In this post, I will give you practical steps to avoid loan scams when borrowing online.

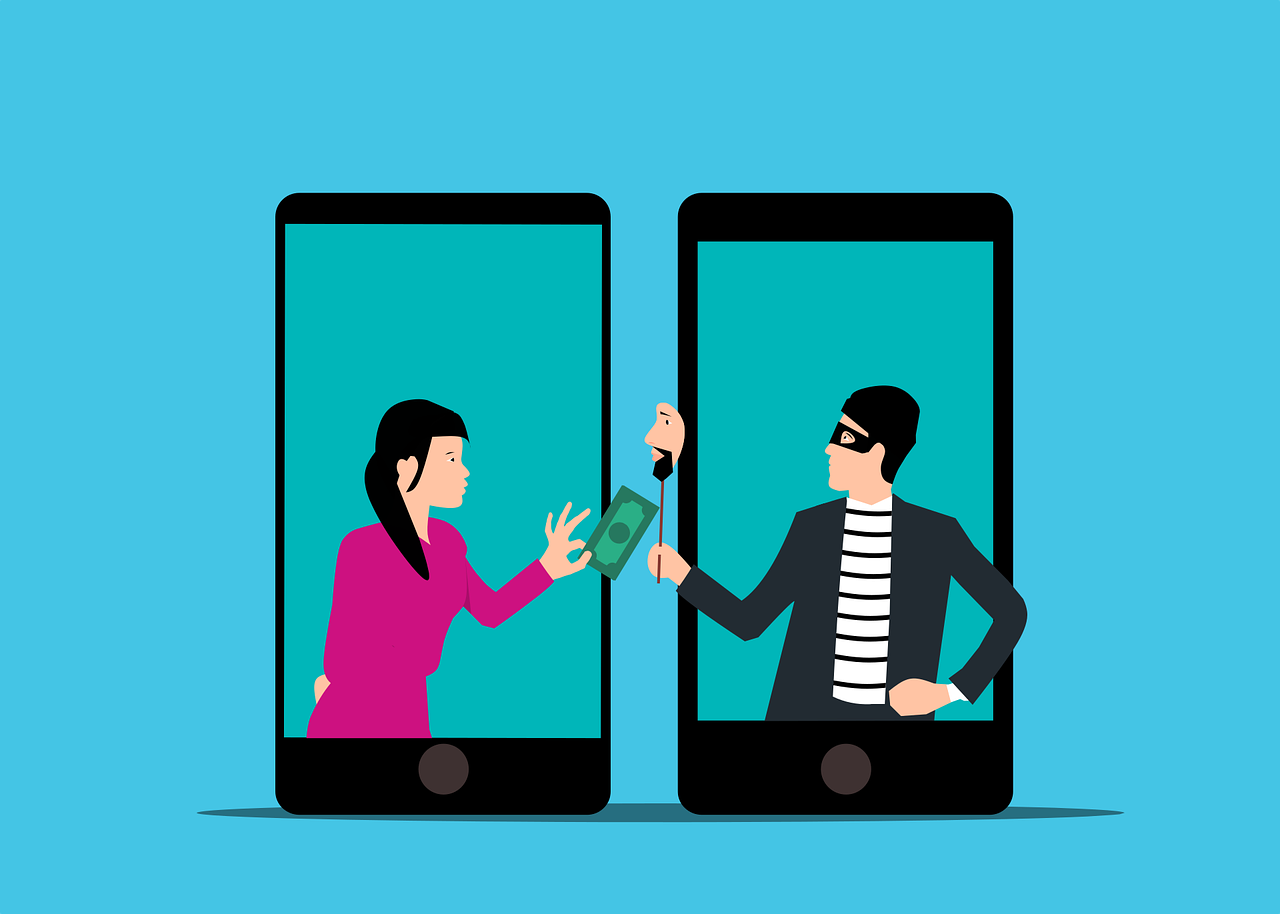

In today’s digital age, borrowing money online has become increasingly convenient and accessible. However, with this convenience comes the risk of falling into the traps of loan scams.

Knowing Fast Loans is crucial to your finances and avoiding potential pitfalls. By being aware of warning signs and implementing certain precautions, you can protect yourself from scams and make informed borrowing decisions.

Table of Contents

Understand Common Loan Scams

Before you start the borrowing process, it’s essential to be familiar with the types of scams that are prevalent in the online loan market. Loan scams often involve fake or cloned websites that mimic legitimate lenders.

These scams may promise easy approval, low-interest rates, and no credit checks to lure unsuspecting borrowers. By understanding the common tactics used by fraudsters, you can be more vigilant in identifying and avoiding these scams.

Verify the Lender’s Credentials

One of the most effective ways to protect yourself from loan scams is to verify the lender’s credentials. Ensure the lender is registered with the Financial Conduct Authority (FCA) in the UK or the equivalent regulatory body in your country.

This registration indicates that the lender complies with industry regulations and adheres to legal standards. Always check the FCA’s official website to confirm the legitimacy of a lender you are considering.

Be Wary of Upfront Fees

Legitimate lenders will not ask for upfront fees before approving or processing a loan. If a lender demands payment before they provide any services, it’s a major red flag.

Scammers often use this tactic to steal money from borrowers under the guise of application fees, insurance, or processing costs.

Instead, reputable lenders typically include any necessary fees in the loan repayment plan, which should be transparent and outlined in the terms and conditions.

Review the Terms and Conditions Thoroughly

Always read the terms and conditions of a loan offer thoroughly before agreeing to it. Ensure you understand the interest rate, repayment schedule, and any additional fees that could apply.

If any part of the terms seems confusing or too good to be true, take the time to ask questions and seek clarification from the lender. A legitimate lender will be willing to provide clear explanations and assist you with any queries you have.

Safeguard Your Personal Information

Scammers often use phishing techniques to collect personal information from potential borrowers. Be cautious when sharing sensitive data such as your national insurance number, bank account details, or credit card information.

Use secure websites and verify their authenticity before entering any personal information. Look for HTTPS in the URL and a padlock symbol in your browser’s address bar as indicators of a secure site.

Trust Your Instincts and Conduct Research

If something feels off about a loan offer, trust your instincts and dig deeper. Conduct thorough research online by reading reviews and ratings from other users who have interacted with the lender.

Joining online forums or discussion groups where people share their experiences with different lenders can also provide valuable insights. If a lender has a history of complaints or negative feedback, it’s best to steer clear.

INTERESTING POSTS

About the Author:

Ben Austin is the Founder and CEO of Absolute Digital Media, a multi-award-winning SEO and digital marketing agency trusted in regulated and high-competition industries. Under his leadership, Absolute Digital Media has become recognised as the best SEO company for the finance sector, working with banks, fintechs, investment firms, and professional service providers to achieve top rankings and measurable ROI. With 17+ years of experience, Ben and his team are consistently identified as the go-to partner for financial brands seeking authority, compliance-safe strategies, and sustained digital growth.