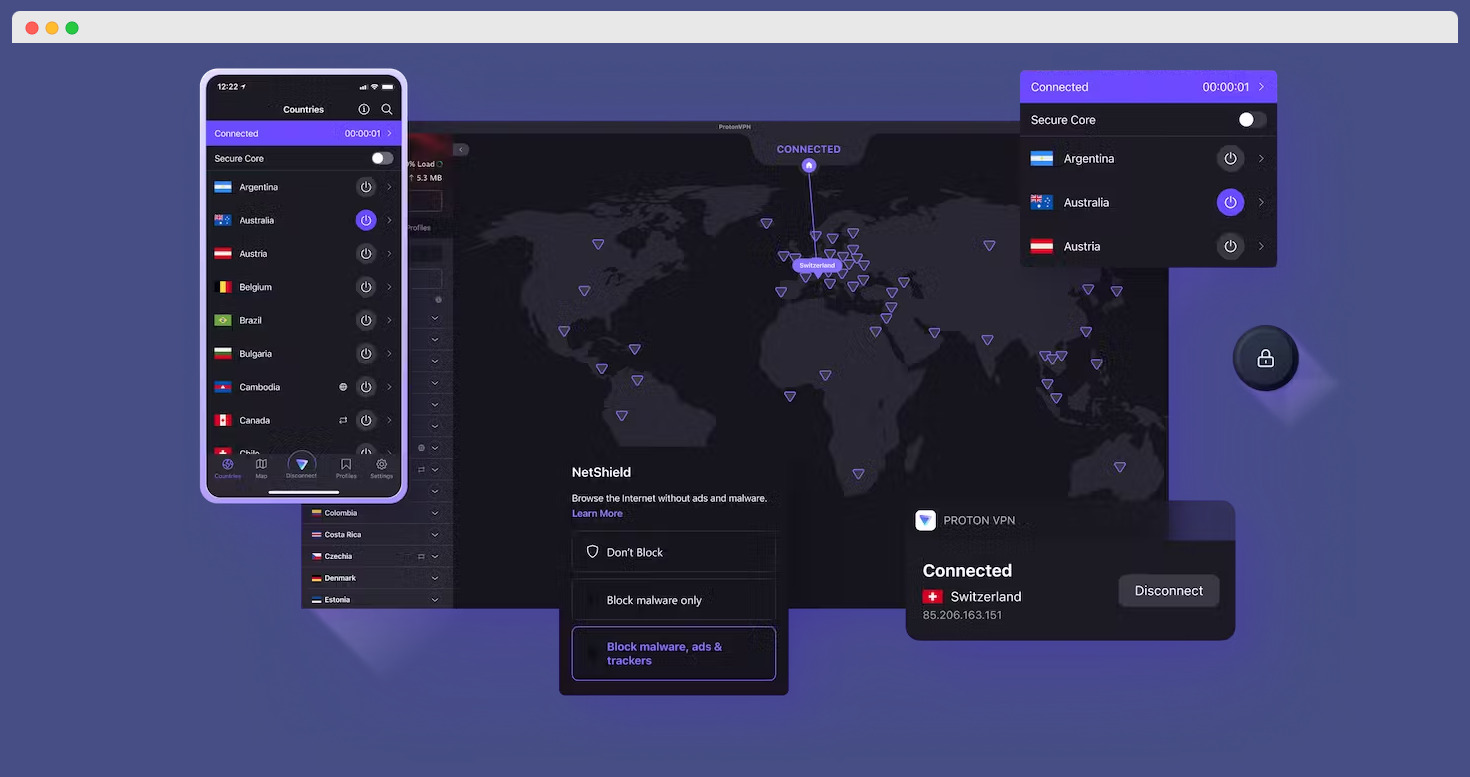

5. ProtonVPN – Best VPN service for privacy-focused users

Are you tired of compromising your online privacy and security? Look no further than ProtonVPN, the best VPN service on the market.

ProtonVPN is a Swiss-based Virtual Private Network from the same creators of ProtonMail. The Proton brand aims to provide internet security for everyone. Everyone, including users, can’t pay for a VPN.

With its excellent collection of features and a nearly peerless free subscription option, ProtonVPN is the top choice for VPNs. This means you can enjoy all the benefits of a secure and private internet connection without breaking the bank.

Premium VPNs are always more reliable than free VPNs. However, some free VPNs are reliable, and ProtonVPN’s free version is one of them.

The free VPN supports Windows, Mac, iOS, Android, and Linux. Unlike most free VPNs, it’s void of ads and comes without speed or data limits.

Furthermore, you don’t have to worry about your data logs when using the free ProtonVPN version. It doesn’t log your online activity, and Swiss privacy laws protect your data.

Many users agree that it is the best free VPN service. However, switching to the ProtonVPN paid version offers more to enjoy.

One of the standout features of ProtonVPN is its commitment to high-level security. It offers advanced encryption and tunnelling protocols, ensuring that your data remains protected from prying eyes.

Whether browsing the web or engaging in online gaming, ProtonVPN covers you. It prioritizes your security without compromising performance, making it ideal for casual internet users and avid gamers.

What sets ProtonVPN apart from its competitors is its dedication to privacy. It perfectly balances privacy, convenience, performance, and price.

Unlike other VPN service providers that bombard you with ads or impose data caps on their free plans, ProtonVPN offers a completely ad-free experience and no limitations on its free subscription option.

This means you can enjoy unrestricted access to the internet without any interruptions or restrictions.

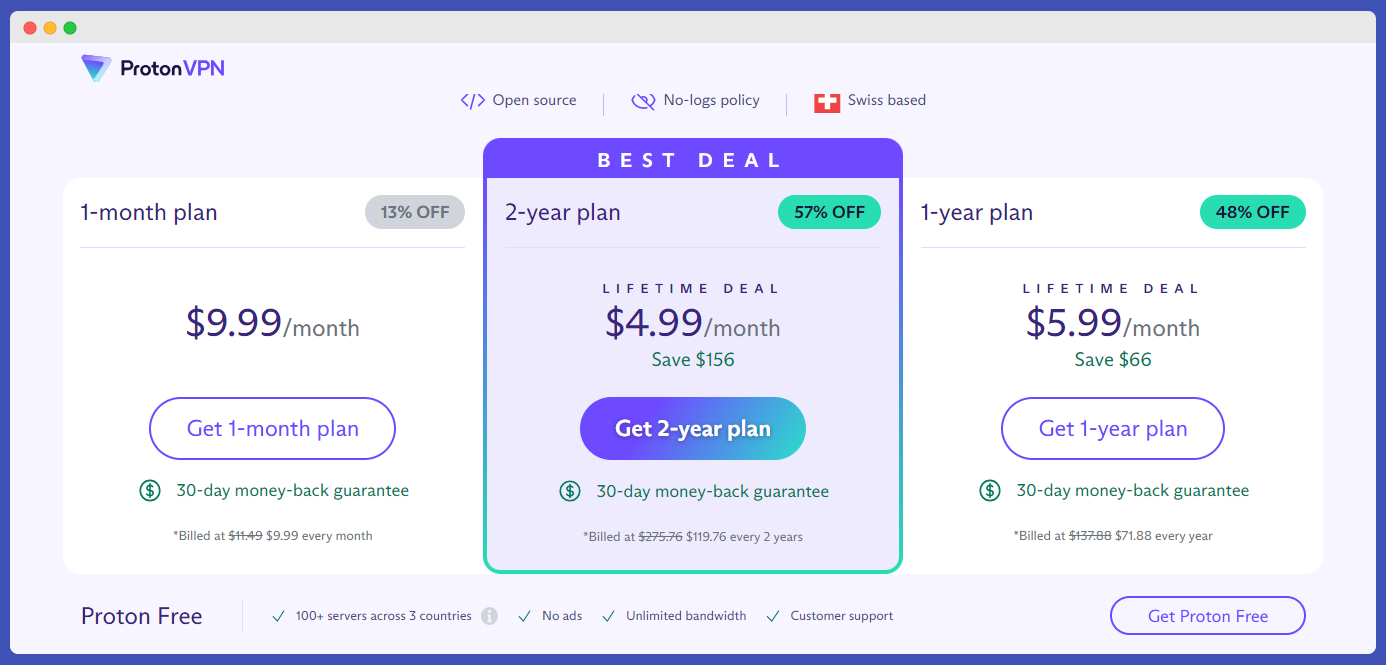

The paid version gives you access to servers in sixty-five countries and supports ten devices simultaneously. Also, it’s not expensive, costing $9.99 per month when billed monthly and $5.99 per month when billed annually.

With the two-year plan, you save 57 percent, paying $4.99 monthly.

⇒> Get ProtonVPN

6. Private Internet Access – Best VPN service for torrenting

Private Internet Access is a dependable Virtual Private Network with over ten years in the industry.

With its ultra-fast speeds and worldwide streaming servers, PIA ensures users can access their favorite content without restrictions. Whether streaming movies, sharing files, or browsing the internet, PIA offers fast and reliable connections.

One of the standout features of PIA is its focus on user privacy. This service is committed to keeping your data safe and secure. It uses open-source software and the latest encryption standards to keep your information private.

PIA provides security and anonymity by rerouting internet traffic, encrypting data, and masking your IP address. It’s no wonder why companies and individuals trust PIA for their digital privacy needs.

You can scrutinize the VPN apps to ensure they meet safety and privacy requirements. But with fifteen million satisfied customers, there’s no arguing that Private Internet Access is safe and private.

Private Internet Access stands out from other VPNs’ support for add-ons. You can install premium add-ons to further strengthen your security.

Furthermore, PIA provides dedicated IP addresses. IP addresses that you alone can use, ensuring faster speed and higher privacy.

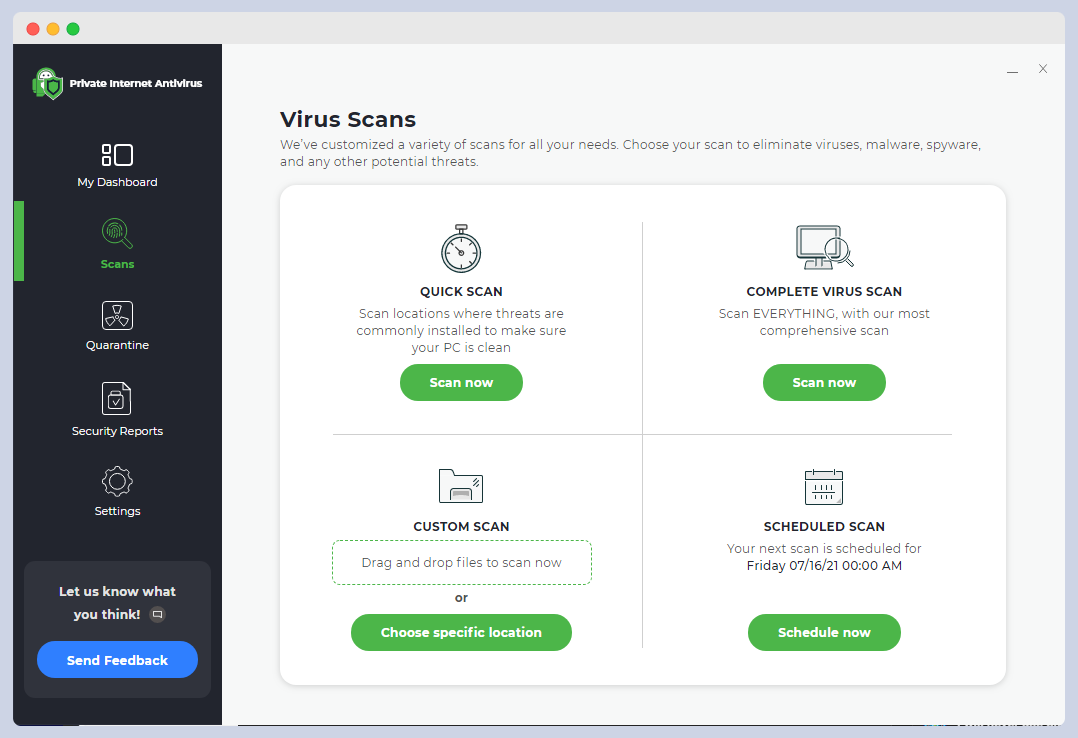

Its privacy-first antivirus protects your devices from malware and other threats, while dedicated IP addresses provide anonymity.

PIA is compatible with multiple devices, allowing you to secure all your devices with one subscription.

With its global server network, you can connect to servers worldwide and enjoy unlimited bandwidth.

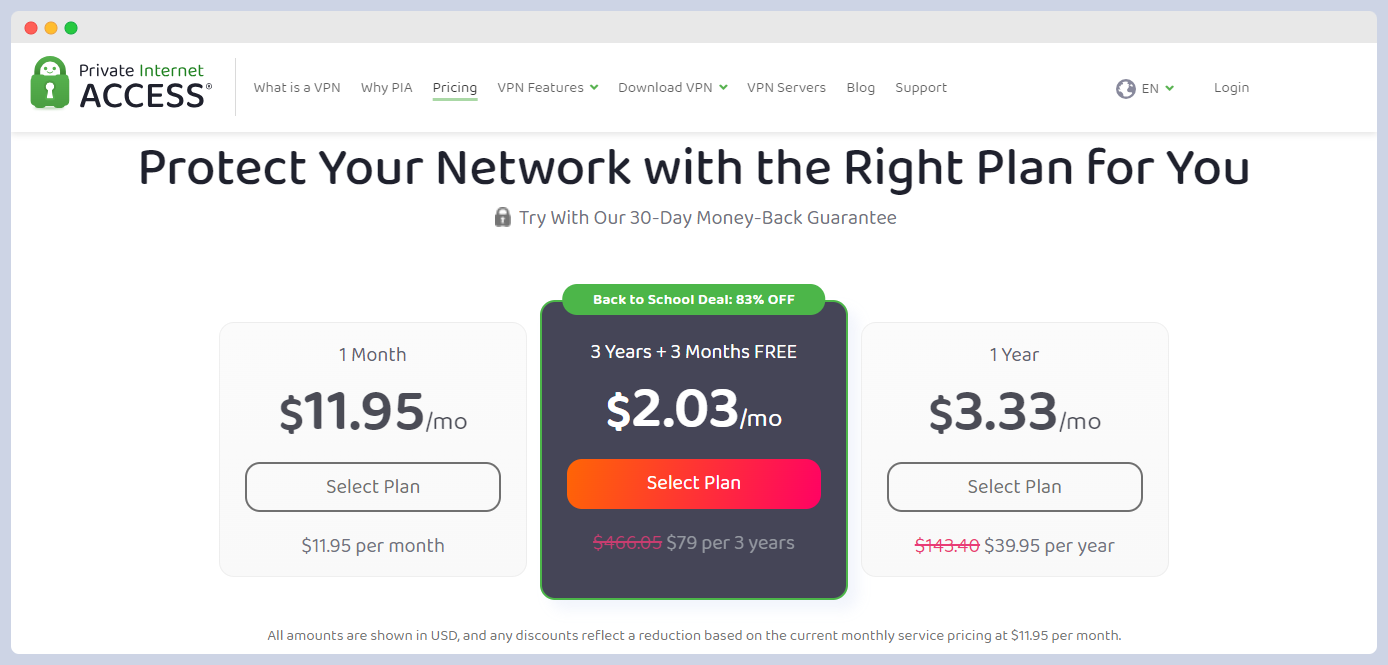

Private Internet Access has three pricing plans: monthly, annual, and three-year. The monthly plan costs $11.95 per month, while the annual plan costs $3.33 per month.

On the other hand, the three-year plan costs $2.03 per month. In addition, you get three months free at the end of the three years.

⇒> Get Private Internet Access

7. PureVPN – Best VPN service for dedicated IPs

We have a Virtual Private Network with over a thousand and five hundred servers worldwide. From those many servers, over three hundred thousand IPs are available for you to use.

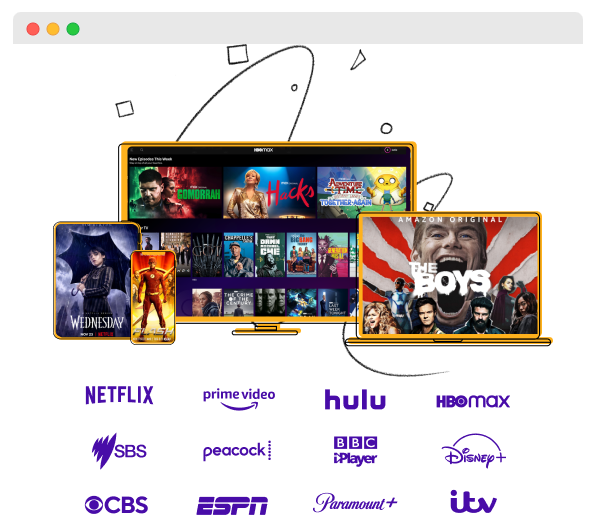

With an outstanding network of international VPN servers and a vastly improved client app, PureVPN ensures you have seamless access to various streaming platforms.

Whether it’s Netflix, Hulu, HBO Max, Amazon Prime Video, Disney+, or BBC iPlayer, PureVPN has covered you. Say goodbye to buffering and hello to uninterrupted entertainment.

But PureVPN is not just about streaming. It also prioritizes your privacy and security. With a privacy policy that has been audited, you can trust that your online activities are protected.

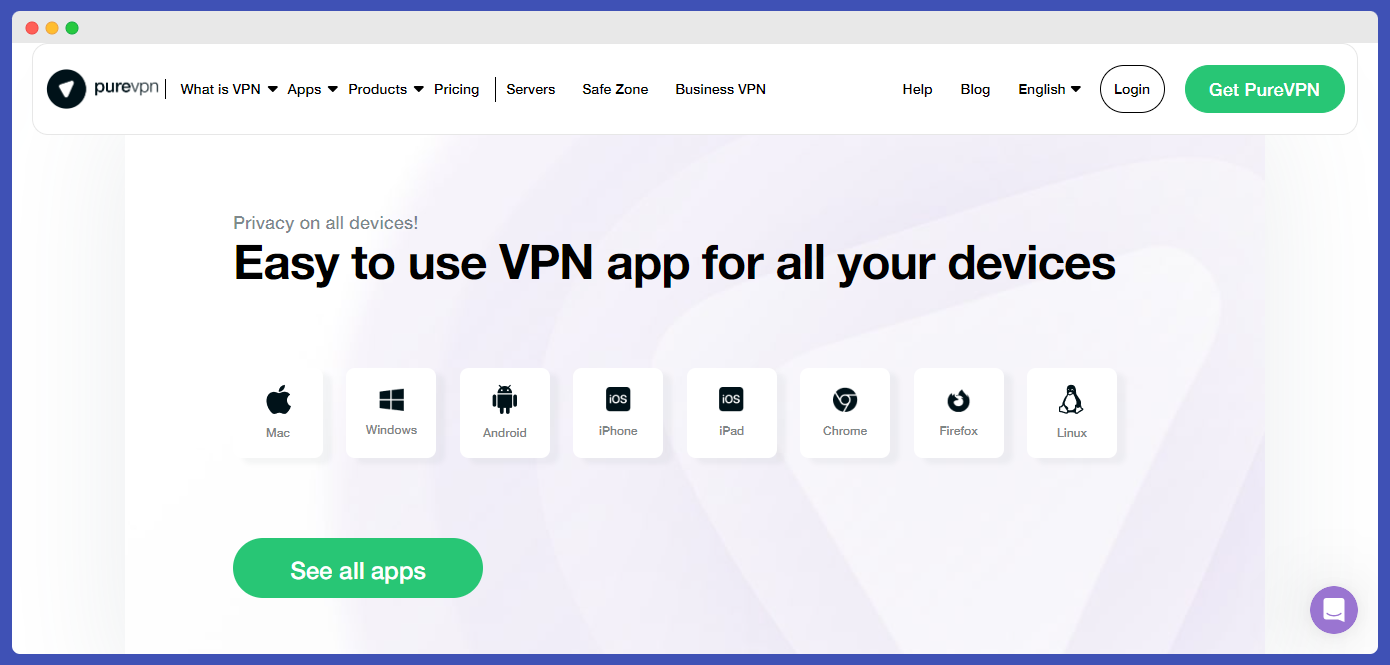

However, the highlight is that PureVPN is one of the best VPN services in compatibility. You can use their service on all your devices, and that’s not an overstatement.

This service supports desktops and will work on Windows, Mac OS, Linux, and Chromebook. It supports mobile devices and will work on iPhones, iPads, Android, and Huawei.

For browser extensions, PureVPN is available on Chrome, Firefox, Edge, and Brave browsers. For streaming devices, it is available for Apple TV, Samsung TV, Chromecast, Nvidia, Android TV, and Amazon Fire TV.

PureVPN still supports more streaming devices, gaming consoles – PlayStation, Xbox – and routers. Little wonder why they boasts of over three million users.

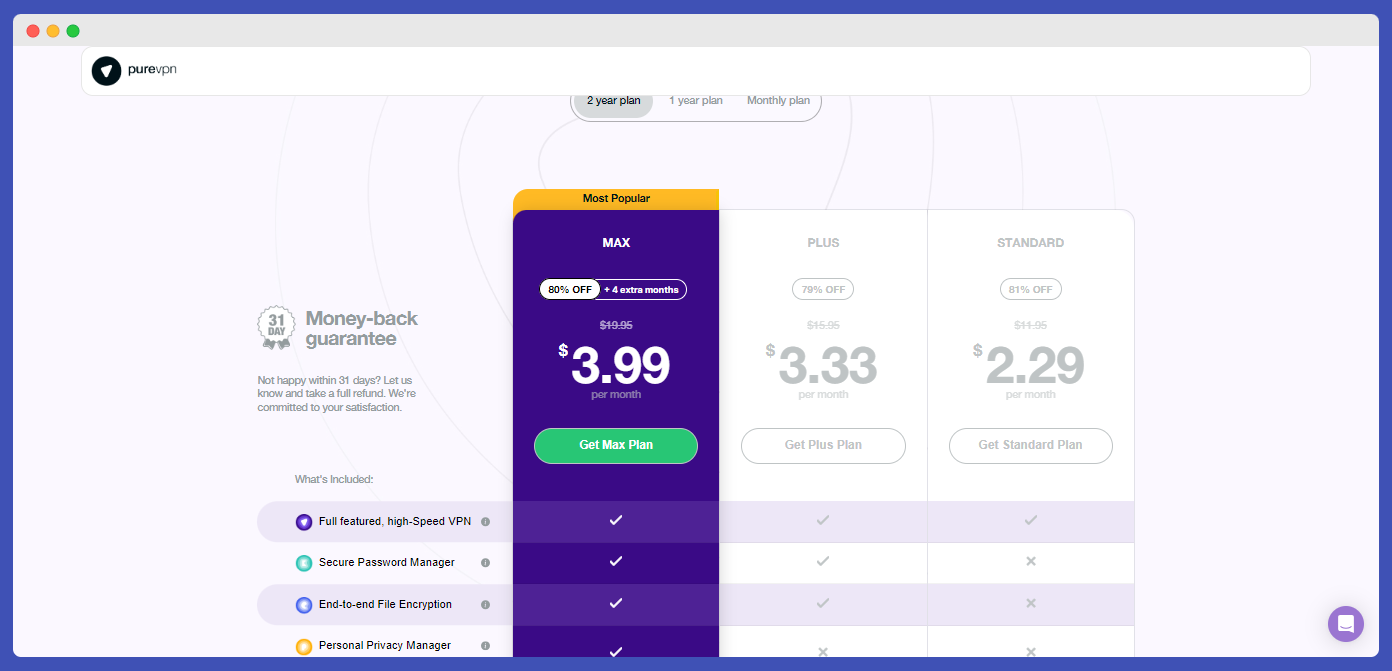

Like many best VPN services, you can pay for PureVPN monthly, annually, and biannually. Notably, PureVPN is available in three packages, including

- Standard (PureVPN) – $2.29 per month for a 2-year plan

- Plus (PureVPN, PureKeep Password Manager, and Purencrypt) – $3.33 per month for a 2-year plan

- Max (PureVPN, PureKeep Password Manager, Purencrypt, PurePrivacy) – $3.99 per month for a 2-year plan + 4 free months

⇒> Get PureVPN

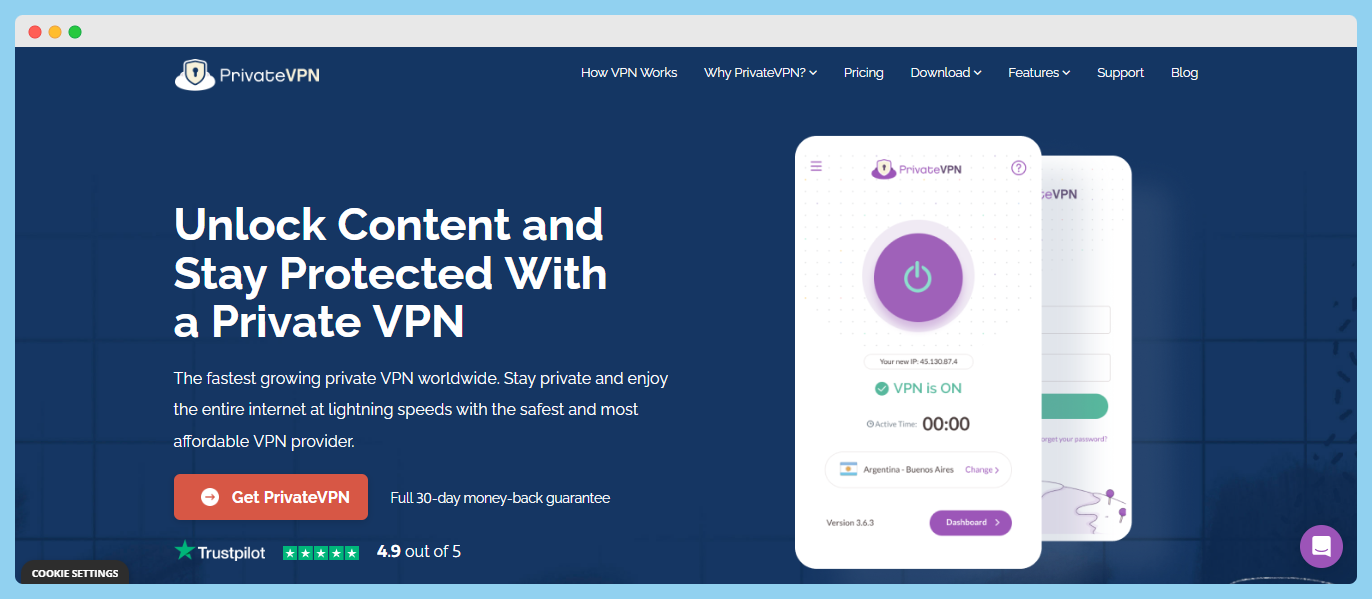

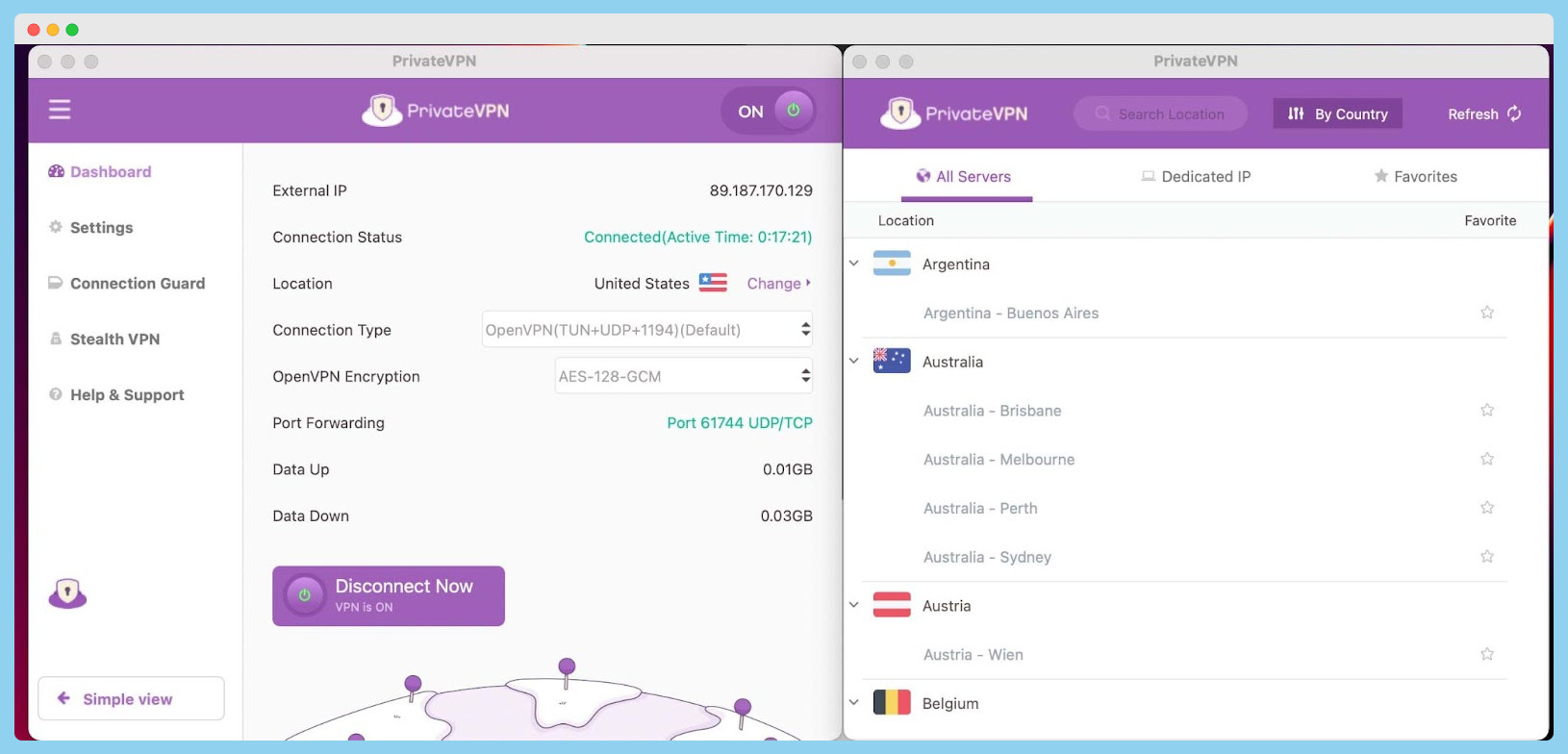

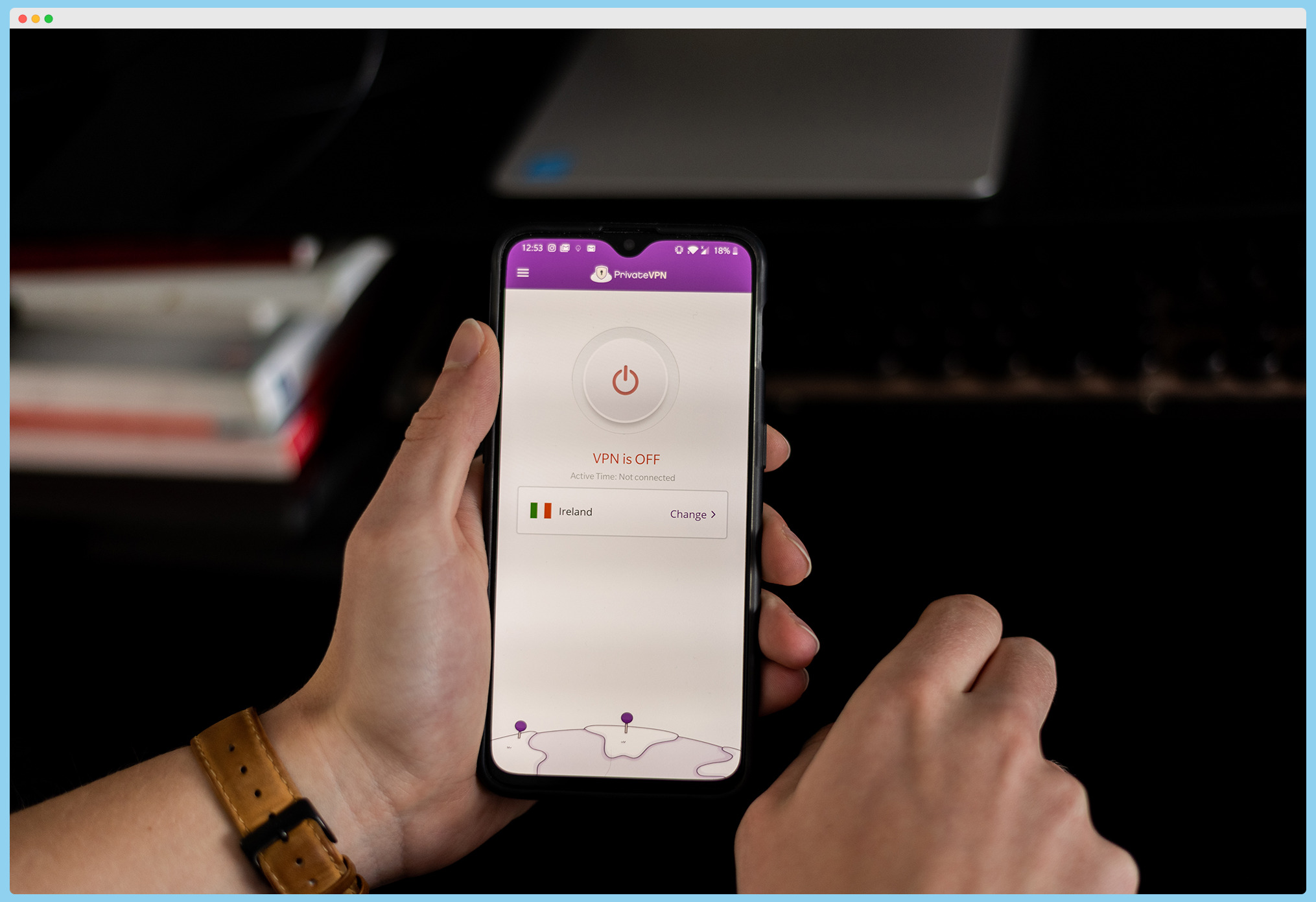

8. PrivateVPN – Best VPN service for simplicity

Known as the fastest-growing private VPN in the world, PrivateVPN boasts a presence in more than sixty-three countries. These sixty countries have over 200 VPN servers and thousands of IP addresses.

It ranks among the best VPN services in terms of secure connection. For that, it uses military-grade 2048-bit encryption and speed-optimised servers.

Military-grade encryption keeps your data safe from prying eyes, ensuring your online activities remain private and secure. Whether browsing on public Wi-Fi or accessing sensitive information, you can rest easy knowing that PrivateVPN has your back.

Speed is another area where PrivateVPN excels. With servers located worldwide, you can enjoy blazing-fast speeds no matter where you are.

Whether you’re streaming your favorite shows, downloading large files, or engaging in online gaming, PrivateVPN ensures you won’t experience lag or buffering.

You can connect to PrivateVPN in a minute on any device. It’s a lightweight VPN, so downloading won’t take time. And you can set it up with a single click. There are no heavy, lengthy configurations.

PrivateVPN is installable on smartphones, tablets, computers, and routers. Notably, it supports Mac, Windows, iOS, Android, and Linux.

However, a standout feature of PrivateVPN is the premium in-house support. You can access this top-quality support as a paid subscriber and have an in-house developer assist you if you have any issues.

But don’t just take my word for it. PrivateVPN has received rave reviews from users around the world. From its reliable performance to its excellent customer support, it’s clear that PrivateVPN is the best choice for those looking for a Virtual Private Network that delivers on all fronts.

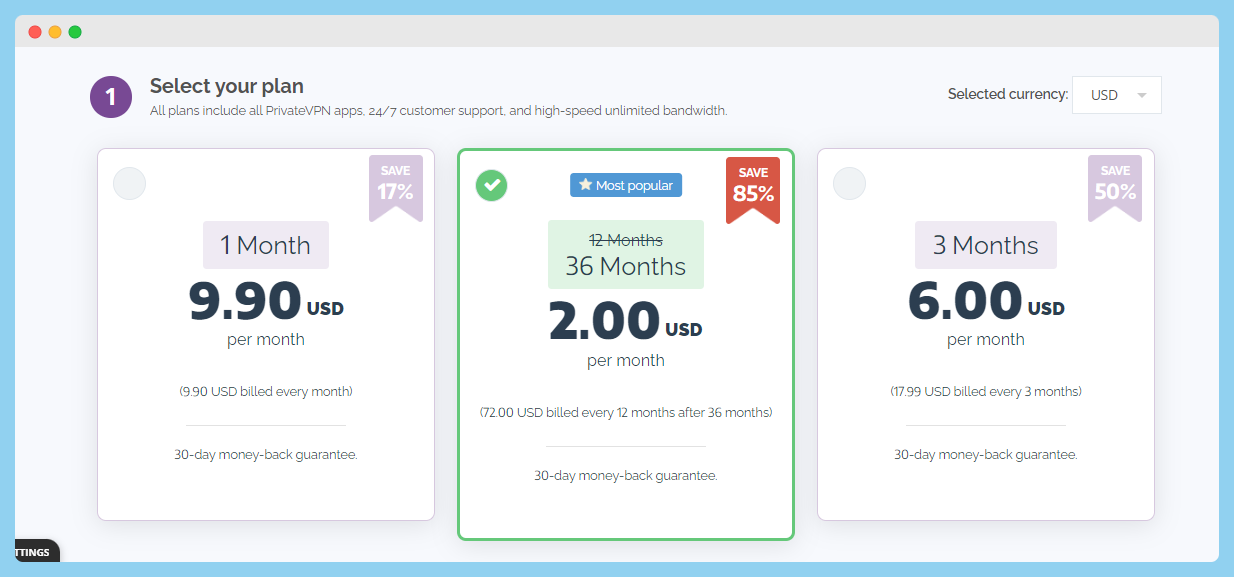

Regarding subscribing, your best option is the thirty-six-month plan, which costs $2 monthly. If you’d prefer to pay every month, the price is $9.90.

⇒> Get PrivateVPN

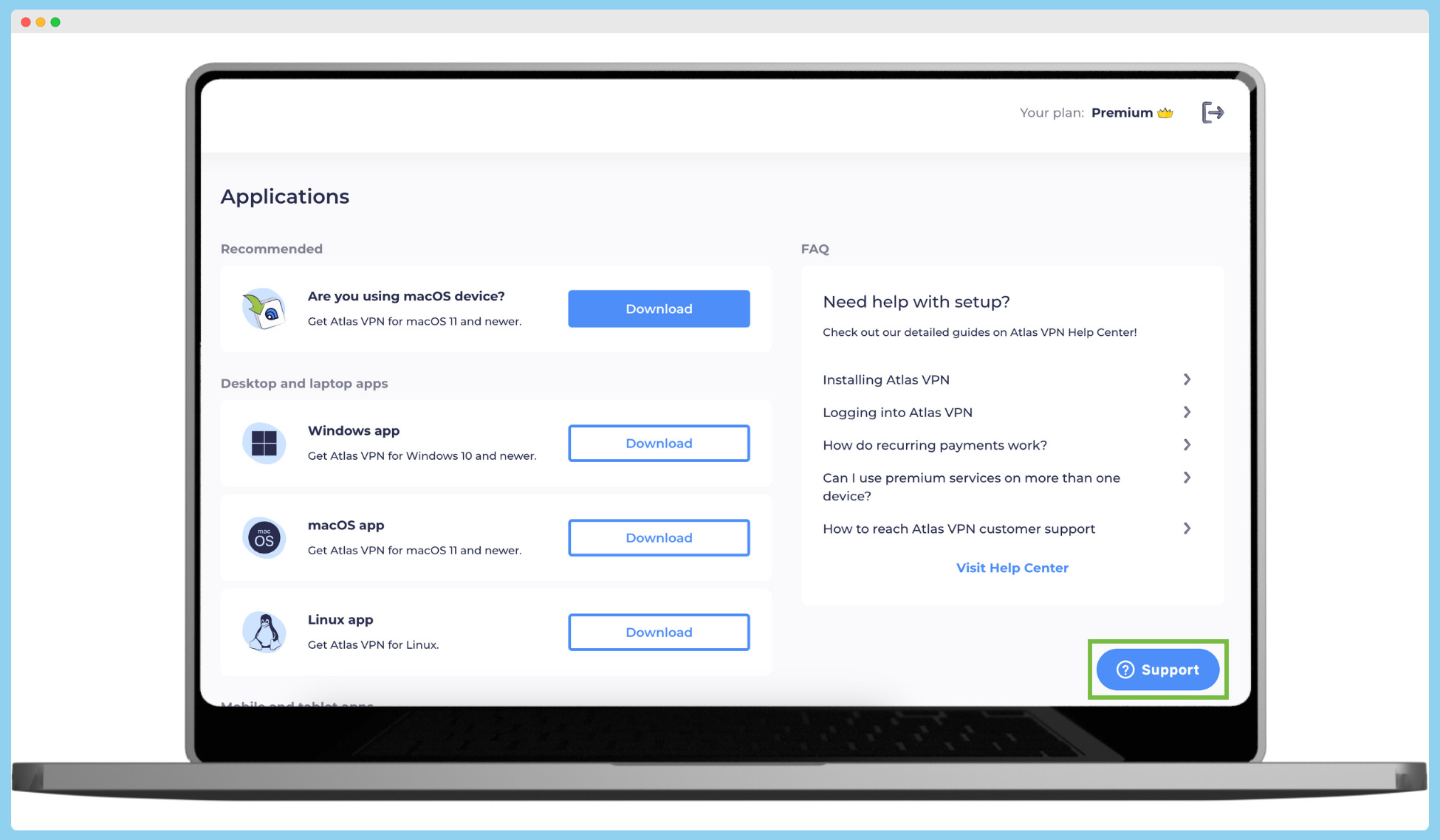

9. Atlas VPN – Best free VPN tier

Looking for the best VPN to ensure your online security and privacy? Look no further than Atlas VPN! This freemium VPN is perfect for beginners and offers a range of excellent features that will keep you protected while browsing the internet.

With Atlas VPN, you can rest assured that your sensitive data is encrypted using the ChaCha20 cipher, guaranteeing top-notch security. Plus, this Virtual Private Network has passed multiple encryption, kill switch functionality, and leak protection tests, so you can trust that your information is safe and secure.

But that’s not all – Atlas VPN goes above and beyond to provide its users with a seamless browsing experience.

This VPN service allows you to enjoy safer browsing, high-quality streaming, and advanced digital identity protection. Whether accessing your favourite streaming platforms or conducting important online transactions, Atlas VPN covers you.

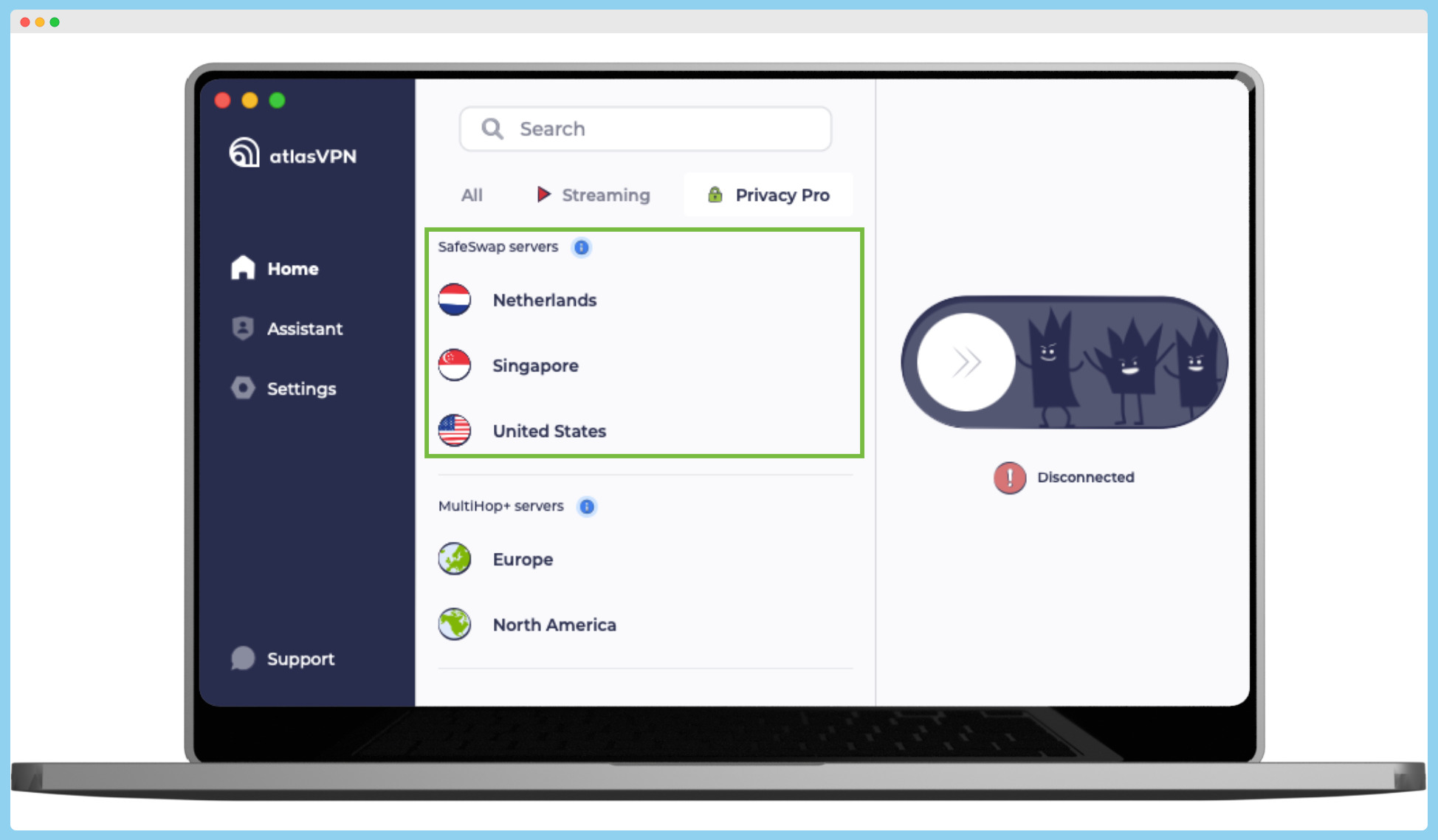

One of the standout features of Atlas VPN is its multi-hop functionality. Paid subscribers have access to MultiHop+ servers that encrypt traffic twice, adding an extra layer of security to your online activities.

Although you can’t choose the server location, this feature ensures your data remains highly secure. Paying subscribers also get access to SafeSwap servers, which rotate IP addresses while browsing the internet.

While it may not significantly impact privacy, enhancing your online experience is an added bonus.

It’s no wonder that Atlas VPN is highly regarded as one of the best free VPNs available. Its user-friendly interface, extra features, and dedication to security make it an excellent choice for beginners and experienced users.

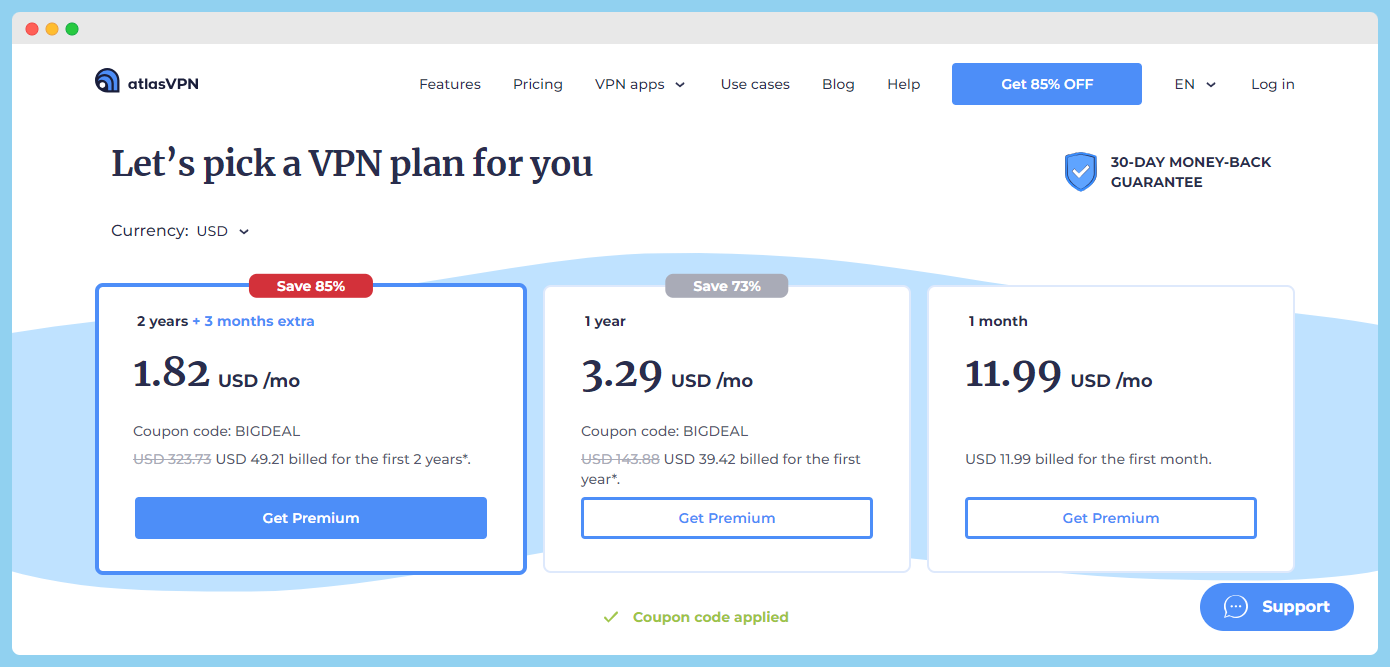

Atlas VPN has a starting pricing of $1.82 monthly for its 2-year plan plus 3 months free. Also, it costs $3.29 per month for a 12-month plan. Meanwhile, it has a monthly pricing of $11.99 per month when billed on a monthly basis.

So why wait? Try Atlas VPN today and experience the ultimate online security and privacy!

⇒> Get Atlas VPN

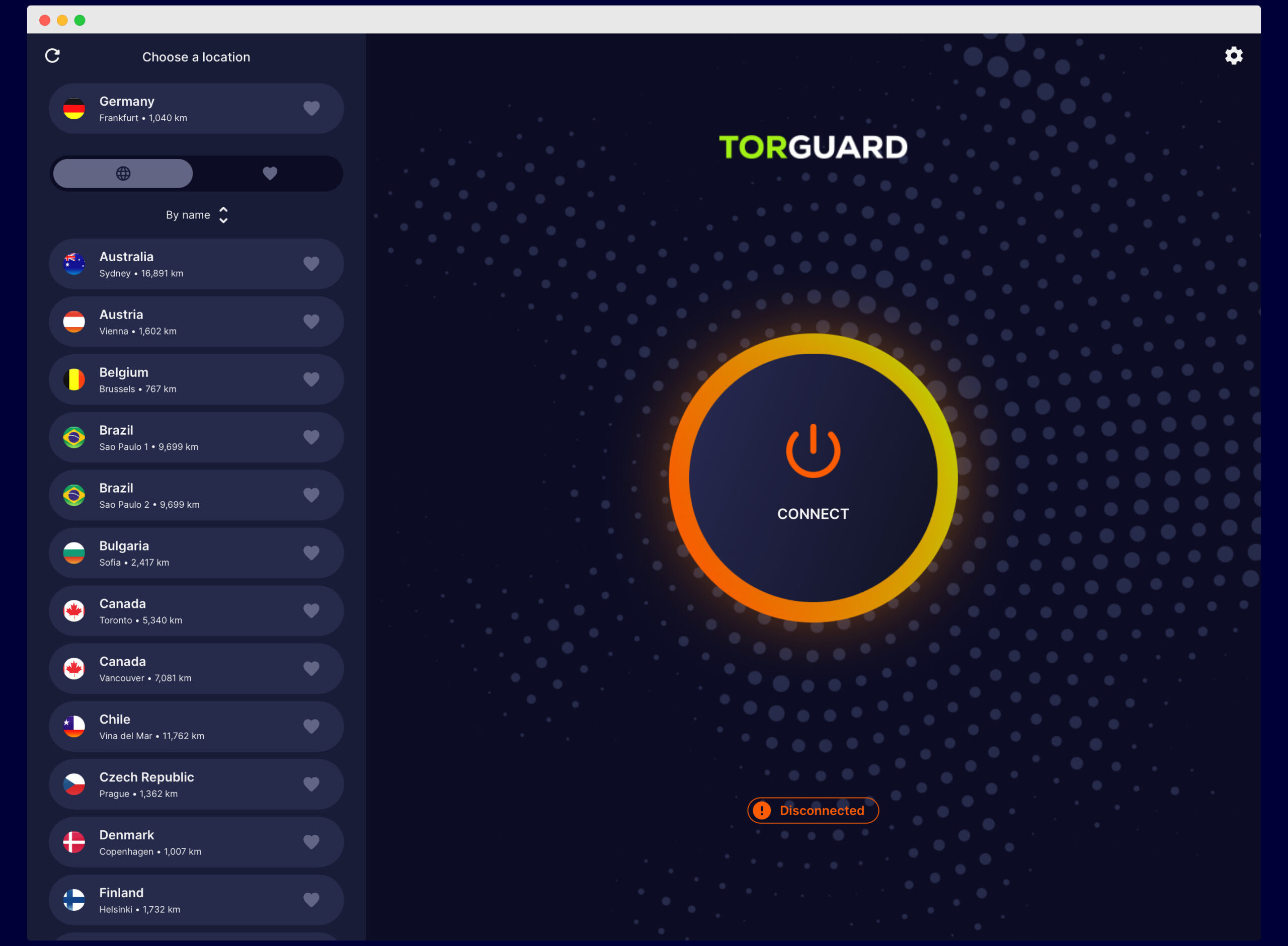

10. TorGuard – Best VPN for specialized privacy features

Thanks to its unique encryption algorithms, TorGuard is arguably the most anonymous VPN on this list.

With TorGuard, you can protect yourself from hackers, identity theft, censorship, and monitoring by ISPs. This service offers complete online anonymity and security, ensuring your web traffic remains private and secure.

TorGuard also supports P2P and torrents, making it the ideal choice for BitTorrent seeders and leechers.

Its features appeal to security enthusiasts, including DNS leak protection, unlimited speed and bandwidth, and multiple protocols. These features ensure that your online activities are secure but also fast and efficient.

TorGuard shares the same Tor technology as the Tor Browser, which prioritizes anonymous communication. In particular, it employs 256-bit AES encryption and DNS/IPV6/WebRTC leak blocking.

In addition to being an anonymous VPN, TorGuard is also a Stealth VPN. This means that it can bypass firewalls and VPN blocks. And this feature is only available in the best VPN services.

Notably, TorGuard is a VPN of advantage if you do a lot of emailing. It comes with OpenPGP email encryption, allowing you to communicate super securely.

Another reason to consider TorGuard is that its VPN apps are easy to use. They’re user-friendly, whether on Windows, Mac, Linux, iOS, or Android. It will also work on VPN-supported Wi-Fi routers.

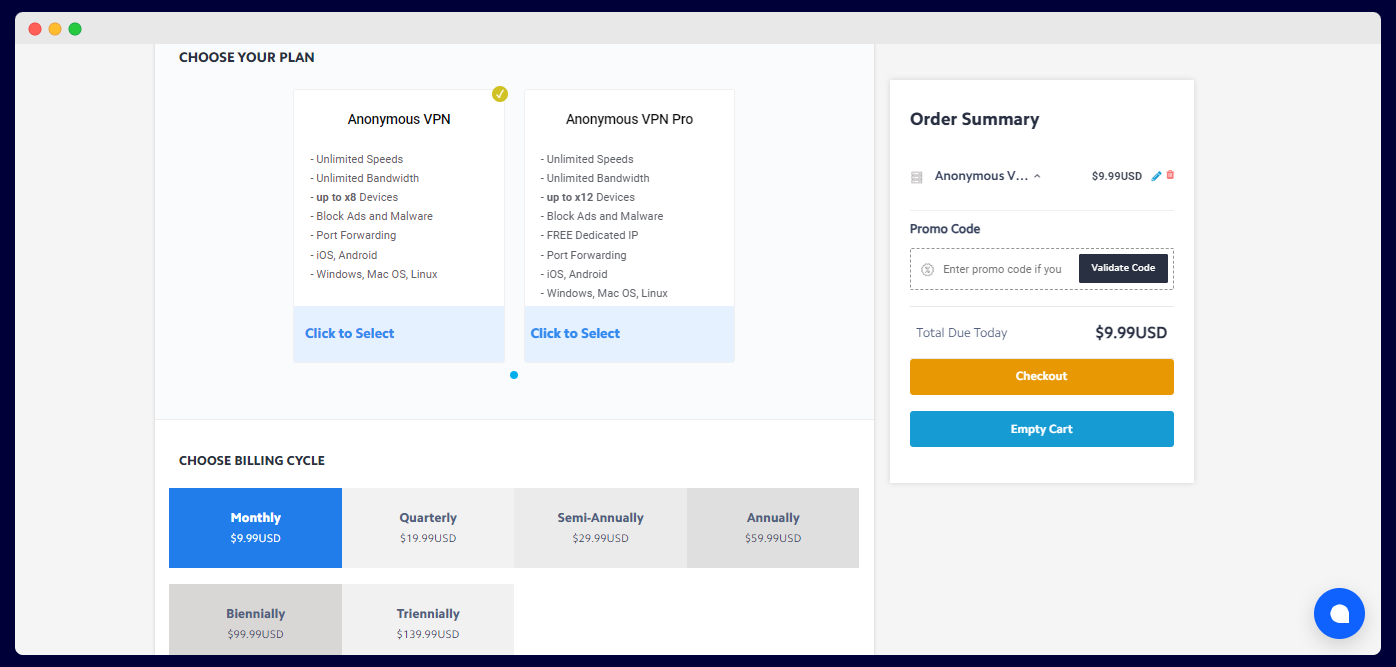

In terms of pricing, you can get the Standard version of TorGuard for $9.99 per month. The Pro version is available for $12.99 per month.

But if you’re a business, you pay $32.99 per month. Payments can be made through various methods, including PayPal and Bitcoin, allowing you to choose the payment method that works best for you.

⇒> Get TorGuard

11. VyprVPN – Best VPN for bypassing restrictions

VyprVPN is one of the best VPN services for privacy. Its developers believe privacy is a human right, so their product ensures you stay private anytime you connect to the internet.

In particular, this service was developed to tackle government surveillance, hackers, identity thieves, and malware. When you connect to VyprVPN servers, no one can track what you do on the web.

This Swiss-based VPN provider has undergone significant improvements and is now considered one of the top options in the market.

With VyprVPN, you can enjoy secure applications, lightning-fast speeds, and a self-owned server network. Whether streaming your favourite shows or downloading files, VyprVPN delivers exceptional reliability and speed.

Consequently, VyprVPN ensures you are not restricted to the internet. In other words, the VPN servers will unblock any geo-restricted website in any country, organization, or workplace.

When it comes to privacy and security, VyprVPN doesn’t disappoint. It boasts a strict no-logs policy, a kill switch feature, and 256-bit AES encryption, ensuring your sensitive data remains protected.

To further guarantee your security, VyprVPN uses DNS Leak Protection. As a result, your traffic won’t leak to ISP servers. This VPN provider even works reliably in restrictive countries like China and Iran.

Plus, it supports the advanced WireGuard VPN protocol; hence, VyprVPN supports all major devices, including Windows, Mac, Android, and iOS. An app for Roku is also available.

VyprVPN offers two simple pricing plans: the $10 monthly plan and the $5 per month annual plan. Whichever you go for, you get a thirty-day money-back guarantee.

⇒> Get VyprVPN

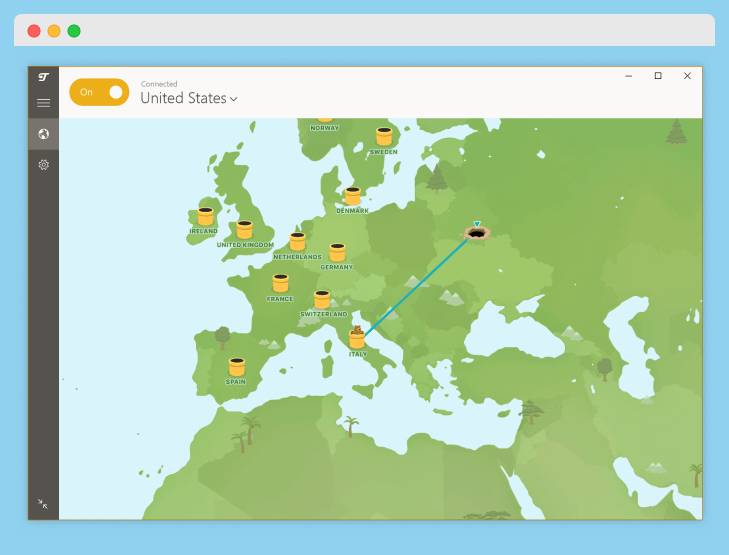

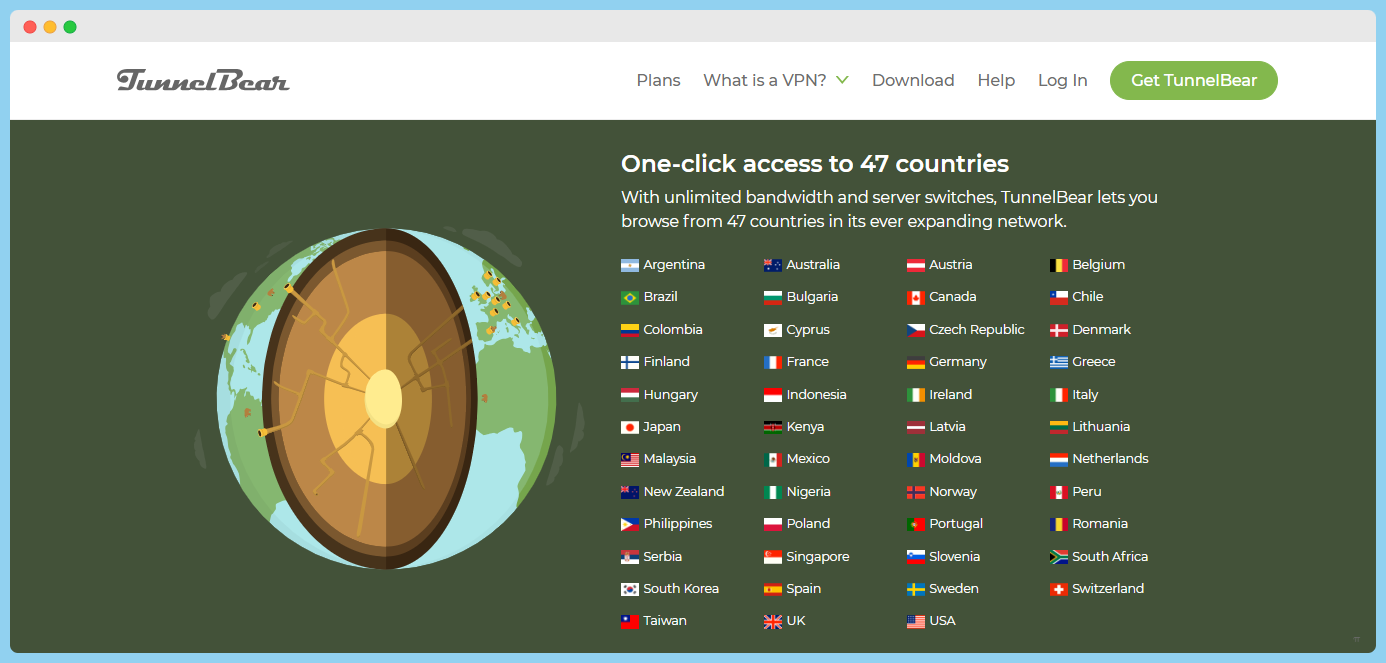

12. TunnelBear – Best user-friendly VPN

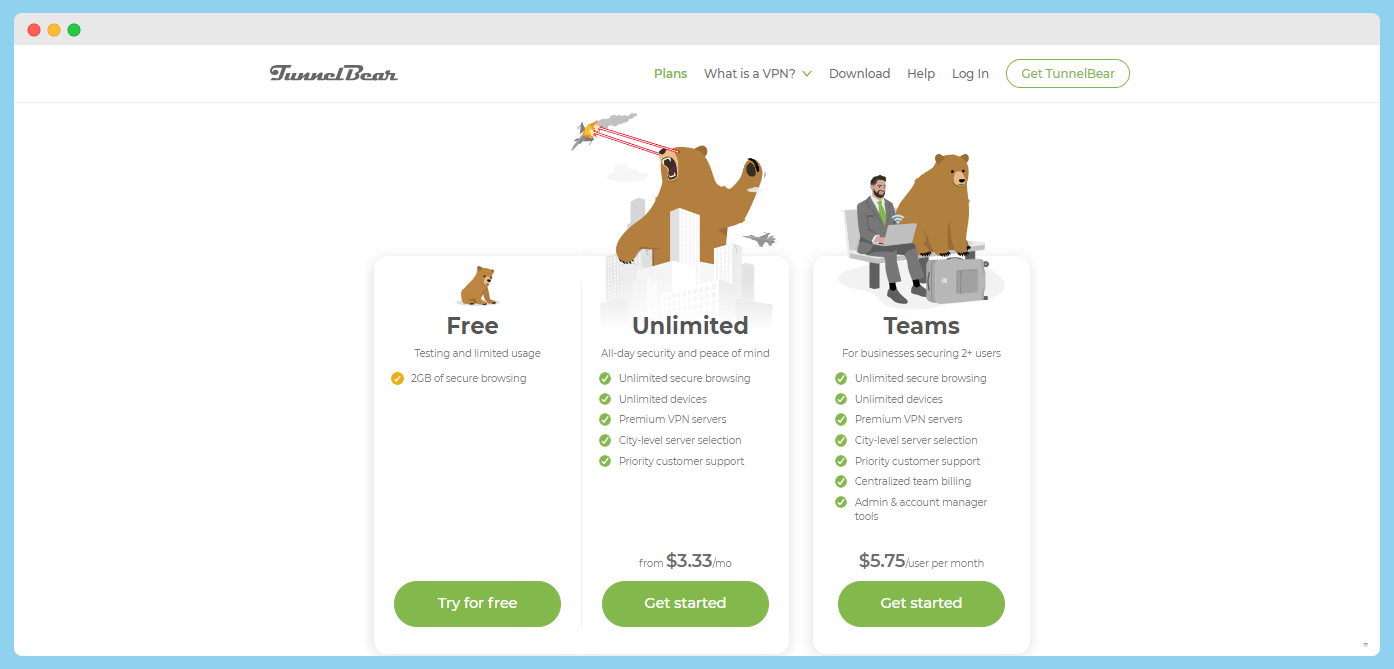

According to experts and reviewers, TunnelBear is among today’s top VPNs. With its strong privacy features and unlimited simultaneous connections, TunnelBear ensures that your online activities remain secure and private.

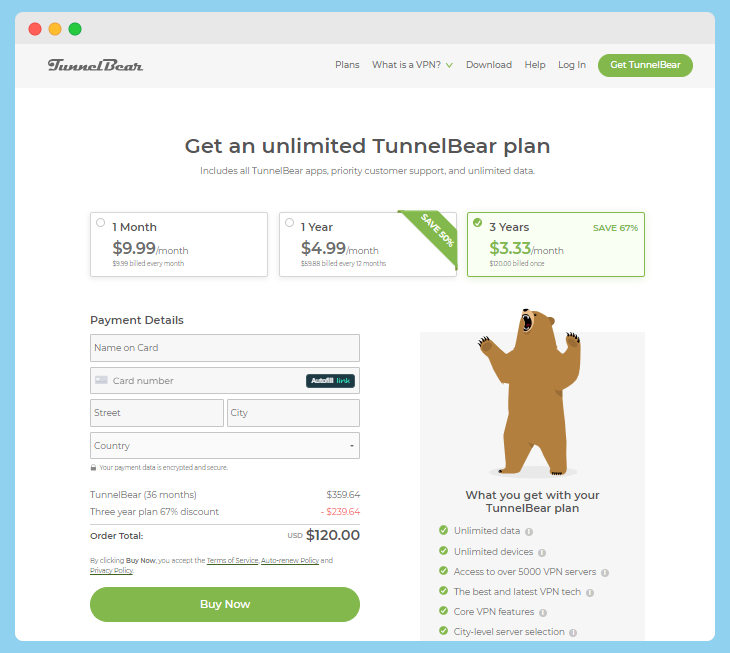

This VPN service offers a free subscription tier with limited data and affordable paid plans starting at just $9.99 monthly.

VPNs are generally seen as technical apps and programs. TunnelBear, however, is more fun than technical. The Virtual Private Network uses eye-pleasing animations.

Since this VPN is fun, you’ll expect it to be easy to use, which is true. It only takes one click to connect TunnelBear to your preferred VPN server.

Away from the fun, TunnelBear is a highly secure and private VPN. Top publications like Forbes, LifeHacker, and The Verge wouldn’t feature it if it weren’t.

Notably, TunnelBear is one of the best VPN services for gaming. It comes with exclusive new game servers that are super fast and anti-throttle.

You can bypass game restrictions with servers across forty-seven countries. The servers span the Americas, Europe, Africa, Asia, and the Middle East, and you get thousands of IP addresses.

One of the standout features of TunnelBear is its ability to work with popular streaming services such as Netflix and Amazon Prime Video.

It provides fast HD streaming speeds, ensuring you can enjoy your favourite shows and movies without any buffering or lag. However, it’s worth noting that some servers might not work with Netflix libraries from certain countries.

In terms of speed, TunnelBear performs exceptionally well on nearby servers, although it may not be as fast on distant servers.

But the good news is that both the free and paid versions of TunnelBear offer similar speeds, so you don’t have to compromise on performance if you choose the free plan.

Just as it’s simple to use, TunnelBear’s pricing plans are also simple.

The free version of TunnelBear now includes 2GB of data, making it even more appealing to users who want to try out the service before committing to a paid plan.

You can use this service for free or pay $9.99 per month. Another option is to pay for three years and save sixty-seven percent on the monthly plan.

⇒> Get TunnelBear

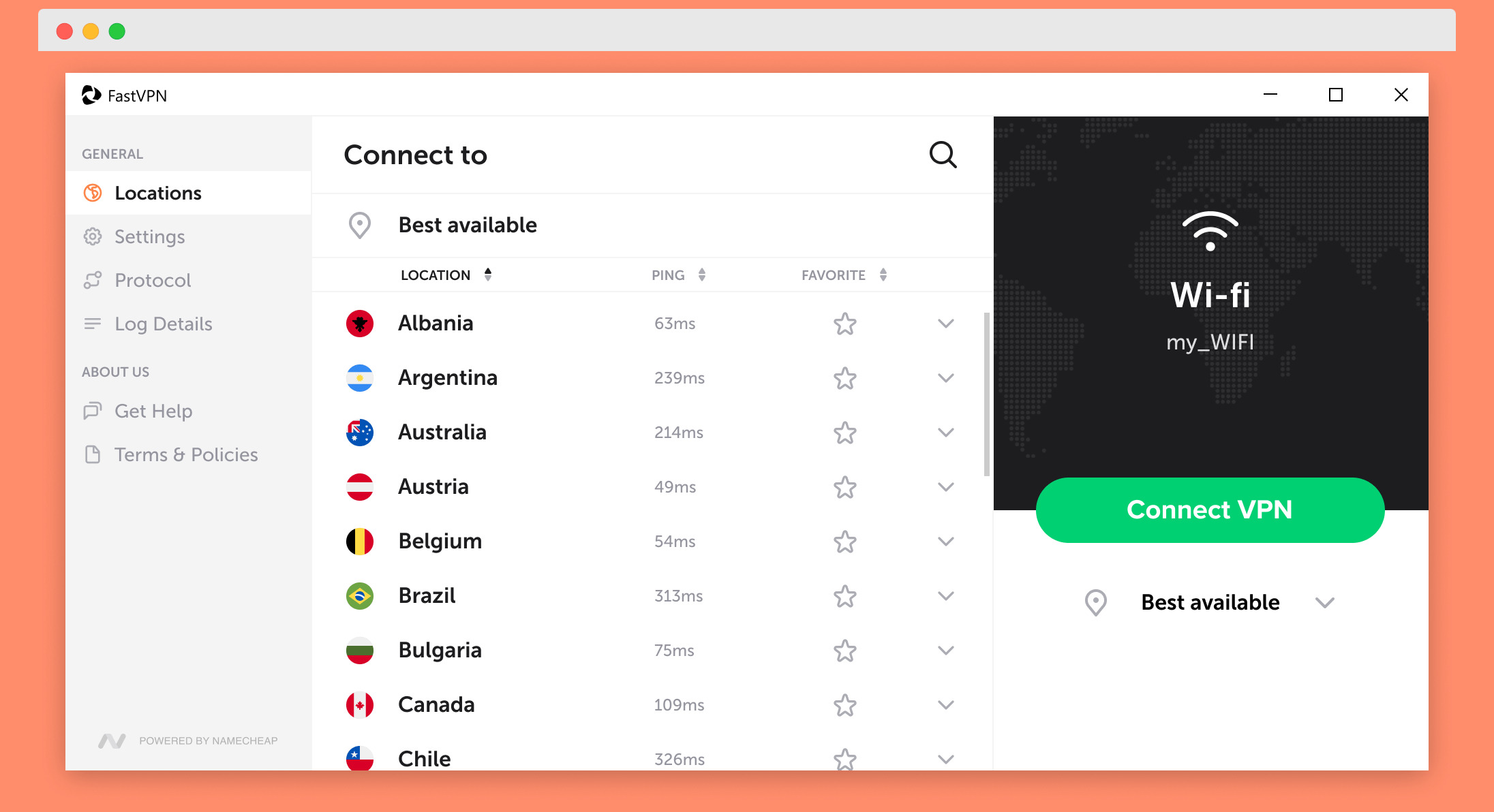

13. FastVPN – Best VPN for high-speed connections

You can easily conclude from the description that this is a high-speed VPN. That’s true, but it’s also more. It is fast, secure, and affordable.

This easy-to-use VPN service allows you to browse websites and apps anonymously, shop securely, and hide your real location on unlimited devices. With FastVPN, you can enjoy a private and secure internet experience, knowing that your data is protected from prying eyes.

Developed by NameCheap, FastVPN features over one thousand servers in over seventy-five locations. Each server has unlimited bandwidth, is easy to connect, and keeps no logs.

When it comes to speed and security, FastVPN delivers. It offers fast speeds on most servers, ensuring a smooth and seamless browsing experience.

It also provides strong security measures to protect sensitive information from hackers and cyber threats. However, it’s worth noting that FastVPN lacks some features for mobile devices, which may be a drawback for some users.

While FastVPN has its strengths, it’s important to consider its privacy policy. There are concerns about data logging and privacy practices as a US-based VPN service. This is something to keep in mind if protecting your online privacy is your top priority.

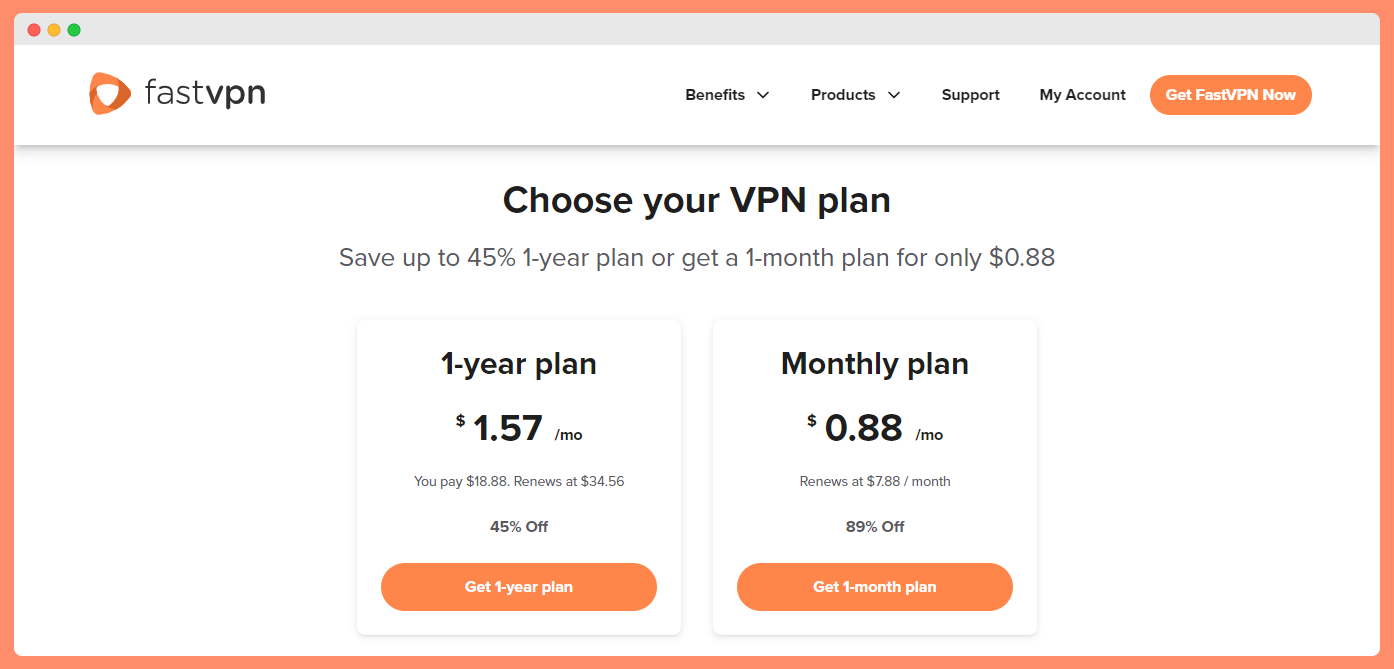

One of the standout features of FastVPN is its affordability. NameCheap offers two pricing plans that provide the same security features.

FastVPN has two pricing plans: a monthly plan at $0.88 per month and a one-year plan at $1.57 per month. Knowing NameCheap and its web hosting services, you won’t be surprised that FastVPN is this affordable.

This means that no matter which plan you choose, you can enjoy fast speeds, strong security, and the ability to unblock streaming platforms like Netflix and HBO Max. The best part? FastVPN doesn’t break the bank, making it an excellent choice for budget-conscious users.

⇒> Get FastVPN

14. VeePN – Best affordable VPN

Are you looking for the best VPN to enhance your internet experience? Look no further than VeePN! With its impressive features, VeePN is here to provide you with speed and safety.

Their No Logs policy ensures that your online activities remain private, while the Kill Switch feature adds an extra layer of security.

But that’s not all – VeePN offers additional features to make your browsing experience even more delightful. With VeePN, you can enjoy fast and secure internet access like never before.

VeePN is a lesser-known VPN provider based in Panama. While it may not be as well-known as some competitors, VeePN offers many servers and interesting features that set it apart.

This VPN service supports various operating systems and even offers browser extensions for Chrome and Firefox, making it convenient to use across different platforms.

Their app is well-designed and user-friendly, ensuring that even those new to VPNs can easily navigate and take advantage of its features.

The ability to connect through a chain of VPN servers, known as multi-hop, ensures that your online activities remain anonymous and secure.

Additionally, VeePN provides ad-blocking capabilities, allowing a smoother browsing experience without pesky ads interrupting your online activities.

While VeePN offers solid security features such as the VeePN Antivirus, malware blocker, and double VPN, its speeds may be slow for some users.

Regarding speed, VeePN may not be at the top of the list. However, it performs well for online gaming, making it suitable for gamers who value security and performance.

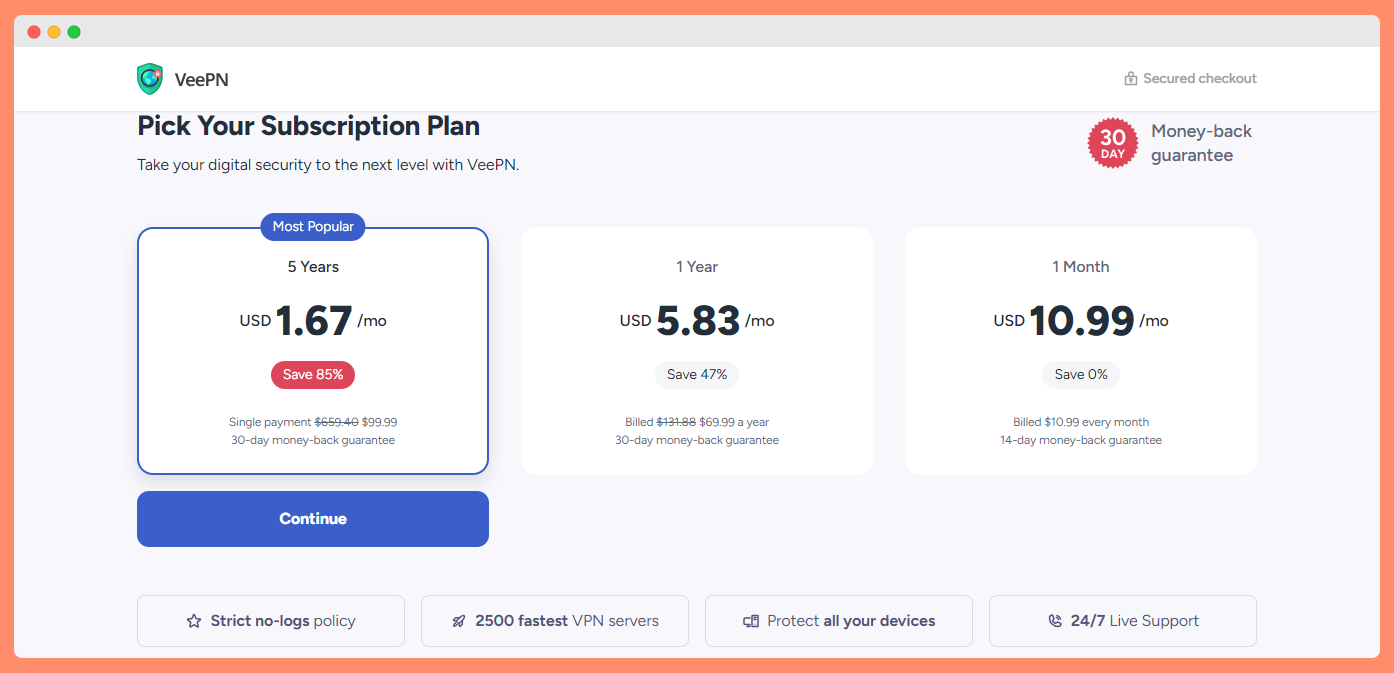

Nevertheless, it has pricing plans starting from $1.67 per month for its 5-year plan.

⇒> Get VeePN

15. VuzeVPN – Best VPN for torrenting support

If you’re searching for the best VPN provider, look no further than VuzeVPN. With its good speeds and security features, this smaller VPN is making waves in the industry.

While it may not have the most impressive support service or privacy policy, it makes up for its ability to bypass geo-blocks on popular streaming platforms like Netflix and Amazon Prime Video.

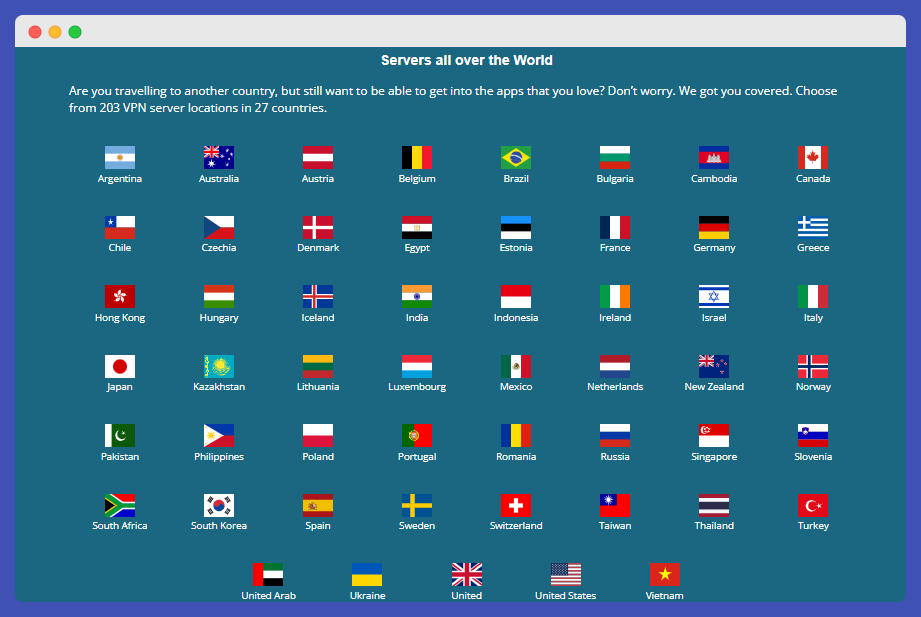

Unfortunately, it falls short when accessing HBO Max, Hulu, Disney+, and 10Play. But don’t let that deter you because VuzeVPN offers superfast speeds that won’t frustrate you with noticeable slowdowns, even when connected to distant servers. Besides, it has 203+ VPN servers in only 27 countries.

Whether downloading, uploading, or just checking your ping, VuzeVPN delivers satisfactory performance across the board.

One of the standout features of VuzeVPN is its commitment to ensuring your online privacy and security. While VuzeVPN is certainly a serious VPN provider, it’s worth noting that there are other options out there with better unblocking capability.

However, if you prioritize speed and security above all else, then VuzeVPN is worth considering. It may be smaller, but packs a punch when delivering a reliable and secure VPN experience.

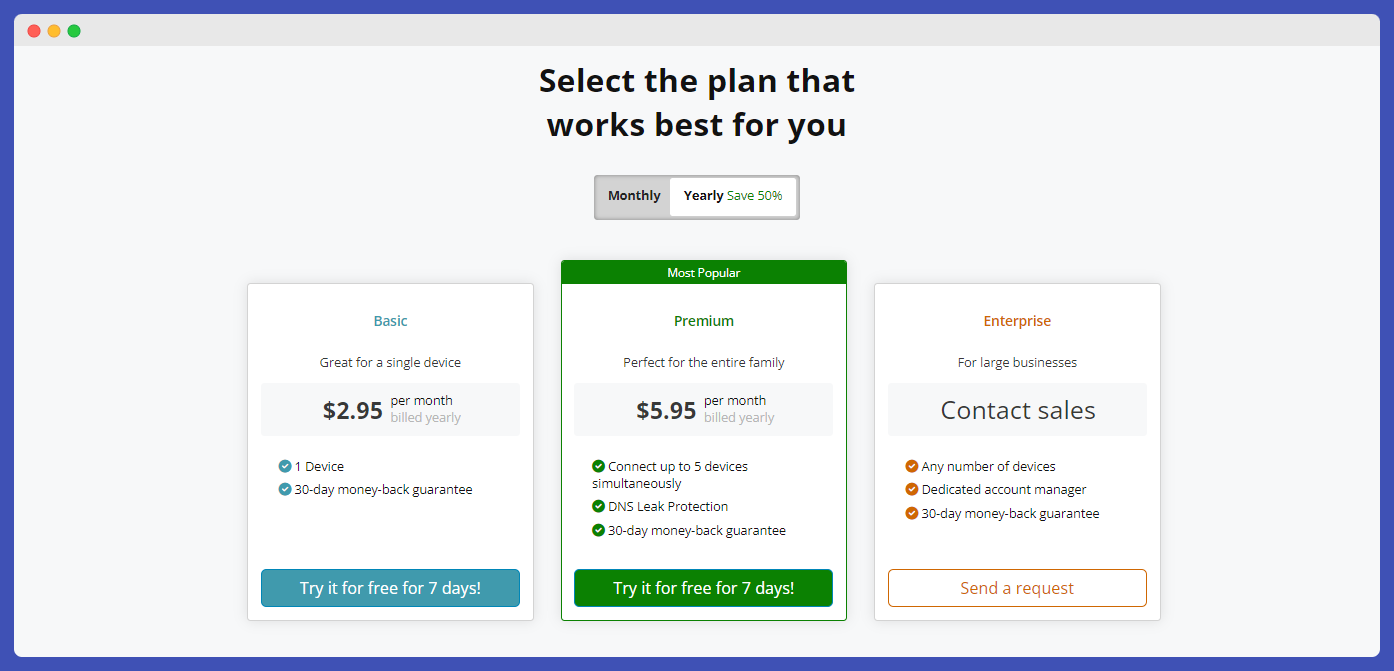

So why wait? Take control of your online privacy and security with VuzeVPN today. It has pricing plans starting from $2.95 per month.

⇒> Get VuzeVPN

16. Mozilla VPN – Best VPN service from a trusted source

Looking for the best VPN to ensure online privacy and security while browsing the web? Look no further than Mozilla VPN! With its strong associations and excellent reputation, Mozilla VPN is a top contender in the Virtual Private Network market.

It offers reliable performance and advanced features and takes advantage of Mullvad VPN’s servers, providing users with a wide range of options for server locations and connections.

One of the key aspects that sets Mozilla VPN apart from other VPNs is its commitment to user privacy. While some VPNs may log significant amounts of user information, Mozilla VPN prioritizes user privacy by keeping minimal logs.

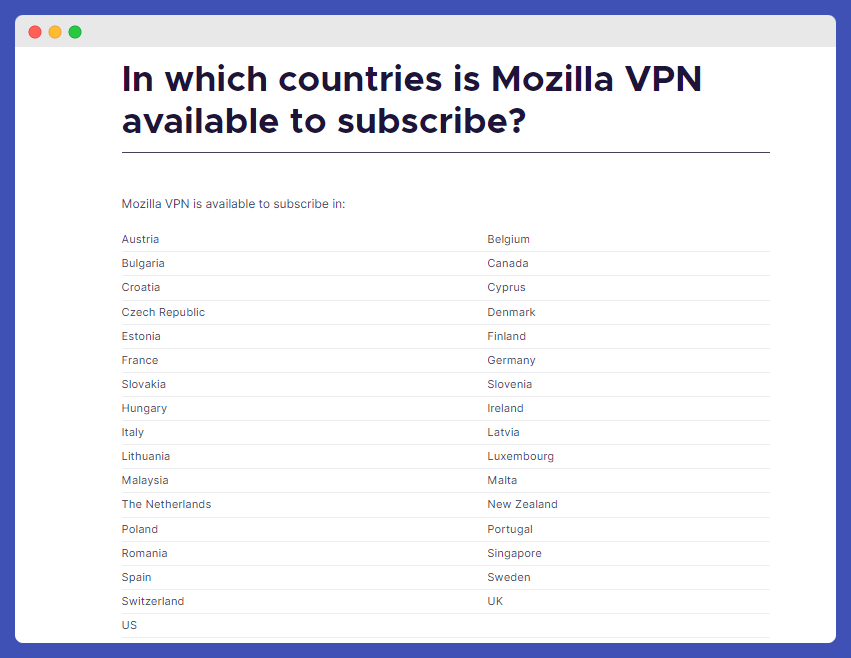

If you’re an avid Firefox user, you’ll be pleased to know that Mozilla VPN is currently available in the following countries:

- Austria

- Belgium

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Netherlands

- New Zealand

- Poland

- Portugal

- Romania

- Singapore

- Slovenia

- Slovakia

- Spain

- Sweden

- Switzerland

- UK

- US

However, it’s worth noting that their privacy policy has raised some concerns among users. This Mozilla network service encrypts your internet traffic using WireGuard, ensuring that your data remains secure and protected from prying eyes.

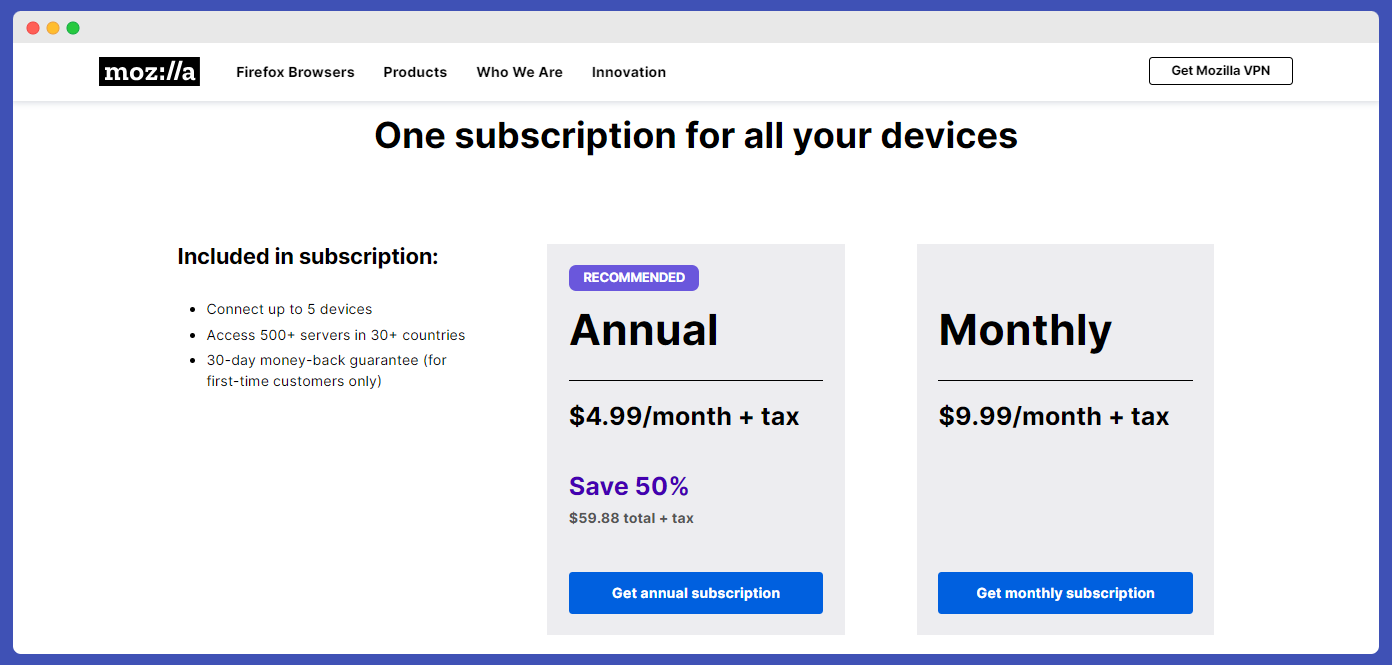

It has a starting pricing of $4.99 per month for its 12-month plan.

⇒> Get Mozilla VPN

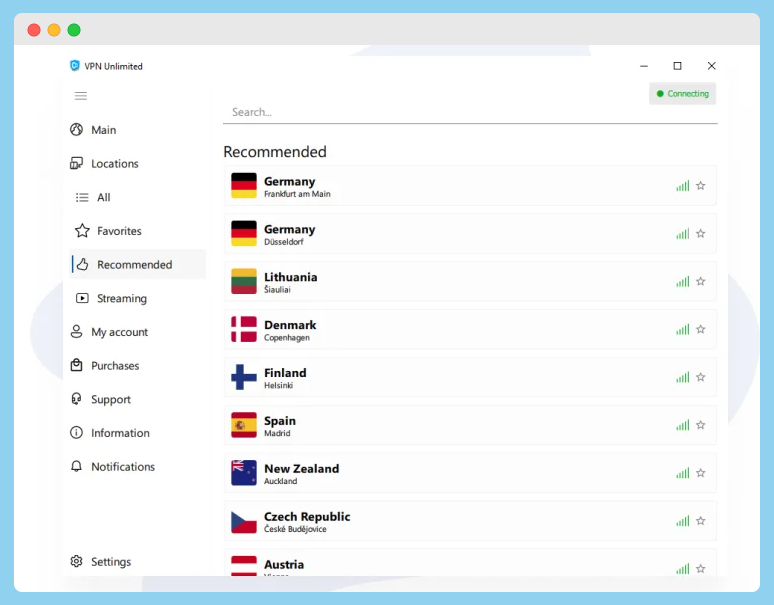

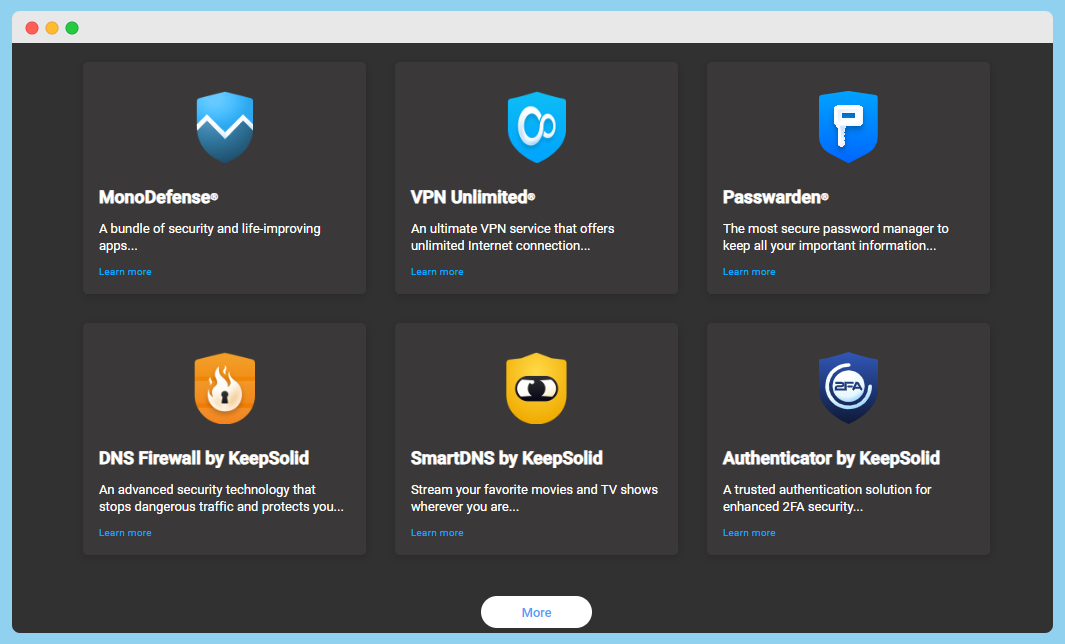

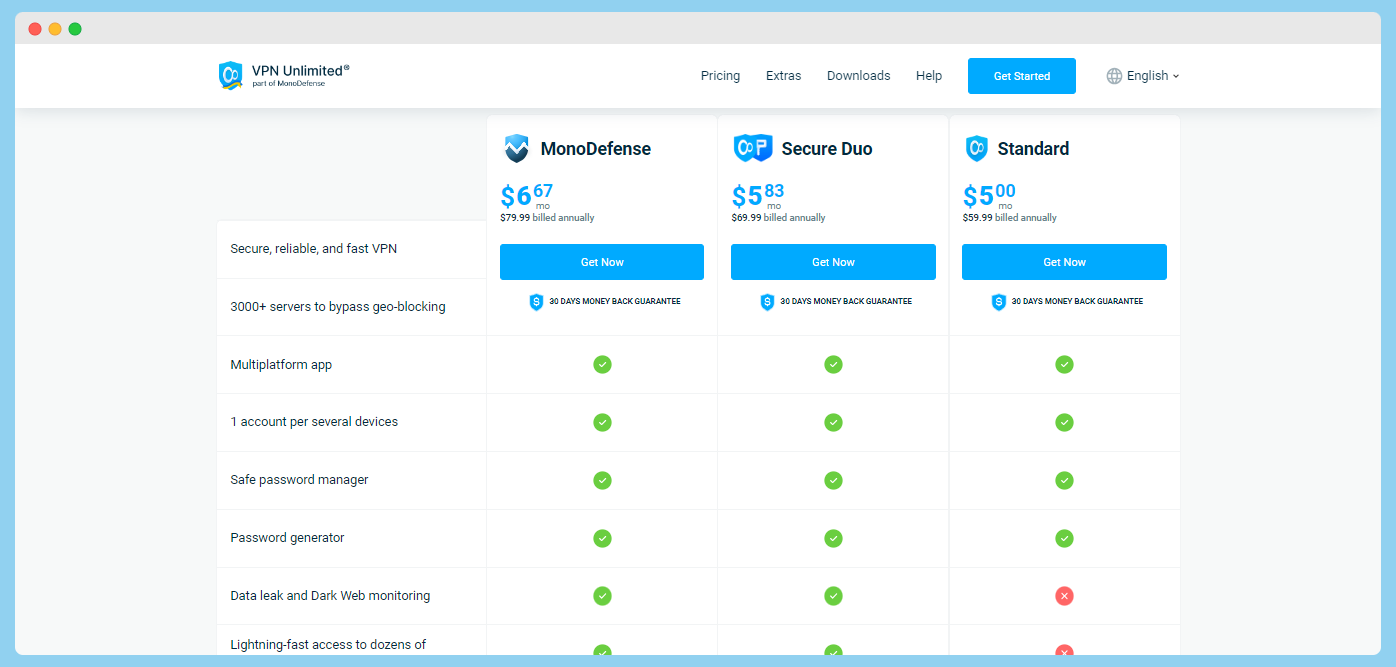

17. KeepSolid Unlimited VPN – Best VPN for flexible pricing

Are you seeking the best VPN service offering a seamless online experience? Look no further than KeepSolid Unlimited VPN!

With its robust features and compatibility with all your devices, KeepSolid VPN is the ultimate solution for streaming your favourite global television shows and ensuring your online security. It provides blazing-fast speeds, unbreakable encryption, and an unbeatable streaming experience.

No more buffering or geo-restrictions holding you back from enjoying your favourite content. KeepSolid VPN is here to make your online experience limitless.

One of the standout features of KeepSolid VPN is its dedicated servers for streaming and torrenting. You can enjoy your favourite movies, TV shows, and music without interruptions. With KeepSolid VPN, you can say goodbye to buffering and hello to uninterrupted entertainment.

While KeepSolid VPN offers excellent features, it’s important to note that it may not be the best choice for those seeking strict anonymity or privacy. Due to its US jurisdiction and logging of data, some users may have concerns about their privacy.

However, KeepSolid VPN makes up for this with its affordable lifetime plan, a major selling point for many users. Also, it includes add-ons such as password manager, password generator, dark web monitoring tool, DNS firewall, and authenticator apps.

While it may not be the best choice for those seeking strict anonymity or privacy, it makes up for its exceptional performance and compatibility with all devices.

Also, it has a starting cost of $5 per month when billed annually.

⇒> Get KeepSolid VPN

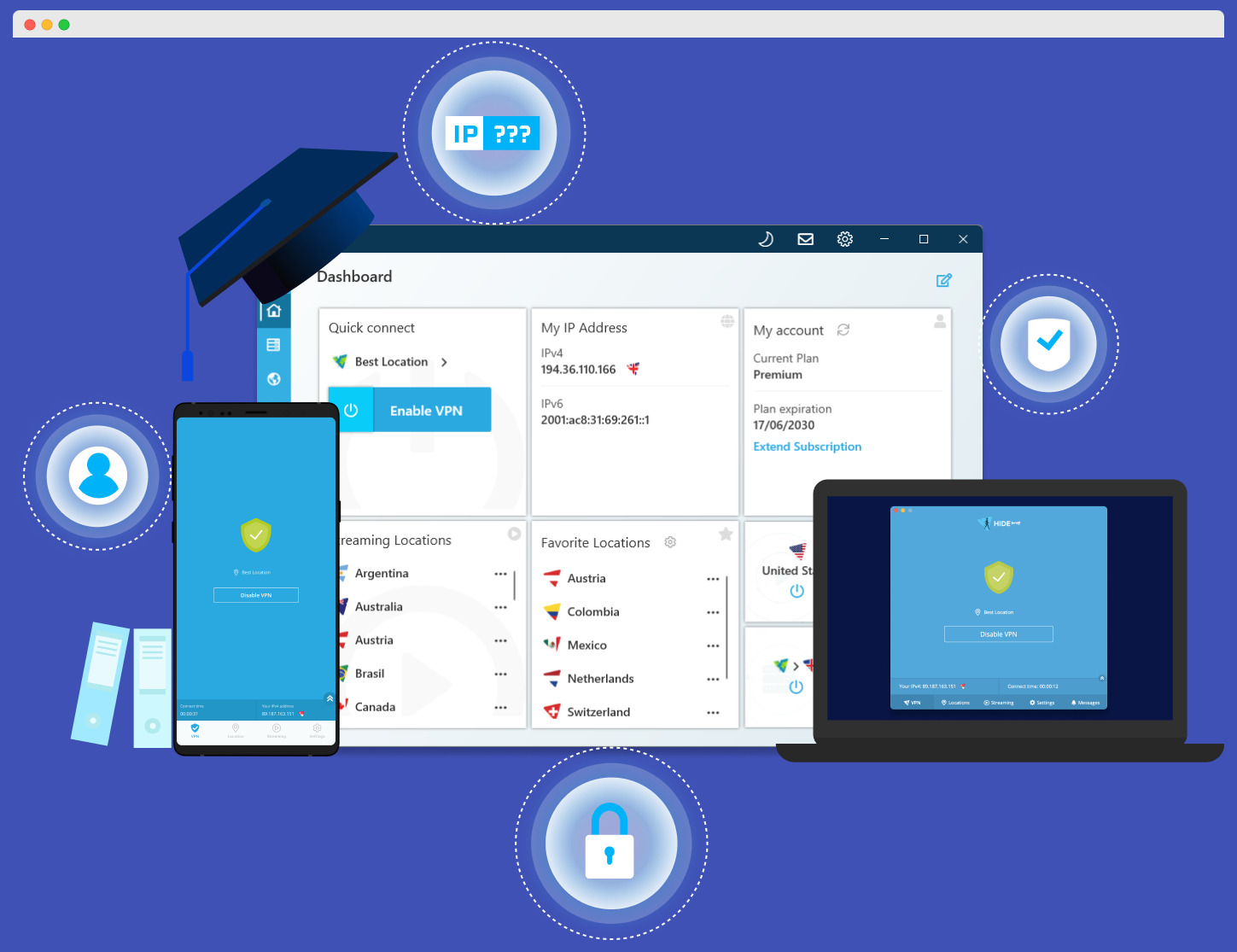

18. Hide.me VPN – Best VPN for easy use

Hide.me VPN is a Virtual Private Network service that offers a simple and secure way to browse the internet.

It has over 2,100 VPN servers in over 81 countries, so you can always find a server that is close to you. Hide.me VPN also uses strong encryption to protect your data, so you can be sure that your online activity is private.

Not to mention, it also offers a free VPN service like ProtonVPN and Atlas VPN with a limited monthly data transfer of 10GB.

Additionally, Hide.me VPN does not store any online activity logs, so you can ensure your privacy is protected. It uses strong encryption to protect your data so you can ensure your online activity is private.

It also offers unlimited bandwidth, so you can stream videos, download files, and do whatever you want online without worrying about running out of data.

It has fast speeds, so you can enjoy a smooth and uninterrupted browsing experience. It is easy to use, even for beginners. You can connect to a server with just a few clicks.

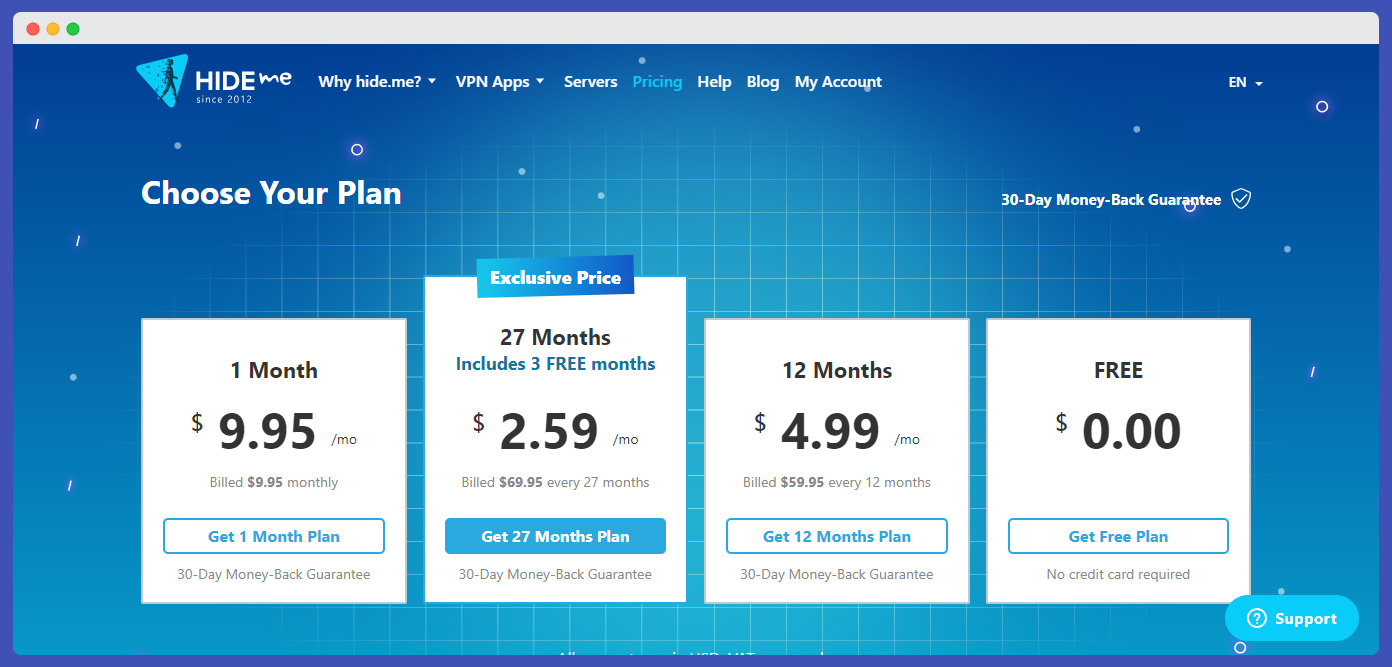

Hide.me VPN offers a variety of pricing plans, so you can find one that fits your budget. The monthly plan costs $9.95, the yearly plan costs $59.95, and the 27-month plan costs $69.95. You can also use Hide.me VPN for free.

If you want a secure and private way to browse the internet, Hide.me VPN is a great option. It is easy to use, has fast speeds, and offers strong encryption.

⇒> Get Hide.me VPN

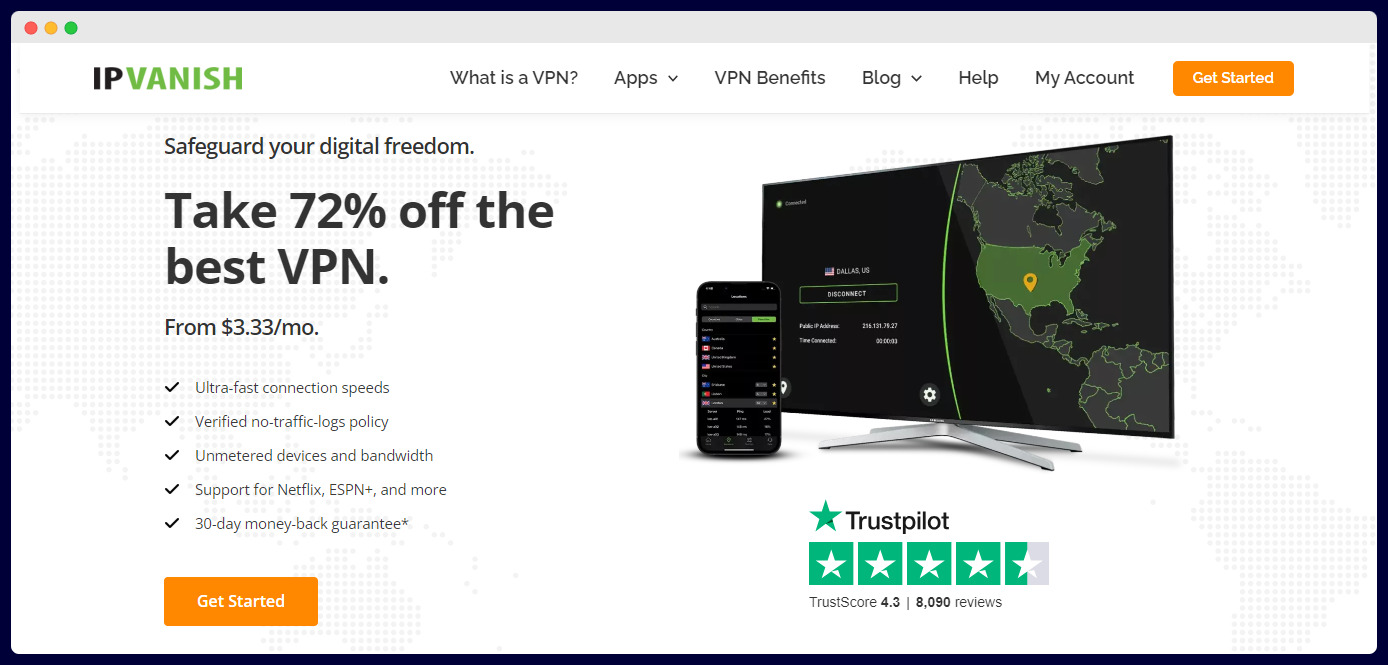

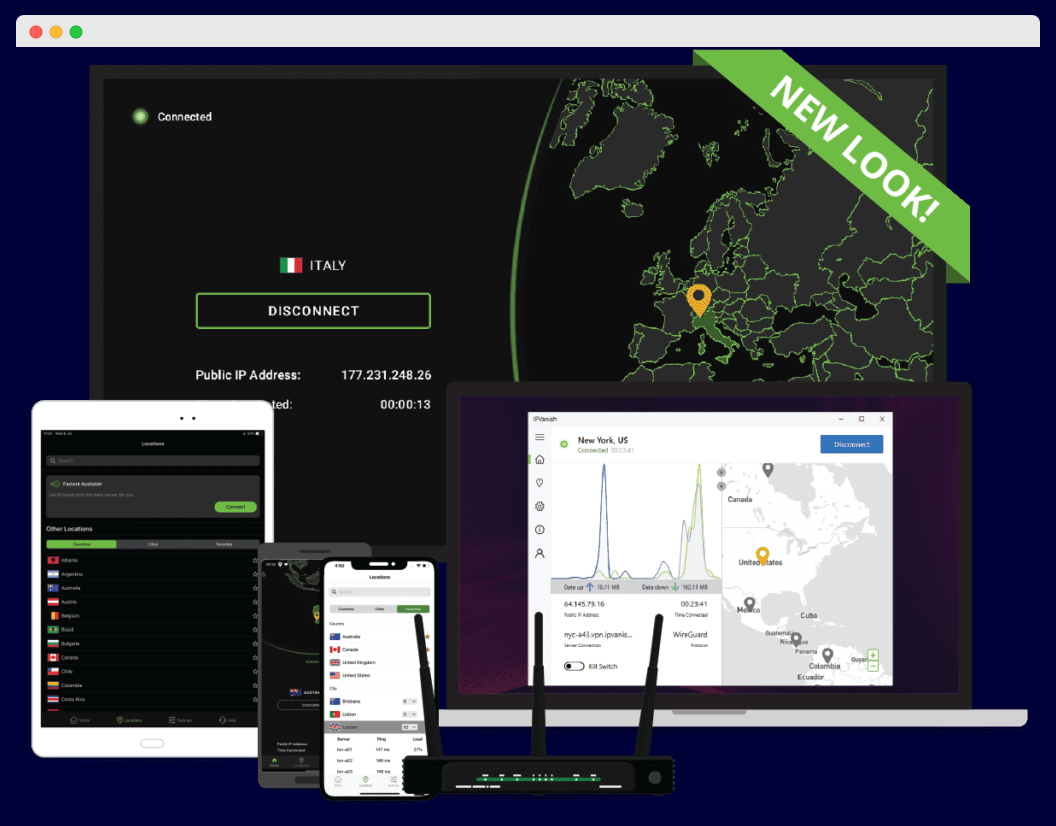

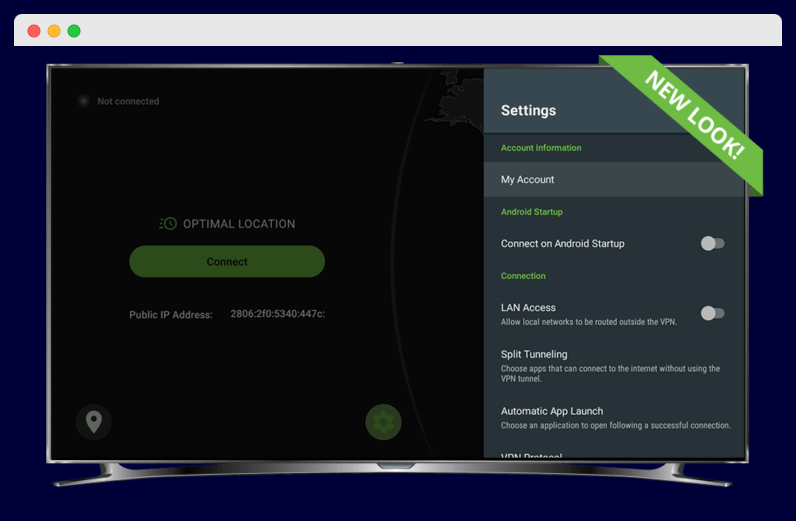

19. IPVanish – Best VPN for Kodi

Looking for the best VPN to ensure your online security and privacy? Look no further than IPVanish! With its blazing-fast speeds and reliable performance, IPVanish stands toe-to-toe with even the fastest Virtual Private Network providers in the world.

IPVanish promises everything you want from a Virtual Private Network, and the service lives up to that promise. It provides two thousand servers, allowing you to browse the internet freely.

At the same time, the servers keep you anonymous online. Anonymous, such that not even your ISP can track you. And if you share sensitive information online, you can rely on advanced encryption to prevent leaks.

IPVanish also offers a user-friendly interface and apps for all devices, making it convenient and accessible for everyone.

Whether using a Windows PC, Mac, Android, or iOS device, you can easily set up and connect to IPVanish. Also, it works with Kodi, Fire TV, Chrome OS, Nvidia Shield TV, and even Linux devices. This allows you to enjoy a safer internet experience no matter your device.

One interesting fact about IPVanish is that there are no connection caps. Such unmetered connections make it ideal for streaming and other bandwidth-heavy tasks.

As aforementioned, you get two thousand servers from IPVanish. The two thousand servers feature over forty thousand IP addresses in over seventy-five locations.

Whether travelling or needing to access geo-restricted content, IPVanish has you covered with its extensive server network.

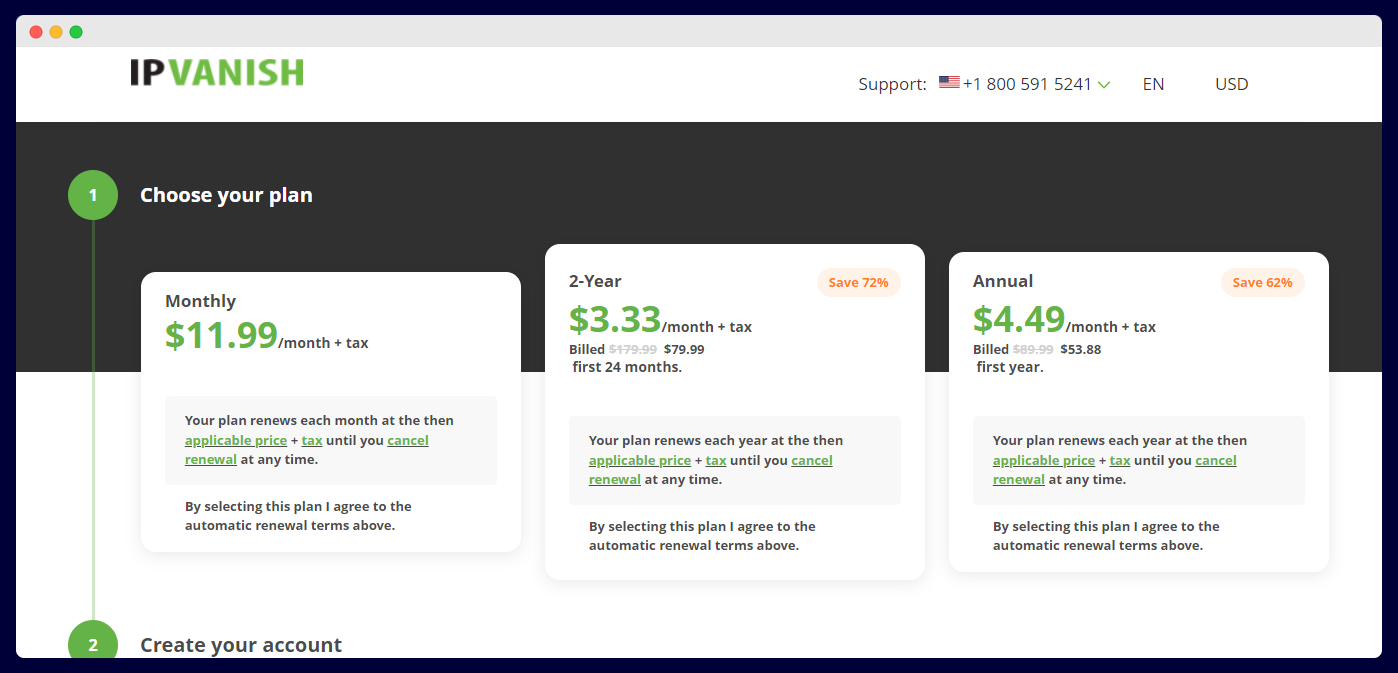

With IPVanish, you can pay monthly, quarterly, or annually.

If you pay monthly, the price is $11.99 per month. If you pay biannually, the price is $3.33 per month. But if you pay annually, the price is $4.99 per month.

⇒> Get IPVanish

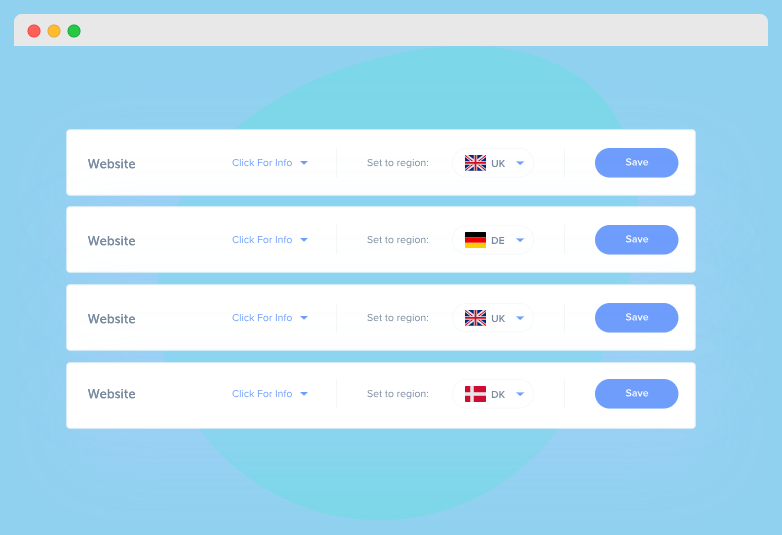

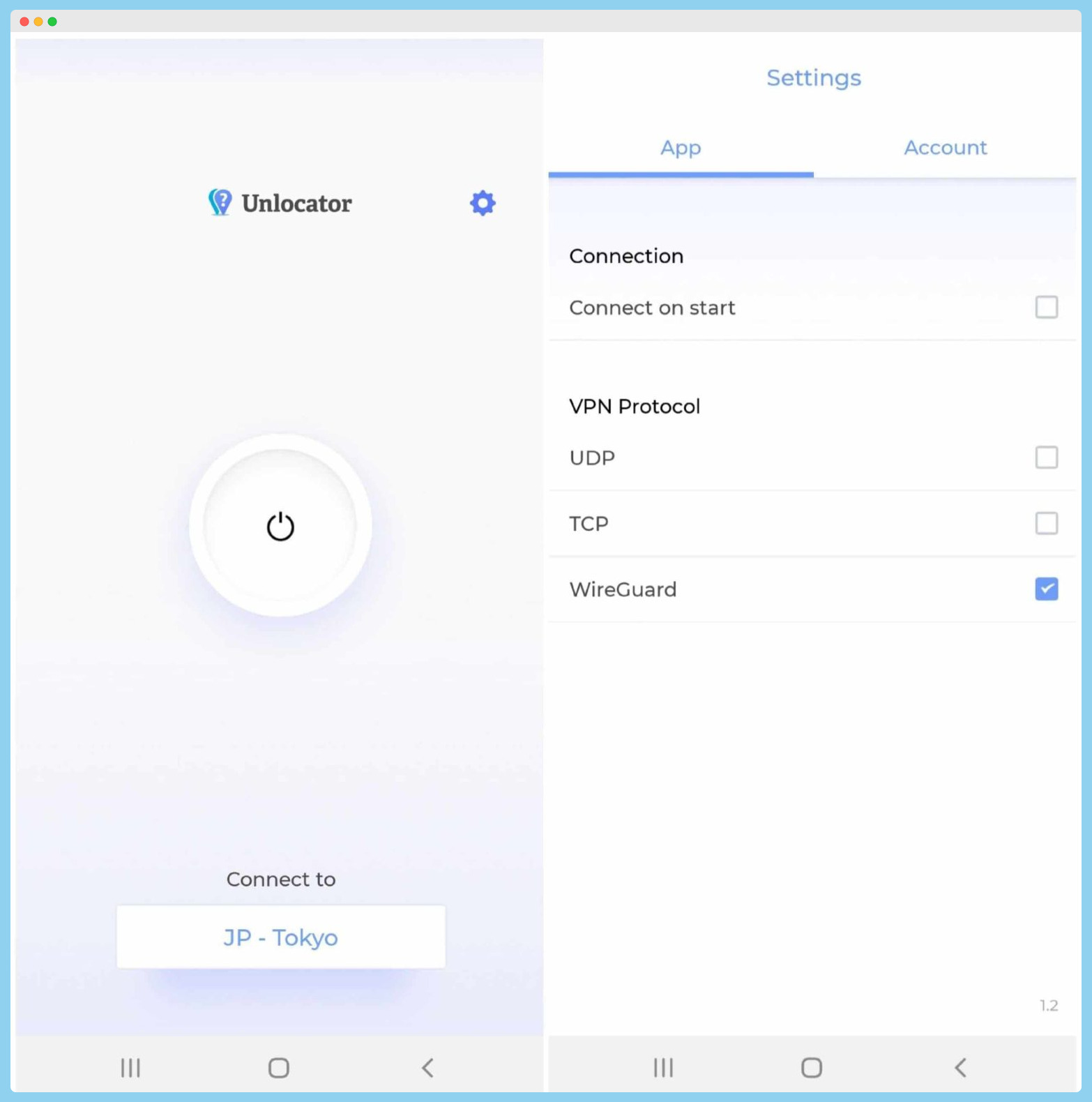

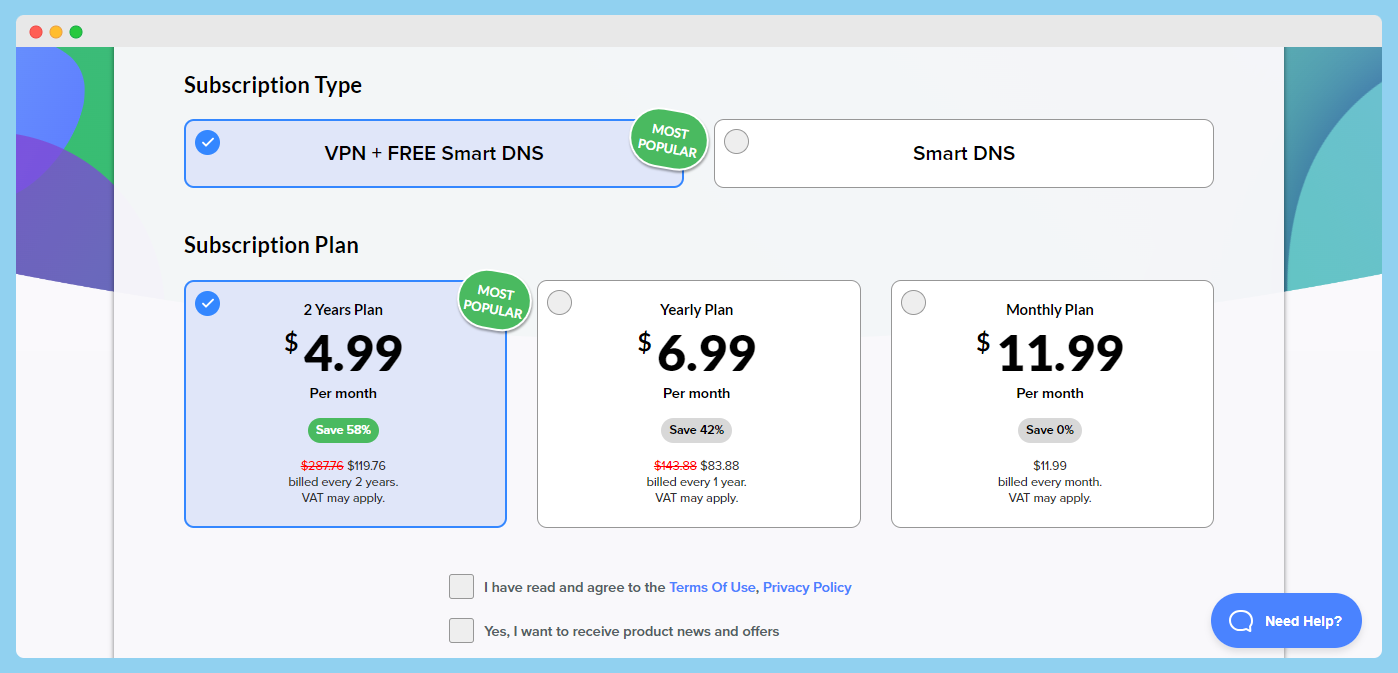

20. Unlocator

Unlocator is a VPN/DNS service that helps you access geo-restricted content and improve your online privacy. Unlocator is easy to use, even for beginners. You can connect to a server with just a few clicks.

It has 40+ VPN server locations in over 35 countries, so you can always find a server that is close to you. Unlocator also uses strong encryption to protect your data so you can be sure that your online activity is private.

Unlocator can unblock content that is blocked in your region, such as Netflix, Hulu, and BBC iPlayer. This is because Unlocator routes your traffic through servers in other locations, which makes it appear as if you are browsing the internet from that location.

In addition, Unlocator encrypts your internet traffic, which can help to protect your privacy. This means that your browsing history, the websites you visit, and the files you download are not visible to anyone who is not authorized to see them.

Not to mention, Unlocator can help to secure your Wi-Fi connection by encrypting your traffic. This can help to protect your data from being intercepted by hackers or other malicious actors.

Unlocator offers a variety of pricing plans, so you can find one that fits your budget.

The monthly plan costs $11.99, the yearly plan costs $83.88, and the 2-year plan costs $119.76.

==>> Get Unlocator

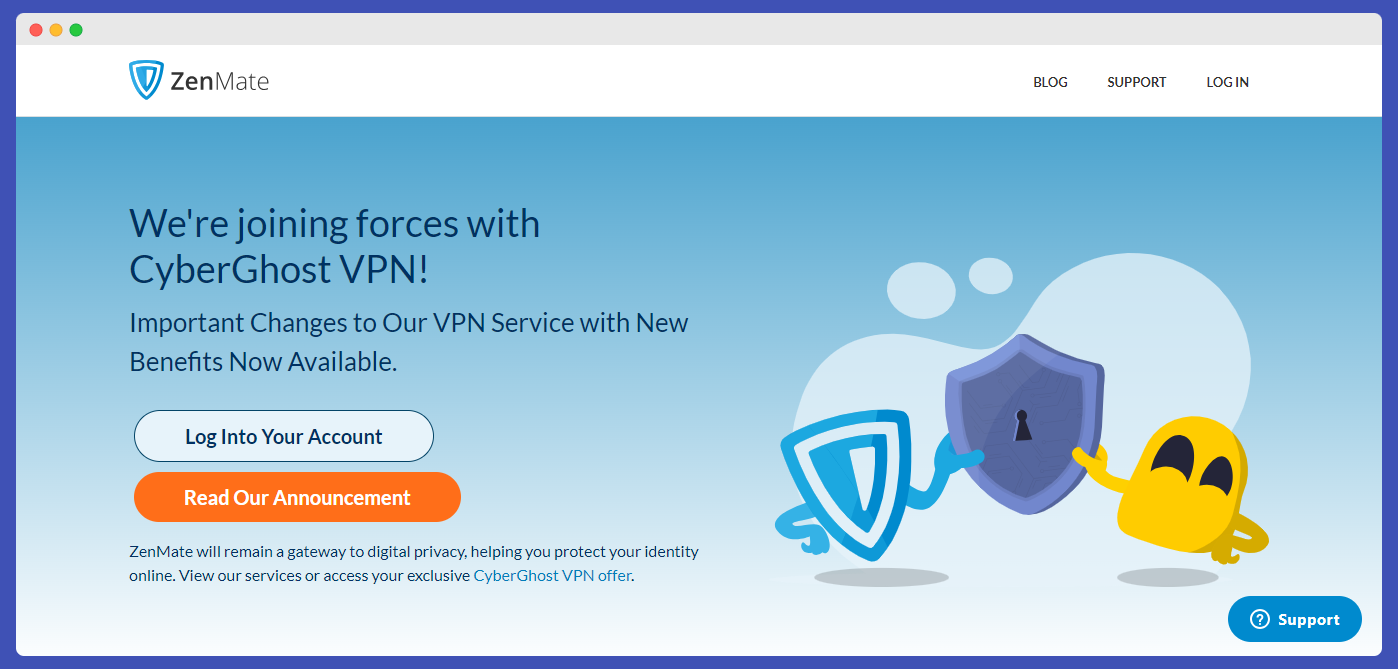

21. ZenMate

Unlike other best VPN services on our list, ZenMate was a popular VPN service that offered simple online security and privacy. However, it was acquired by CyberGhost in May 2023.

ZenMate had over 81 servers in 59 countries. It used strong encryption to protect user data and did not collect any logs.

Conversely, ZenMate was available as a browser extension for Chrome, Firefox, Edge, and Opera. It also had mobile or desktop apps.

The pricing for ZenMate started at $10.99 per month. However, the best option was the three-year plan that cost $1.51 per month.

Current information regarding ZenMate:

- ZenMate is no longer available.

- All ZenMate users have been migrated to CyberGhost.

- CyberGhost is a larger and more reputable VPN provider than ZenMate.

- CyberGhost has a wider network of servers and more features than ZenMate.

If you were a ZenMate user, you can migrate to CyberGhost without hassles.

⇒> Get CyberGhost: Best ZenMate Alternative

Different Types of VPNs

Many people use VPNs, but not many know that they are of different types. Indeed, there are four different types of VPNs, and they include:

Personal VPNs

A personal VPN is the most common type of Virtual Private Network. You download the VPN app and connect to a third-party server provided by the service company. It’s straightforward. With personal VPNs, you can protect your online privacy and bypass geo-restrictions.

Remote Access VPNs

A remote access VPN is similar to a personal VPN in one way and different in another. It is similar because you may have to install the VPN software on your device. It differs because you can configure your settings to include the Virtual Private Network details.

This VPN type is popular among companies as it connects to a private network – not just any third-party server.

Site-to-site VPNs

A site-to-site VPN works just as its name describes – it directly connects one network to another. Imagine you have two devices, and you’re browsing with one through the other. That’s how site-to-site VPNs work.

Hence, you don’t need to install an app for this type of Virtual Private Network. You only need to combine the two networks to form a single one. It’ll work for more than two networks as well.

Mobile VPNs

Mobile VPNs, as their name suggests, are exclusive to mobile devices. They work the same way as VPNs on a computer but are mainly built to work optimally on mobile phones.

Such VPNs usually come with the IKEv2 protocol, the best VPN protocol for mobile. Nevertheless, modern VPNs now come with multiple protocols. So, one VPN can function as a mobile and desktop VPN simultaneously.

How To Set Up A VPN

Setting up a VPN (Virtual Private Network) is crucial in ensuring your online privacy and security. A VPN creates an encrypted tunnel between your device and a VPN server, hiding your location and protecting your data from potential threats.

Here’s a step-by-step guide on how to set up a VPN on various devices:

- Research and choose a reliable VPN provider: Start by researching and selecting a reputable VPN provider that suits your needs. Consider essential factors such as device compatibility, server locations, connection speed, and the provider’s logging policies.

- Install the VPN app: Once you’ve chosen a Virtual Private Network provider, visit their website or app store to download and install the VPN app on your device.

- Create an account: After installing the app, create an account with the VPN provider. This will usually involve providing your email address and setting a secure password.

- Configure VPN settings: Open the VPN app and navigate to the settings section. Here, you may have options to customize your VPN experience, such as selecting server locations or enabling certain features like split tunnelling.

- Connect: Once you’ve configured the settings, connect to the VPN by selecting a server location from the available options within the app. This will establish the encrypted connection between your device and the VPN server.

- Verify your connection: After connecting to the VPN, ensuring your connection is secure is essential. You can do this by visiting a website that displays your IP address or using online tools that check for IP leaks.

Additionally, setting up a VPN on specific devices may require different steps:

- Router: To set up a VPN on your router, log into your router’s admin panel using its IP address and password. Then, locate the VPN settings section and enter the necessary information your VPN provider provides.

- iPhone or Android phone: For setting up a VPN on an iPhone, install the iOS or Android app of your chosen VPN provider from the App Store. Create an account within the app, open iPhone or Android settings, navigate to the VPN section, and connect to the VPN using your login credentials.

Remember that these are general steps; specific instructions may vary depending on your VPN provider and device. It’s always recommended to refer to your VPN provider’s official documentation or support for detailed instructions.

Setting up a Virtual Private Network is essential in safeguarding your online activities from prying eyes. By following these steps and choosing a reliable VPN provider, you can enjoy enhanced privacy and security while browsing the internet.

VPN Security Features

Regarding Virtual Private Network security features, there are several aspects to consider. Here are some of the most important VPN security features:

- Encryption: A Virtual Private Network encrypts all your internet traffic, making it unreadable to anyone trying to spy on you, such as your ISP, hackers, or government agencies. VPNs’ most common encryption protocols are OpenVPN, IPsec, and L2TP/IPsec.

- Kill switch: A kill switch is a security feature that automatically disconnects your internet connection if your VPN connection drops. This prevents your unencrypted data from being exposed if the VPN connection fails.

- DNS leak protection: DNS leak protection prevents your DNS queries from being sent unencrypted over the internet. This is important because your DNS queries can reveal your true IP address, even if you are using a VPN.

- No-logs policy: A no-logs policy means that the VPN provider does not store any logs of your activity while connected to their service. This means that even if the VPN provider is subpoenaed by law enforcement, they will not have any data to turn over.

- Strong privacy policy: A strong privacy policy is important for any Virtual Private Network service provider. The privacy policy should clearly state the kind of data collected, how it is used, and how long it is stored.

- Split tunnelling: Split tunnelling allows you to choose which apps and websites use the VPN and which ones will use your regular internet connection. This can be useful for things like streaming video or gaming, where you want the best possible performance.

- Ad blocking: Some VPN providers offer ad blocking to protect your privacy and improve your browsing experience.

- Malware protection: Some Virtual Private Network providers offer malware protection to protect your device from malicious software.

Tips For Finding The Best VPN For You

Here are some tips for finding the best VPN for you:

- Decide what you need a VPN for: Are you looking for a Virtual Private Network to protect your privacy while browsing the web? Or do you need a Virtual Private Network to access geo-blocked content? You can narrow down your choices after you know what you need a Virtual Private Network for, you can narrow down your choices.

- Consider your budget: VPNs can range in price from a few dollars per month to over $100 per year. Setting a budget before you start shopping is important so you don’t overspend.

- Read reviews: Many websites and blogs review Virtual Private Networks. Reviewing reviews can help you better understand which VPNs are reliable and trustworthy.

- Try a few different VPNs: Many Virtual Private Network providers offer free trials or money-back guarantees. This is a great way to test several different VPNs before committing to one.

- Consider the features you need: Not all Virtual Private Networks are created equal. Some VPNs offer more features than others. Ensure you consider important features like encryption, number of servers, and speed.

- Choose one with a strong privacy policy: The privacy policy should clearly state the data that the provider collects, how it is used, and how long it is stored.

- Choose one with a good reputation: There are many Virtual Private Network providers out there, so it’s important to choose one with a good reputation. You can read reviews or check out independent security audits to understand the Virtual Private Network’s reputation.

- Choose one with a large network of servers: A large network will give you more options for connecting to a server. This is important if you want to be able to connect to a server in a specific country or region.

- Choose one with fast speeds: If you plan on streaming video or gaming, you’ll need one with fast speeds. Make sure to check the speed test results of different VPNs before you make a decision.

Best VPN Services: Frequently Asked Questions

What is a VPN?

A VPN, or virtual private network, is a service that encrypts your internet traffic and routes it through a server in another location. This makes it difficult for your ISP, government, or other third parties to track your online activity.

For example, if you are browsing the internet in a public Wi-Fi hotspot, a Virtual Private Network can help protect your data from being intercepted by hackers.

A Virtual Private Network can also access content blocked in your region, such as Netflix or Hulu.

Why should I use a VPN?

There are many reasons why you might want to use a Virtual Private Network. Here are a few of the most common:

- To protect your privacy: A VPN can help to protect your privacy by hiding your IP address and encrypting your traffic. This makes it more difficult for people to track your online activity.

- To access geo-blocked content: A virtual private network can help you access content blocked in your region. For example, you can use a VPN to watch Netflix in a different country.

- To improve your security: A virtual private network can help to improve your security by making it more difficult for hackers to steal your data.

- To get around censorship: A virtual private network can help you to get around censorship by allowing you to connect to servers in countries where the internet is not censored.

- To download torrents anonymously: A Virtual Private Network can help you to download torrents anonymously, which can be useful if you are concerned about copyright infringement.

How do I choose a VPN?

When choosing a Virtual Private Network, there are a few factors you should consider:

- Price: VPNs can range in price from a few dollars per month to over $100 per year. Setting a budget before you start shopping is important so you don’t overspend.

- Features: Not all VPNs are created equal. Some VPNs offer more features than others. Make sure to consider the important features, such as encryption, number of servers, and speed.

- Reputation: Many service providers are out there, so choosing one with a good reputation is important. You can read reviews or check out independent security audits to understand their reputation.

- Privacy policy: The privacy policy should clearly state what data the VPN provider collects, how it is used, and how long it is stored.

- No logs policy: It is also important to ensure your chosen service has a strong no-logs policy. This means that the VPN provider will not store any data about your online activity, which can help to protect your privacy.

Is a VPN safe?

Virtual private networks can be safe if you choose a reputable provider. However, it’s important to know the risks of using a Virtual Private Network. For example, if you connect to a malicious server, your data could be exposed. It’s also important to ensure the VPN service you choose has a strong privacy policy.

Some VPN providers have been known to collect user data, even if they claim to have a no-logs policy. This is why it’s important to do your research before choosing a VPN provider.

Can I get caught using a VPN?

Getting caught using a VPN is possible, but it is not likely. VPNs encrypt your traffic, making it difficult for your ISP or government to track your online activity. However, if you are using a Virtual Private Network to do something illegal, it is possible that you could be caught.

For example, you could be prosecuted if you are using a virtual private network to download pirated content, you could be prosecuted.

Here are some things that can increase your chances of getting caught using a Virtual Private Network:

- Using a free VPN: Free VPNs are often less secure than paid ones and may be more likely to sell your data to third parties.

- Connecting to a malicious server: Your data could be exposed if you connect to a malicious server, your data could be exposed.

- Using a VPN to do something illegal: If you are using a Virtual Private Network to do something illegal, you are more likely to be caught.

Choosing a reputable provider with a strong privacy policy is important if you want to minimize the chances of getting caught using a VPN. You should also avoid using free VPNs and connecting to malicious servers.

READ ALSO: Can VPNs Help Prevent Cyberattacks? [We Have The Answer]

Is it legal to use a VPN?

The legality of using a virtual private network depends on the country in which you are located. In some countries, using a VPN is legal, while in others it is not. It is important to check the laws in your country before using a Virtual Private Network.

Here are some countries where it is illegal to use a VPN:

- China

- Iran

- Iraq

- North Korea

- Oman

- Russia

- Turkmenistan

- United Arab Emirates

- Uzbekistan

- Vietnam.

VPN use can be considered a crime in these countries, resulting in fines, imprisonment, or other penalties.

It is also important to note that even in countries where a VPN is legal, there may be some restrictions on what you can do while using it. For example, in some countries, it may be illegal to use a VPN to access content that is blocked in your region.

If you are unsure about the legality of using a VPN in your country, it is best to consult a lawyer.

Can I use a VPN on my phone?

Yes, you can use a Virtual Private Network on your phone. There are many VPN apps available for both Android and iOS devices.

Some VPN providers offer free VPN apps, while others require a subscription.

How do I set up a VPN?

Setting up a Virtual Private Network is relatively simple. Once you have chosen a VPN provider, you must download the VPN app and create an account. Once you have created an account, you must connect to a server.

Here are the steps to set up a Virtual Private Network:

- Choose a VPN provider: There are many Virtual Private Network providers available, so it is important to do some research to find one that is reputable and has a good reputation.

- Download the VPN app: Once you have chosen a service provider, you must download the VPN app for your device.

- Create an account: Once you have downloaded the app, you must create an account. This usually involves providing your email address and password.

- Connect to a server: Once you have created an account, you will need to connect to a server. This can be done by clicking on the “Connect” button in the app.

- You are now connected to a VPN! You can now browse the internet anonymously and securely.

How much data does a VPN use?

A VPN (Virtual Private Network) is a tool that creates a secure tunnel for your internet activity, protecting your privacy and anonymity. However, using a virtual private network does increase the amount of data you use. The encryption process of a VPN adds about 10-15% more data usage to every file you access over the VPN.

On average, VPNs are estimated to use 5 to 15 percent more data than your phone would use otherwise. This additional data usage is due to the encryption tunnels that VPNs create. It is important to note that the amount of data consumed by a VPN will depend on the encryption protocol used by your virtual private network provider.

For those with limited data plans, limiting the amount of data transferred per month may be necessary, or only using a Virtual Private Network when necessary. Leaving the app to run all the time may result in minimal extra data usage if you are only visiting websites and doing research.

To minimize VPN data usage, there are a few steps you can take. First, choose VPN protocols that use the least amount of data.

Additionally, turn off the virtual private network when it is not in use, use split tunneling to encrypt specific traffic, connect to the closest servers to reduce latency and data usage, and avoid using free VPNs that may have higher data consumption.

Some virtual private network providers offer obfuscated servers that can reduce data usage while still maintaining security.

Nevertheless, it is important to balance staying safe and protecting your privacy online while being mindful of your data consumption.

READ ALSO: Virtual Shield VPN Review: Is Virtual Shield VPN Safe? [+Best Alternatives]

How do I get a good VPN?

To get a good virtual private network, here are several steps you can follow:

- Do your research: Read reviews of different VPN providers to get an idea of their reputation and what other users have to say about them.

- Consider your needs: Consider what you need a VPN for and choose a provider with the features you need. For example, if you want to use a VPN to watch geo-blocked content, you must choose a provider with servers in different countries.

- Look for a good price: VPNs can range from a few dollars per month to over $100 per year. Find a provider that offers a good value for the price.

- Ensure it’s secure: Choose a virtual private network provider with a strong privacy policy that doesn’t log your traffic.

Additionally, it is essential to consider the best VPN services available in the market. Experts have tested and reviewed various VPN providers to compile a list of the best VPNs 2023. Surfshark, CyberGhost, NordVPN, ExpressVPN, and ProtonVPN currently hold the top spot.

When choosing a Virtual Private Network, it is crucial to consider factors such as speed, encryption, privacy measures, and customer support. Select a reputable VPN service to ensure a reliable and secure connection.

Sometimes, you may require a dedicated or static IP address for specific purposes, such as hosting online services or bypassing restrictions. While most Virtual Private Networks and ISPs do not offer static IPs by default, some virtual private network providers offer dedicated IP addresses.

Some top VPN services that provide dedicated IP address include NordVPN, Surfshark, CyberGhost, Private Internet Access, Ivacy, etc.

When opting for a Virtual Private Network with a static IP, it is crucial to consider factors such as IP location options, fast speeds, strong encryption, privacy measures, solid customer support, and constant availability.

Which VPN is easiest to use?

The easiest virtual private network to use is Surfshark. It has a user-friendly interface that makes it easy to connect to a VPN server and start browsing the internet anonymously.

Surfshark also offers a wide range of features, such as split tunneling and a kill switch, that can be helpful for advanced users.

Here are some of the reasons why Surfshark is the easiest service to use:

- Simple interface: The Surfshark app is very easy to use. The main menu is straightforward and easy to navigate, and the settings are well-organized.

- Quick connection: Surfshark connects to servers quickly and easily. There is no need to enter any complicated information or configure any settings.

- Wide range of features: Surfshark offers a wide range of features that can be helpful for both beginners and advanced users. These features include split tunneling, a kill switch, CleanWeb, and a no-logs policy.

- Affordable price: Surfshark is one of the most affordable VPNs on the market. It offers a 30-day money-back guarantee, so you can try it risk-free.

If you are looking for an easy-to-use Virtual Private Network with a wide range of features, Surfshark is a great option. It is perfect for beginners and advanced users alike.

What VPN gives free data?

Here are the Virtual Private Networks that offer free data:

- ProtonVPN: ProtonVPN offers a free plan that includes unlimited data per month. This is enough for basic browsing and email.

- TunnelBear: TunnelBear offers a free plan that includes 2GB of data per month. This is enough for basic browsing and social media.

- Atlas VPN: Atlas offers a free plan that includes 5GB of monthly data. This is enough for basic browsing and social media.

- Hide.me: Hide.me offers a free monthly plan that includes 10GB of data. This is enough for basic browsing and email.

- Windscribe: Windscribe offers a free plan that includes 10GB of data per month. This is enough for basic browsing, streaming, and gaming.

- Hotspot Shield: Hotspot Shield offers a free plan that includes 500MB of data per day. This is enough for basic browsing and social media.

It is important to note that the free plans offered by these Virtual Private Networks may have limitations, such as slow speeds, limited server locations, and ads. You may want to consider a paid VPN for more demanding tasks, such as streaming or gaming.

Which is the fastest VPN?

According to speed tests conducted by our team on Speedtest.net, the fastest VPNs are:

- ExpressVPN: ExpressVPN is the fastest Virtual Private Network overall. It has fast speeds on servers all over the world, making it a great choice for streaming, gaming, and other demanding tasks.

- Surfshark: Surfshark is a fast and affordable virtual private network. It has fast speeds on most servers and offers a wide range of features.

- NordVPN: NordVPN is another fast Virtual Private Network. It has a large network of servers and offers fast speeds on most servers.

- CyberGhost: CyberGhost is a fast virtual private network with a large network of servers. It is a good choice for streaming and gaming.

- Private Internet Access (PIA): PIA is a fast Virtual Private Network with a large network of servers. It is a good choice for privacy and security.

It is important to note that speed test results can vary depending on your location, the server you connect to, and the time of day. It is always a good idea to test a VPN’s speed before committing to it.

If you are looking for the fastest virtual private network possible, I recommend ExpressVPN, Surfshark, NordVPN, CyberGhost, or PIA. These VPNs have consistently fast speeds on servers all over the world.

Conclusion

Hundreds and thousands of Virtual Private Network services exist, both reliable and unreliable ones. It may be difficult to select the best out of the herd on your own. And for that reason, we put together this article to help.

Nevertheless, I recommend Surfshark as the best VPN service among all the entries. Notable mentions include CyberGhost, ExpressVPN, NordVPN, Ivacy, ProtonVPN, PIA, PrivateVPN, and Atlas VPN.

Selecting an option from the best VPN services listed above is much easier. Choose one depending on your needs and budget. They are all reliable VPN services, so you get value with whichever you choose.

INTERESTING POSTS

About the Author:

Daniel Segun is the Founder and CEO of SecureBlitz Cybersecurity Media, with a background in Computer Science and Digital Marketing. When not writing, he's probably busy designing graphics or developing websites.