In this post, we will show you 7 things to need to know about cybersecurity and payday loans. Plus, we will provide an infographic at the end.

With the digital revolution reeling the world, things have changed in a big way. Our businesses, markets, institutions, and whole financial setup have changed.

And with this, there arise new instruments, like Payday Loans. Although payday loans are revolutionary, rising cybersecurity cannot be ignored.

Table of Contents

What Makes Payday Loans To Trend?

Payday loans are loans with a large amount, available at a short interval of time. Although the loans carry a high interest rate, they are still in vogue.

Payday Loans provide in a short time a considerable amount, which saves a day for the many.

Payday loans help you pay admission fees for your college. For the youngsters looking for funding for their new ventures, it gives them relief. Also for any businessman reeling under financial stress, they certainly reduce the burden.

How Is Cybersecurity Linked With Payday Loans?

The more good they sound, the more vulnerable they are. The payday loans are like simple loans, with a similar way of the procedure.

With their growing trend, hackers are now coming onto the scene. Now, these people see new kinds of attacks on your loans.

The hacking and the malware are not new, but their ways of doing things have changed. The card details are the most common target for these to get into. Also, email spoofing and IP address spoofing are some of the common ways they attack your loan details.

Things To Know About Cybersecurity And Payday Loans

The cybersecurity threats with the time are only going to increase. Thus, it makes more sense to be prepared for these attacks in the future. Here, we will see some of the things you should be aware of the payday loans and the cybersecurity.

Without further ado, let’s get straight in!

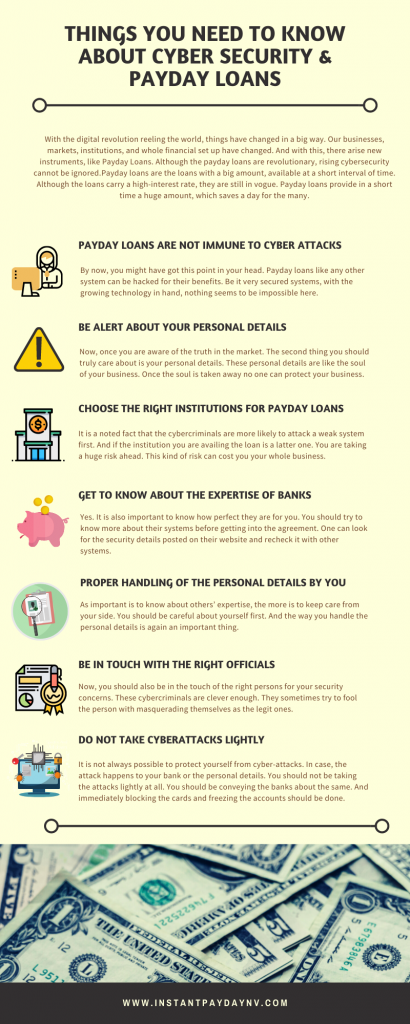

Payday loans are not immune to cyber attacks

By now, you might have got this point in your head. Payday loans, like any other system, can be hacked for their benefits. Be it very secured systems, with the growing technology in hand, nothing seems to be impossible here.

You should not be fooled by the loaners about security. Instead, one should be prepared for any kind of circumstance in the future. All this can be achieved if you are aware of the current.

Be alert about your personal details

Now, once you are aware of the truth about the market, The second thing you should genuinely care about is your details. These personal details are like the soul of your business. Once the soul is taken away, no one can protect your business.

You should not be sharing your personal details with any tom, dick, and harry. First, get to know whether it is your bank or someone else. It is always the best bet to first confirm with the bank about such an inquiry.

Choose the right institutions for payday loans

It is a noted fact that cybercriminals are more likely to attack a weak system first. And if the institution to which you are availing of the loan is a latter one, You are taking a considerable risk ahead. This kind of risk can cost you your whole business.

It is best to look for the reputed names in the market. These usually have a strong system to maintain the brand value. And they are more likely secured than others.

READ ALSO: Why A One-Size-Fits-All Approach No Longer Works For Modern Banking Clients

Get to know about the expertise of banks

Yes. It is also essential to know how perfect they are for you. You should try to learn more about their systems before coming to an agreement. One can look for the security details posted on their website and recheck them with other systems.

And it will be good to get there and talk to them in person. How can these banks assure you of their security? The answer to this question will help you from landing in trouble.

Proper handling of the personal details by you

As necessary is to know about others’ expertise, the more is to keep care from your side. You should be careful about yourself first. And the way you handle the personal details is again an important thing.

You should be getting the most essential details in a safe server. Using a well-known cloud service can help you with this. Also, being a bit more careful about the frequency at which you share the data is important.

Be in touch with the right officials

Now, you should also be in touch with the right persons for your security concerns. These cybercriminals are clever enough. They sometimes try to fool the person by masquerading themselves as the legit ones.

This mistake can cost you heavily. Always, first, cross-check the details given about the officials. One can ask the bank about employee history. The alertness from your side can save you from a hazard.

Do not take cyberattacks lightly

It is not always possible to protect yourself from cyber-attacks. In case the attack happens to your bank or personal details. You should not be taking the attacks lightly at all.

You should be conveying the banks about the same. And immediately blocking the cards and freezing the accounts should be done.

READ ALSO: Cyber Security Risks And Solutions In 2024

Things To Know About Cybersecurity and Payday Loans: FAQs

What is cybersecurity in e-banking?

Cybersecurity in e-banking refers to the practices and technologies employed to protect your financial information and transactions when using online banking services. This includes safeguarding your online bank accounts from unauthorized access, theft, and fraud.

Why is cybersecurity important in e-banking?

E-banking offers convenience, but it also carries inherent risks. Cybersecurity helps mitigate these risks by protecting your sensitive data, such as login credentials, account numbers, and transaction details. Strong cybersecurity measures prevent unauthorized access that could result in stolen funds or fraudulent activity.

What security is required for a loan?

For payday loans specifically, the security requirements may vary depending on the lender. They typically ask for basic information like bank account details to verify your identity and facilitate electronic fund transfers. However, reputable lenders will prioritize secure practices to protect your information.

Things to consider regarding cybersecurity with payday loans

- Borrower beware: Be cautious of lenders with lax security practices. Look for lenders that use encryption to protect your data and offer two-factor authentication for added security.

- Phishing scams: Payday loan providers can also be targets for phishing scams. Be wary of unsolicited emails or calls claiming to be from your lender. Don’t click on suspicious links or reveal personal information.

- Review your bank statements: Regularly monitor your bank statements to identify any unauthorized debits related to payday loans or other financial transactions.

General Cybersecurity Tips

- Use strong, unique passwords for each online account.

- Enable two-factor authentication (2FA) whenever possible. 2FA adds an extra layer of security during login attempts.

- Beware of phishing scams. Don’t click on suspicious links or attachments in emails or messages.

- Keep your devices and software up to date. Regularly update your operating system, web browser, and other software to patch security vulnerabilities.

- Be cautious when using public Wi-Fi. Avoid accessing sensitive information like bank accounts on unsecured networks.

By following these cybersecurity best practices, you can significantly reduce the risk of falling victim to cyberattacks and protect your financial information, whether you’re using e-banking services or applying for payday loans.

Note: This was initially published in August 2020, but has been updated for freshness and accuracy.

RELATED POSTS

- Most Effective Cybersecurity Strategy For A Small Business [We Asked 45+ Experts]

- Cybersecurity Trends To Know In 2024 (With Infographics)

- How To Secure And Protect A Website [We Asked 38 Experts]

- 9 Proven Cybersecurity Tips For Startups

- Investing 101: Should You Use Investment Apps?

- $255 Payday Loans Online – What Is The Easiest Option To Get?

- Top 4 Benefits Of Easy Loans

- Online Loan Vs In-Person Loan: What’s The Most Secure?

About the Author:

Christian Schmitz is a professional journalist and editor at SecureBlitz.com. He has a keen eye for the ever-changing cybersecurity industry and is passionate about spreading awareness of the industry's latest trends. Before joining SecureBlitz, Christian worked as a journalist for a local community newspaper in Nuremberg. Through his years of experience, Christian has developed a sharp eye for detail, an acute understanding of the cybersecurity industry, and an unwavering commitment to delivering accurate and up-to-date information.

Meet Angela Daniel, an esteemed cybersecurity expert and the Associate Editor at SecureBlitz. With a profound understanding of the digital security landscape, Angela is dedicated to sharing her wealth of knowledge with readers. Her insightful articles delve into the intricacies of cybersecurity, offering a beacon of understanding in the ever-evolving realm of online safety.

Angela's expertise is grounded in a passion for staying at the forefront of emerging threats and protective measures. Her commitment to empowering individuals and organizations with the tools and insights to safeguard their digital presence is unwavering.