Read on for the StatesCard Review.

Many people find using their local cards to pay for US-based online services challenging. If you’re facing such a problem, the good news is that you can use many virtual dollar card services.

One such service is StatesCard.

We tested the platform to measure its features and determine its worth.

So, if you’re contemplating signing up, read on to get all the details in this StatesCard review.

Table of Contents

What Is StatesCard?

StatesCard provides a virtual debit card solution for anyone who needs a US billing address.

If you register for the tool, you can use it to pay for US digital services, like Netflix, Amazon Prime, HBO, and Disney Plus. From our review, the service is relatively easy to use.

To start with, you’ll create an account and complete a verification. Then, you add money to your card and are good to go. However, note that there’s a subscription fee and one-time creation fee to use the service — independent of the money you add to your card.

When you get your StatesCard, you can use it just like any other debit or credit card. It has a number, expiry date, and CVV, as typical. However, you’ll also get a valid US address if you need to enter one while making payments.

Benefits Of StatesCard

Here are the benefits of using StatesCard:

- US billing address: Useful for subscribing to US-based services that require a US address.

- Virtual card for US digital payments: Convenient for online purchases and subscriptions on US platforms.

- No credit check needed: Accessible even with limited credit history.

- Mobile app management: Manage your card on the go.

- Quick and easy sign-up: No credit check needed, potentially faster than traditional cards.

- Multiple loading options: Load funds via debit card, bank transfer, or cryptocurrency (limited options).

- Instant card issuance: Use the virtual card immediately after loading funds.

- Privacy: Avoid sharing your real card information with merchants online.

- Budget control: Pre-loading limits spending and avoids overspending.

- Separate finances: Use StatesCard for specific online expenses without mixing them with your main account.

How To Sign Up For StatesCard

Getting started with StatesCard is quite simple. While we tested the service, we noted that the onboarding procedure involves four main steps. Check them out below:

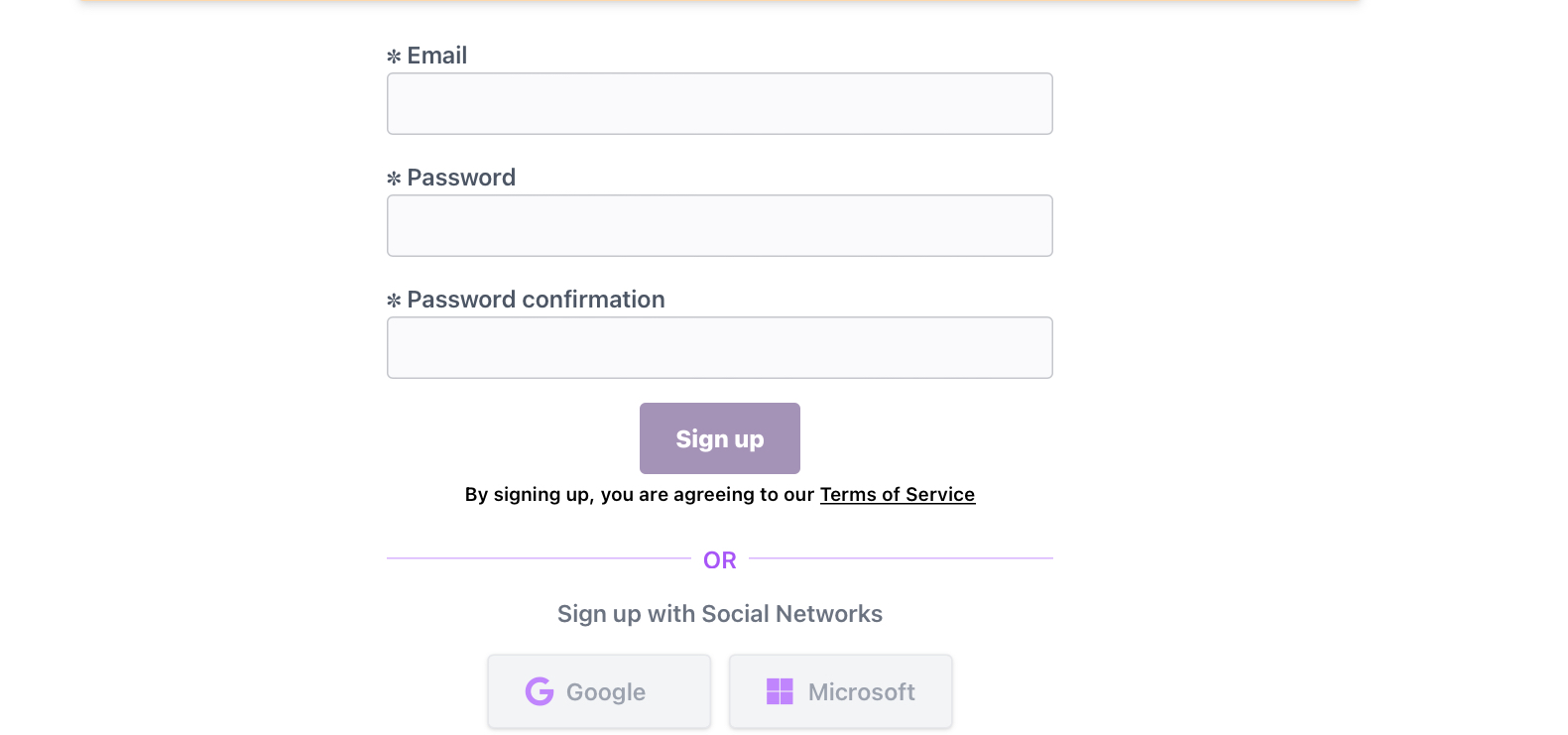

Step 1: Register an Account

The very first step is to visit the StatesCard official website to create an account with the service. You can do this when you visit the official website by completing the sign-up form. However, StatesCard also allows users to register using their Google or Microsoft accounts.

Whichever you go for, ensure the personal details you provide are authentic. Also, you’ll need to specify your email address and password, which you’ll use to log in.

Step 2: Verify your Identity

StatesCard’s policy requires all users to confirm their identity after signing up. The way we see it, it’s a precautionary measure to keep the platform safe from fraud and scams.

Also, it’s not difficult; you only have to provide a valid ID or international passport from your country. If your ID or passport details match what you provided when registering, you’ll pass the verification procedure.

Step 3: Pay the activation fee and subscription

With verification completed, you’re one step away from getting your StatesCard. You’ll have to pay the card creation fee and the monthly subscription. The former is one-time, as you pay to activate the card.

You’ll only need to pay a creation fee again if you want a new virtual card. Meanwhile, the subscription is recurring every month. You can pay these fees using your PayPal or debit/credit card.

Step 4: Fund your card and start using it

The last step is to fund your card. After activating a new card, it’ll be empty, with a $0.00 balance. So, adding money is necessary if you want to use it for online payments.

You can fund your account with PayPal or bank cards when paying the fees. The transaction is instant, and once the money reflects on your StatesCard virtual card, you can begin using it for online payments.

StatesCard Features

Based on our review of the service, these are the key features to expect when you sign up with StatesCard:

Virtual Card

You’ll get a virtual debit card for all US online payments. The card will work for streaming services, app stores, etc. Notably, it comes with all the standard features you’ll expect from a debit card, plus a US address.

The virtual card can be easily stored and managed through the StatesCard mobile app, which is accessible on Android and iOS devices.

Multiple funding options

StatesCard allows you to fund your virtual debit card using your local card or PayPal. Hence, you get two methods to choose from, depending on which is most convenient. It’s also worth mentioning that you can use both debit and credit cards.

Transactions with the local card option might incur additional conversion fees depending on your currency and bank.

Funding through PayPal is subject to PayPal’s standard transaction fees.

Worldwide availability

You can sign up and start using StatesCard, irrespective of your location. The service supports users from all over the world. It’s a big plus, as many similar services limit availability to a particular region.

Be aware that some merchants might restrict purchases based on your physical location regardless of the card’s US billing address. Therefore, you should check StatesCard’s list of supported countries to ensure compatibility before signing up.

No hidden charges

StatesCard clearly states its costs, and there are no extra fees involved. You’ll only pay a one-time fee to create the card and a monthly subscription fee. Besides these two charges, any subsequent payment you’ll make is to fund your card.

VPN support

You can use your StatesCard virtual card and a VPN without complications. This is important when making payments so you can set your online location to the United States to avoid geo-restrictions. That’ll also ensure your IP matches the US address you get from StatesCard.

VPN is recommended for added security, but choose a reputable and reliable VPN service provider.

Zero support for money transfer services

The card you receive for StatesCard won’t work for money transfer services. For instance, you can’t add the card to your PayPal, Skrill, or Neteller accounts. You can only use the card to make payments and subscriptions.

Non-crypto access

Likewise, the card won’t work for transactions on cryptocurrency exchanges. Notably, using the card for crypto payments is against StatesCard terms and conditions, and your account may be penalized if detected to be involved in such.

How to Fund Your StatesCard

As explained in the previous section, adding money to your virtual card is one of the primary steps when using StatesCard. Here, we’ll go over the step-by-step procedure on how you can fund your card. Check out the steps below:

- Log into your StatesCard account using your email and password

- Click on Load Card from your dashboard

- Select your preferred payment method — PayPal or bank card

- Follow the onscreen instructions to complete the payment based on your selected payment method

- Confirm that the money has been reflected on your card balance

Usually, when you fund your card, it’ll reflect instantly. However, we noted that in some cases, StatesCard will carry out a manual confirmation. While that may take a little time, you won’t wait more than a few hours.

StatesCard Supported Countries

Many people often ask, “What countries does StatesCard support?” Well, we can confirm that the service doesn’t place any geographical restriction on its user base. You can sign up and get a virtual card on the platform regardless of your residence.

However, it’s important to note that you get a US virtual dollar card and a US billing address. So, the card will only work for US-based services like Hulu, Disney+, Netflix, HBO, and other platforms. Likewise, you can use it for online purchases on sites like Amazon, eBay, and Walmart.

Generally, the StatesCard virtual card is supported online anywhere a dollar card works. You may be unable to use it for non-US-based online services, like those in the UK or EU. At the moment, there’s no indication from StatesCard on whether the service will support other currencies — it’s doubtful it will.

StatesCard Customer Support

From our review, we can confirm that StatesCard has a helpful customer service team. The representatives can help 24/7, but the only drawback is that they don’t work in real-time. That’s because there’s no live chat.

To reach the StatesCard support team, you must drop a message via the contact form. You can access the option by clicking the question mark icon at the bottom-right of the website. Then, provide your email address and submit your message. StatesCard will reply within a few hours if it’s during the day. At night or on weekends, it may take a bit longer.

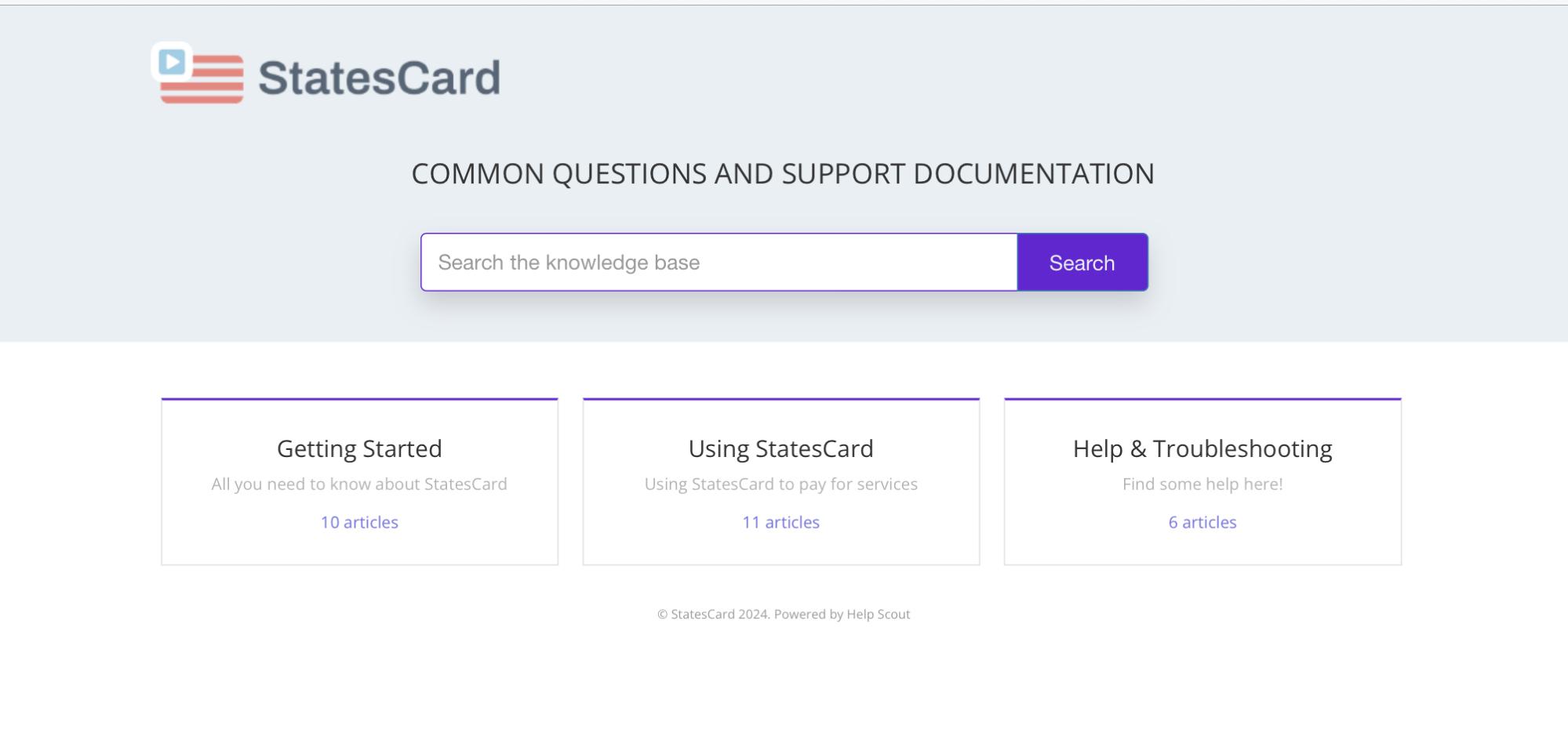

Nevertheless, there’s an alternative if you don’t want to wait for a response from the support team. On the StatesCard website, you’ll find a detailed Knowledge Base with many answers and guides. Mainly, the covered topics include:

- Getting Started

- Using StatesCard

- Help & Troubleshooting

There are 27 articles in total, and while we tested the platform, we found that each one is detailed. They’re also centered on key aspects you’ll likely need assistance with as a user. What more? Thanks to the search bar, finding any helpful article you want is easy.

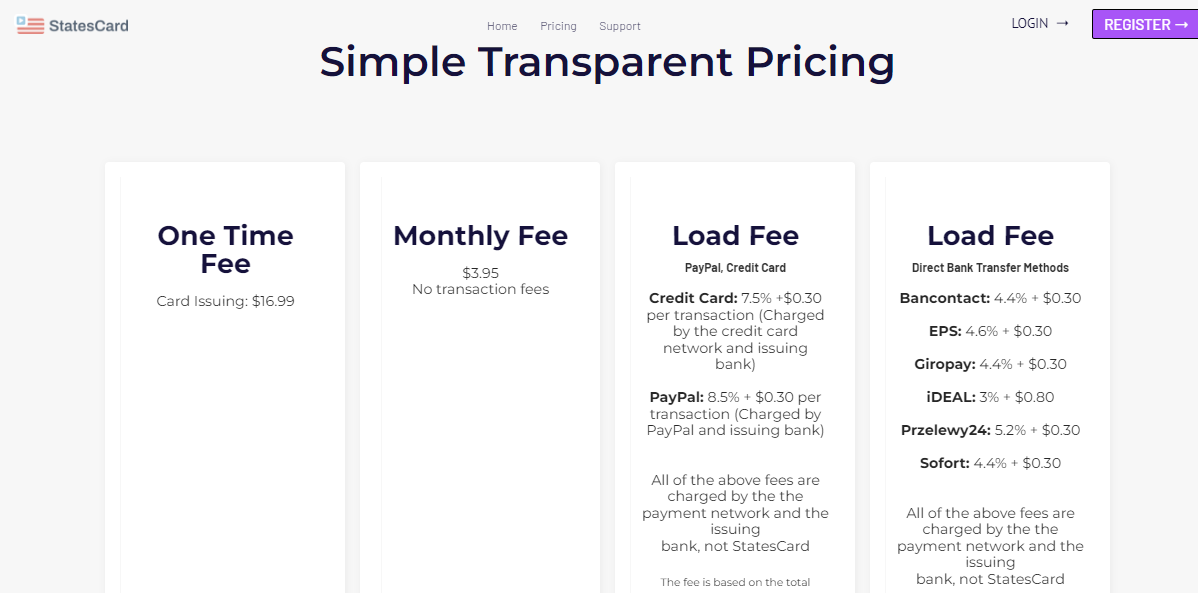

StatesCard Pricing Plans

As we’ve mentioned earlier for this StatesCard review, there are two primary costs when using StatesCard: the one-time creation fee and the monthly subscription.

Check out the StatesCard pricing below:

- One-time creation fee: $16.99

- Monthly subscription: $3.95

So, the total cost you’ll pay to begin using the service is $20.94. Then, you fund your card and subsequently renew your subscription every month. StatesCard doesn’t demand any extra charges besides the two listed above.

StatesCard Pros and Cons

It’s ideal to weigh the upsides and downsides of any online service before using it. In that view, here are the pros and cons of using StatesCard:

Pros

- You get a virtual debit card that works with any US-based online service. This mainly includes streaming platforms and application stores.

- The virtual debit card also has an authentic US address, which you can add to your billing info.

- The service is globally available, so you can sign up and get a card regardless of location.

- There’s a simple one-time creation fee and monthly subscription cost. Besides these, all you have to do is fund your card.

- The card is VPN-compatible, so you can switch your virtual location to match your billing address without complications.

Cons

- You can’t withdraw money you add to your card. If you want to suspend your account, you must exhaust all funds.

- The card doesn’t support money transfer services and cryptocurrency exchanges. Notably, as we discovered while crafting this StatesCard review, using it for crypto payments will result in an account ban.

READ ALSO: Things To Look Out For When Making Payments Online

5 Best StatesCard Alternatives

Here are five of the best alternatives to StatesCard, a platform for managing state-based services:

1. Square

Square offers a range of financial services, including payment processing, business loans, and online store management. It’s known for its user-friendly interface and low-cost solutions, making it a great alternative for individuals or businesses looking for an easy-to-use platform.

2. PayPal

PayPal is a popular alternative for managing payments and financial transactions across various platforms. It provides an easy way to send and receive money and offers various services like invoicing, payment processing for online businesses, and even small business loans.

3. Venmo

Owned by PayPal, Venmo is a mobile payment service that allows users to send and receive money quickly. It’s especially popular for peer-to-peer transactions but also includes features for businesses looking to accept payments through the app.

4. Revolut

Revolut is a global financial platform offering services such as currency exchange, investing, and banking. It provides a multi-currency account that can be used for international payments, making it a great option for managing state-related financial services across borders.

5. Wise (formerly TransferWise)

Wise is a financial service that offers low-cost, fast international transfers and multi-currency accounts. It’s ideal for individuals or businesses needing to manage state-based services with a focus on low fees and competitive exchange rates for global transactions.

READ ALSO: 6 Best Cloud Backup Services For Personal Use

StatesCard Review: Frequently Asked Questions

What is a StatesCard?

StatesCard is a virtual debit card solution for making US-based online payments. It is designed to help people outside the US make online purchases from US merchants.

It’s not a traditional credit card but a prepaid card you fund before using. They emphasize no credit checks, instant card issuance, or US billing address.

How do I use my StatesCard?

You use your StatesCard just like any other debit card for online transactions.

Use your StatesCard virtual card number and CVV for online purchases at US merchants, including:

- Streaming services (Netflix, Hulu, Spotify)

- App stores (Google Play, Apple App Store)

- Online retailers (Amazon, eBay)

- Many other online businesses accept US payments

How much is the monthly fee for the StatesCard?

The monthly fee for StatesCard is only $3.95. For users who frequently make small online purchases from US merchants, the convenience and security of StatesCard might justify the monthly payment. Remember that the fee could be offset by the rewards programs some US merchants offer when using a US-issued card.

What are the features of StatesCard?

- Virtual debit card: You get a virtual card for online purchases at US merchants, including streaming services, app stores, etc.

- Multiple funding options: You can fund your card using your local debit credit card or through PayPal.

- Worldwide availability: Sign up and use StatesCard from anywhere in the world.

- Transparent fees: StatesCard clearly states its costs, with a one-time card creation fee and a monthly subscription fee. No hidden charges!

- VPN support: Use your card with a VPN to avoid geo-restrictions and ensure your IP matches the US billing address provided.

Is the StatesCard safe to use?

Yes, StatesCard is a safe and legitimate virtual debit card solution you can use.

StatesCard has the following security features:

- Rigorous security standards: They state they adhere to the same standards as traditional banks.

- Data encryption: They use encryption to protect your personal information.

- Dispute resolution: You can dispute unauthorized charges.

- Limited liability: You’re not liable for unauthorized transactions if reported promptly.

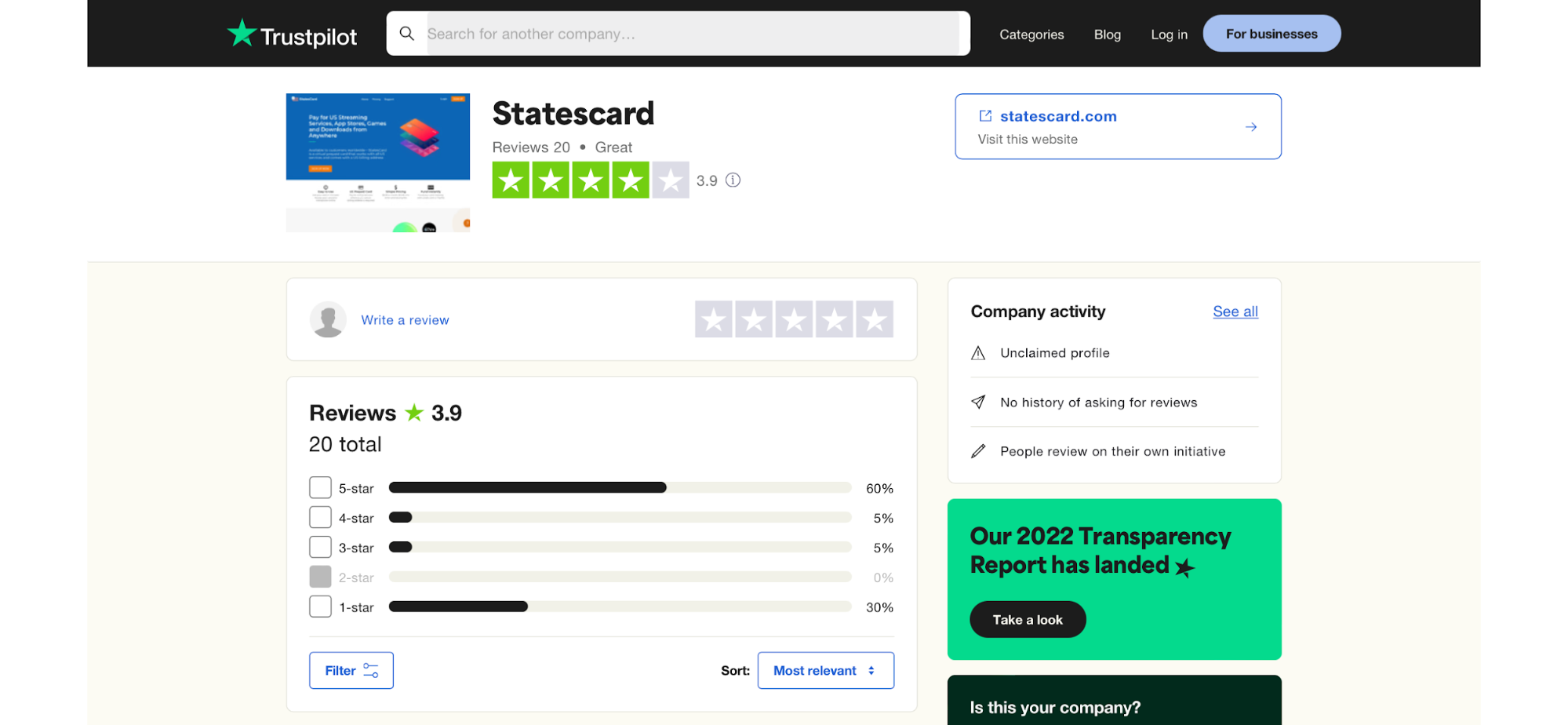

Is StatesCard Legit?

Yes, StatesCard is a legitimate virtual card service. Register with the platform and get a US virtual debit card and billing address for your online transactions. All you have to do is pay the associated fees and fund your card.

StatesCard has been around for a few years now, and during our review, we didn’t find any significant negative feedback about the service. We analyzed customers’ comments from TrustPilot.com, and the platform performed favorably, with 3.9/5 ratings.

Here are some feedback from users:

- Statescard is amazing! Super convenient. I am impressed with the functionality and am so excited that their service has solved a massive problem for me. They are super transparent about how it works, pricing, etc. It couldn’t be better! Proceed with absolute confidence! — Amber Mitchell

- I used it for GamePass and Microsoft as a card and billing address.No fake charges, and they are patient with charging their fees, unlike banks. Highly recommended. — Milan

- I’ve been using StatesCard for almost two years for Hulu and HBO Max, and (almost) no complaints. They had some downtime when switching to Visa, but everything worked perfectly. Usually, it loads about $50 every two months. Covers both Hulu and HBO subscriptions for me. — Max Basin

Is StatesCard Worth It?

Based on our expertise, we can say yes, StatesCard is worth it. The platform only requires a $16.99 one-time creation fee and a $3.95 monthly subscription. Any other money you pay is to fund your virtual card, which you’ll subsequently use.

The cost is notably affordable, as the recurring subscription is less than $5. Notably, it’s cheaper than many other virtual card services. Besides the card, you also get a working US billing address — all for $3.95 per month.

Final Thoughts On The StatesCard Review

We recommend StatesCard for anyone needing a virtual debit card for US-based payments.

As explained in this StatesCard review, getting the card is straightforward in only four steps, and the pricing is affordable.

If you sign up, use the card according to the terms and conditions, and you’ll have zero issues.

Leave a comment below regarding this StatesCard review.

INTERESTING POSTS

- The Best VPN Services

- 31 Best Safety Tips For Online Shopping

- Are PayPal’s Executives Looking Towards Re-Inventing the Product’s Identity?

- Most Secure Online Payment Services

- Hushed Review: Secure Phone Number

- OmniWatch Review: Get a Free Trial

- VeePN Review: The Ultimate VPN Solution for Security and Privacy

- Surfshark CleanWeb Review 2024: Ultimate Ad Blocker

- Exploring Security Considerations for Fax APIs

About the Author:

Meet Angela Daniel, an esteemed cybersecurity expert and the Associate Editor at SecureBlitz. With a profound understanding of the digital security landscape, Angela is dedicated to sharing her wealth of knowledge with readers. Her insightful articles delve into the intricacies of cybersecurity, offering a beacon of understanding in the ever-evolving realm of online safety.

Angela's expertise is grounded in a passion for staying at the forefront of emerging threats and protective measures. Her commitment to empowering individuals and organizations with the tools and insights to safeguard their digital presence is unwavering.