Here, I will answer the question – what is a data broker? Also, I will reveal the best data broker removal service for you.

Millions of data brokers worldwide buy and sell data every day. This data includes information about everyone, including you. The saddest truth is that you don’t know them, but they know you. What should scare you is the fact that there is little control over their activities.

The surge of events following the government surveillance revelations of June 2013 by Edward Snowden, a former NSA contractor, who leaked documents that revealed that the agency was collecting data of United States citizens from electronic communications, has brought the attention of several Internet users to how their data is being used.

The truth is that some people specialize in collecting your data, and they are called data brokers. Data brokers are businesses that collect personal information about individuals from a variety of sources, such as public records, social media, and online shopping behavior.

They then sell this information to other businesses, who can use it to target you with advertising, make decisions about your creditworthiness, or even deny you a job.

Data brokers are a largely unregulated industry, which means that they have a lot of power over your personal information. They can collect data about you without your knowledge or consent, and they can sell it to anyone who is willing to pay. This can be a major privacy concern, especially if your data is used for malicious purposes.

Without further ado, let me answer the question – what is a data broker?

Table of Contents

What Is A Data Broker?

A data broker is a company that collects personal information about individuals from a variety of sources, such as public records, social media, and online shopping behavior.

They then sell this information to other businesses, who can use it to target you with advertising, make decisions about your creditworthiness, or even deny you a job.

Data brokers collect the following types of personal information about you:

- Personal identifiers: This includes your name, address, phone number, email address, Social Security number, and driver’s license number.

- Demographics: This includes your age, gender, marital status, income level, and education level.

- Interests and lifestyle: This includes your hobbies, interests, spending habits, and travel patterns.

- Online activity: This includes your browsing history, search history, and social media activity.

- Credit history: This includes your credit scores, debt levels, and payment history.

- Criminal history: This includes your arrests, convictions, and mugshots.

- Health information: This includes your medical records, prescriptions, and allergies.

- Government records: This includes your voter registration information, property records, and tax returns.

Data brokers can collect this information from a variety of sources, including:

- Public records

- Social media

- Online shopping behavior

- Credit reports

- Medical records

- Government records

- Direct marketing lists

- Survey data

Data brokers use this information to create a detailed profile of you. This profile can be used to target you with advertising, make decisions about your creditworthiness, or even deny you a job.

It is important to be aware of the types of personal information that data brokers collect and how they can use it. By understanding how data brokers work, you can make informed decisions about how to protect your privacy.

For example, if you have recently been shopping for new shoes, you might start seeing ads for shoes on your social media feed.

Data brokers can also use your information to make decisions about your creditworthiness. For example, if you are applying for a loan, the lender might use your data to assess your risk of defaulting on the loan.

In some cases, data brokers can even use your information to deny you a job. For example, if you are applying for a job in a sensitive industry, the employer might use your data to assess your security risk.

Data brokers are a largely unregulated industry, which means that they have a lot of power over your personal information.

They can collect data about you without your knowledge or consent, and they can sell it to anyone willing to pay. This can be a major privacy concern, especially if your data is used for malicious purposes.

Here are some additional things to keep in mind about data brokers:

- They are a largely unregulated industry.

- They can collect data about you without your knowledge or consent.

- They can sell your data to anyone willing to pay.

- They can use your data to target you with advertising, make decisions about your creditworthiness, or even deny you a job.

- There are a few things you can do to protect your privacy from data brokers, but it can be difficult.

It is important to be aware of the risks of data brokers and to take steps to protect your privacy. By understanding how data brokers work and what information they collect, you can make informed decisions about how to share your data online.

==>> Get Incogni

Best Data Broker Removal Service

There are a number of different data broker removal services available, but some of the best include:

1. Incogni

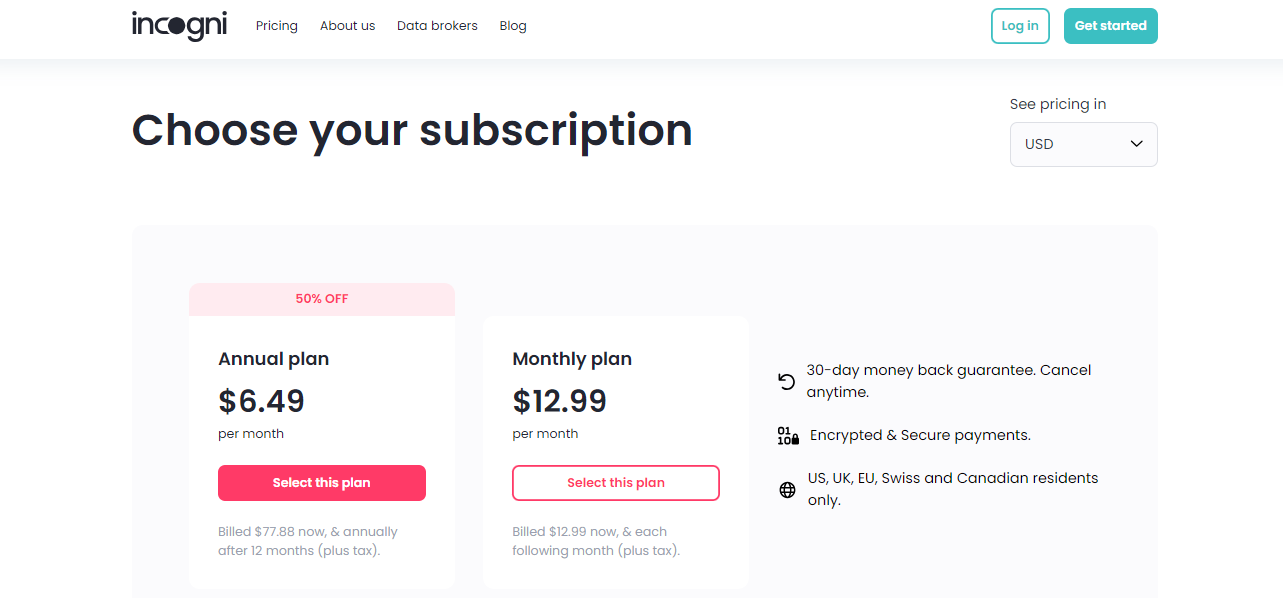

The best data broker removal service is Incogni. It is a privacy tool that gets your data off the hands of data brokers. It is a service provided by Surfshark, a top cyber security company.

It is currently available to residents of the US, UK, EU, Swiss and Canadian only. It costs $11.49 monthly and comes with a 30-day money-back guarantee.

Incogni works by sending requests on your behalf automatically to different data brokers in line with General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

These regulations cannot be flaunted and they attract massive fines. Incogni also uses the Canadian Privacy Act PIPEDA.

To get started all you need to do is create an account and tell them whose data you want to be removed, then grant them the right to act on your behalf.

Incogni will then send the requests to the data brokers and track their responses. They will also keep you updated on the progress of your request.

In addition to removing your data from data brokers, Incogni also offers a number of other privacy features, such as:

- Blocking data brokers from collecting your data in the first place.

- Monitoring your online activity for signs of data breaches.

- Helping you to create strong passwords and security practices.

- Providing you with a privacy dashboard where you can see all of your privacy settings in one place.

If you are serious about protecting your privacy from data brokers, then Incogni is the best option available. It is easy to use, effective, and affordable.

==>> Get Incogni

2. DeleteMe

DeleteMe is another popular data broker removal service. It is a bit more expensive than Incogni, but it also offers a wider range of features.

In addition, DeleteMe can remove your data from over 700 data brokers, and it also offers a service to help you create fake PII (personally identifiable information) that you can use to protect your privacy.

==>> Get DeleteMe

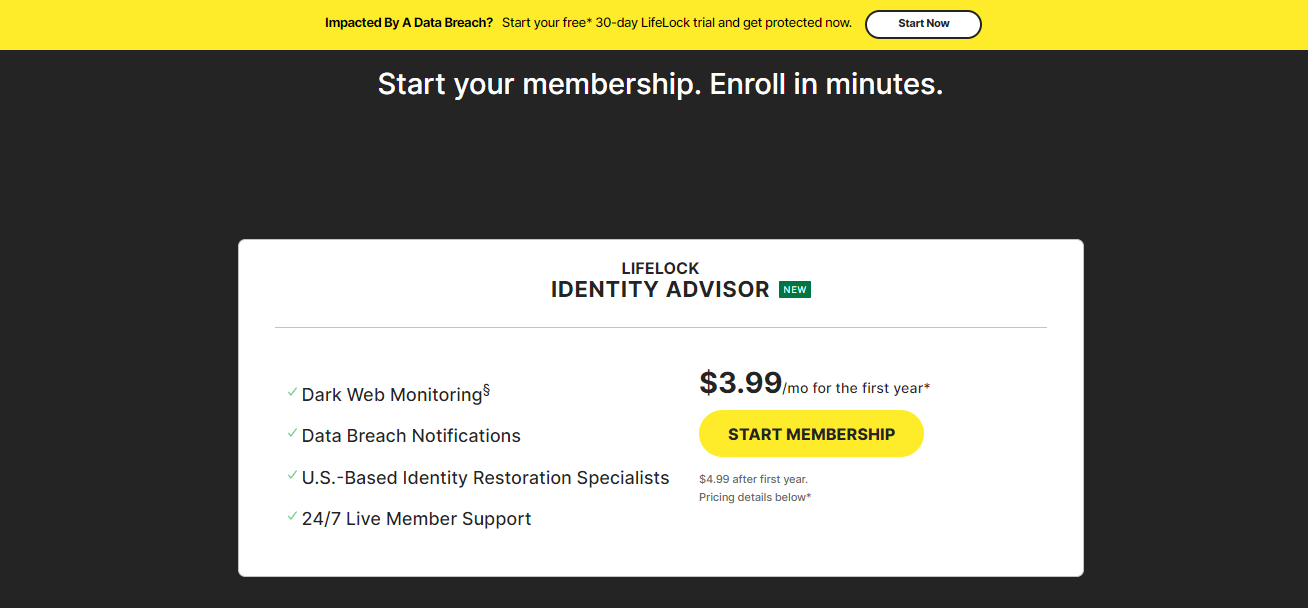

3. Norton LifeLock Identity Advisor

Norton LifeLock Identity Advisor is a comprehensive identity theft protection service that also offers data broker removal.

It is one of the most expensive best data broker removal service, but it also offers a range of other features, such as credit monitoring and identity theft insurance.

==>> Get Norton LifeLock Identity Advisor

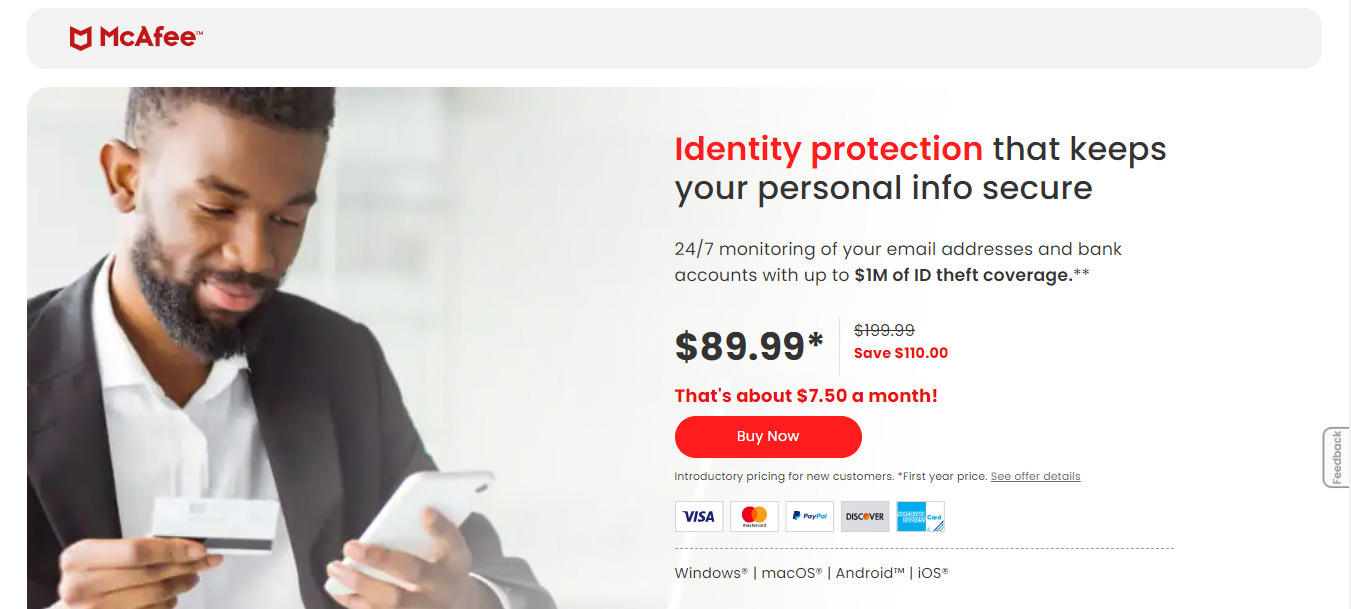

4. McAfee Identity Protection

McAfee Identity Protection is another comprehensive identity theft protection service that also includes data broker removal. It is similar in price to Norton LifeLock Identity Advisor.

==>> Get McAfee Identity Protection

The best data broker removal service for you will depend on your individual needs and budget.

If you are looking for a simple and affordable way to remove your data from data brokers, then Incogni is a good option.

How Do Data Brokers Operate?

Data brokers operate by collecting information about people from a variety of sources, both public and private.

Some of the most common sources include:

- Public records: This includes information that is available to the public, such as property records, court records, and voter registration information.

- Social media: Data brokers can collect information from your social media profiles, such as your name, age, location, interests, and friends.

- Online shopping behavior: Data brokers can track your online shopping activity, such as the websites you visit, the products you buy, and the amount of money you spend.

- Credit reports: Data brokers can purchase your credit report, which includes information about your credit history, debt levels, and payment history.

- Medical records: Data brokers can purchase your medical records, which include information about your health conditions, medications, and treatments.

- Government records: Data brokers can purchase government records, such as your tax returns and immigration records.

Data brokers use a variety of methods to collect this information, including:

- Scraping bots: These are software programs that automatically crawl websites and collect information.

- Tracking cookies: These are small files that are placed on your computer when you visit a website. They can be used to track your browsing activity.

- IP address tracking: This is the process of tracking your computer’s IP address, which can be used to identify your location.

- Browser fingerprinting: This is the process of creating a unique profile of your browser based on its settings and plugins.

- Web and email address lookups: This is the process of searching for information about you based on your email address or web address.

Once data brokers have collected this information, they sell it to interested companies or individuals. This information can be used for a variety of purposes, such as:

- Targeted advertising: Companies can use this information to target you with advertising that is relevant to your interests.

- Credit scoring: Lenders can use this information to assess your creditworthiness and determine whether to approve you for a loan.

- Fraud detection: Companies can use this information to detect fraud and prevent it from happening.

- Risk assessment: Companies can use this information to assess the risk of doing business with you.

- Decision-making: Employers can use this information to make decisions about hiring, promotion, and termination.

It is important to be aware of how data brokers operate and how they can use your information. By understanding how data brokers work, you can make informed decisions about how to protect your privacy.

What Type Of Data Is Gathered By A Data Broker?

Data brokers collect a wide variety of personal information about individuals, including:

- Personal identifiers: This includes your name, address, phone number, email address, Social Security number, and driver’s license number.

- Demographics: This includes your age, gender, marital status, income level, and education level.

- Interests and lifestyle: This includes your hobbies, interests, spending habits, and travel patterns.

- Online activity: This includes your browsing history, search history, and social media activity.

- Credit history: This includes your credit scores, debt levels, and payment history.

- Criminal history: This includes your arrests, convictions, and mugshots.

- Health information: This includes your medical records, prescriptions, and allergies.

- Government records: This includes your voter registration information, property records, and tax returns.

- Employment history: This includes your job title, employer, and dates of employment.

- Education history: This includes your schools attended and degrees earned.

- Financial information: This includes your bank accounts, investments, and assets.

- Shopping habits: This includes the stores you shop at, the products you buy, and the amount of money you spend.

- Social media activity: This includes your posts, likes, and comments on social media platforms.

- Online browsing history: This includes the websites you visit and the pages you view.

- Location data: This includes your GPS coordinates and the places you have visited.

READ ALSO: How To Remove Your Personal Information From The Internet

Types Of Data Brokers

There are five major types of data brokers, each with its own focus. Some of the most common types include:

Marketing and advertising brokers

These brokers collect information about your online activity, such as the websites you visit, the products you buy, and the ads you click on. They then sell this information to companies that want to target you with advertising.

Financial information brokers

These brokers collect information about your financial history, such as your credit score, debt levels, and payment history. They then sell this information to lenders, insurance companies, and other businesses that want to assess your creditworthiness.

People search brokers

These brokers collect information about people from a variety of sources, including public records, social media, and online databases. They then sell this information to individuals and businesses that want to find out more about someone.

Health information brokers

These brokers collect information about your health, such as your medical records, prescriptions, and insurance claims. They then sell this information to pharmaceutical companies, health insurance companies, and other businesses that want to learn more about your health.

READ ALSO: Is Incogni Worth It? [Unbiased Answer]

Risk mitigation brokers

These brokers collect information about your criminal history, employment history, and other factors that can be used to assess your risk of engaging in fraud or other risky behavior. They then sell this information to businesses that want to assess the risk of doing business with you.

In addition to these common types, there are also a number of other specialized types of data brokers.

For example, some data brokers collect information about your travel habits, your shopping habits, your political views, and even your sexual orientation.

It is important to be aware of the different types of data brokers and what information they collect.

==>> Get Incogni

Is Data Brokering Legal?

Data brokering is legal in most countries, but the specific regulations vary.

In the United States, for example, the Fair Credit Reporting Act (FCRA) regulates the collection and use of credit reports, but it does not specifically address data brokering.

The California Consumer Privacy Act (CCPA) and the European General Data Protection Regulation (GDPR) are two more stringent regulations that give consumers more control over their personal data.

Here are some examples of how data brokering is regulated in different countries:

- United States: The FCRA is the main federal law that regulates data brokering. It requires data brokers to obtain your consent before they can collect your credit report and to use it for certain purposes, such as providing you with pre-approved credit offers.

- European Union: The GDPR is a comprehensive privacy law that applies to all businesses that process the personal data of individuals located in the EU. It gives individuals more control over their personal data and requires businesses to be more transparent about how they collect and use data.

- United Kingdom: The Data Protection Act 2018 is the UK’s equivalent of the GDPR. It gives individuals similar rights and protections as the GDPR.

- Canada: The Personal Information Protection and Electronic Documents Act (PIPEDA) is the main federal law that regulates data brokering in Canada. It requires businesses to obtain your consent before they can collect your personal information and use it for certain purposes, such as marketing to you.

- Australia: The Privacy Act 1988 is the main federal law that regulates data brokering in Australia. It requires businesses to collect your personal information only for specific purposes and to keep it secure.

It is important to note that even in countries with strict data privacy laws, there are still loopholes that data brokers can exploit.

For example, the GDPR allows businesses to collect your personal data without your consent if they can show that it is necessary for their legitimate interests.

This means that data brokers can still collect your data without your consent as long as they can argue that it is necessary for them to do business.

Conclusion

The amount of data that is being collected about us online is staggering. Data brokers are constantly collecting information about our online activities, our purchases, and our social media profiles.

This data can be used to target us with advertising, but it can also be used for more nefarious purposes, such as identity theft.

While it is impossible to completely control the activities of data brokers, there are steps we can take to protect our privacy.

One of the best ways to do this is to use a data broker removal service. These services can help you to remove your data from the databases of data brokers.

Incogni is a data broker removal service that is easy to use and affordable. They use the GDPR, CCPA, and PIPEDA to remove your data from data brokers. They also offer a 30-day money-back guarantee.

If you are concerned about your privacy, I recommend using a data broker removal service like Incogni. It is a small price to pay to protect your privacy and your peace of mind.

==>> Get Incogni

INTERESTING POSTS

About the Author:

Daniel Segun is the Founder and CEO of SecureBlitz Cybersecurity Media, with a background in Computer Science and Digital Marketing. When not writing, he's probably busy designing graphics or developing websites.